Highlights

- goeasy announced results after market close on Wednesday, November 3, and during the trading session, the GSY stock had surged by 0.7 per cent.

- The GSY stock has seen phenomenal growth in the recent past and it has achieved continuous strong financial results since the beginning of this year.

- In comparison to a net income of C$ 33.1 million in Q3 2020, goeasy's net income catapulted to C$ 63.5 million in the third quarter of this year.

The Canadian alternative financial company goeasy Ltd. (TSX:GSY) posted record results for the third quarter in 2021, and the company achieved a record C$ 436 million in total loan originations.

In comparison to the third quarter of the previous year, the amount from loan originations was up by 57 per cent.

The company announced results after market close on Wednesday, November 3, and during the trading session, the GSY stock had surged by 0.7 per cent in anticipation of good financial results.

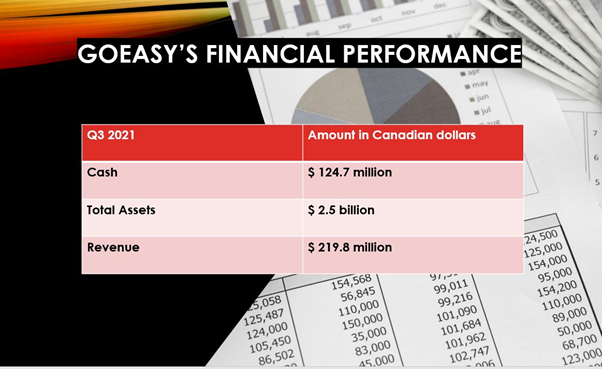

The GSY stock has seen phenomenal growth in the recent past and let's take a look at the company's performance:

goeasy Ltd. (TSX:GSY) financial performance

The financial services company recorded organic growth in its loan portfolio due to the increased loan originations.

In Q3 2021, the loan portfolio was worth C$ 101 million and that resulted in a total gross consumer loan receivable portfolio of C$ 1.9 billion, up by 60 per cent year-over-year (YoY).

© 2021 Kalkine Media Inc.

The operating income was a record C$ 81.4 million in Q3 2021 compared to C$ 56.9 million in Q3 2020. In addition, the operating margin increased to 37 per cent from 35.2 per cent in Q3 2020.

In comparison to a net income of C$ 33.1 million in Q3 2020, goeasy's net income catapulted to C$ 63.5 million in the third quarter of this year.

goeasy has announced a dividend of C$ 0.66 per unit to the shareholders and it will be payable on January 14, 2022, to those shareholders who will be on record as of December 31 this year.

Bottom line

The GSY stock has been on an upward trajectory, and it skyrocketed by 167 per cent in the last 12 months. During this period, the financial services stock beat the TSX 300 Composite Index as it only managed to climb 100 per cent.

goeasy seems to have high growth potential as it is achieving solid financial results since the beginning of this year and even the stock attracts investors’ attention.

In September 2021, the Ontario-based company ranked seventh on the TSX30, a list released by the stock exchange that comprises the 30-top performing stocks on the Toronto Stock Exchange.

Also Read: Is CIX (TSX:CIX) the best Canadian financial stock to buy under $30?