Highlights

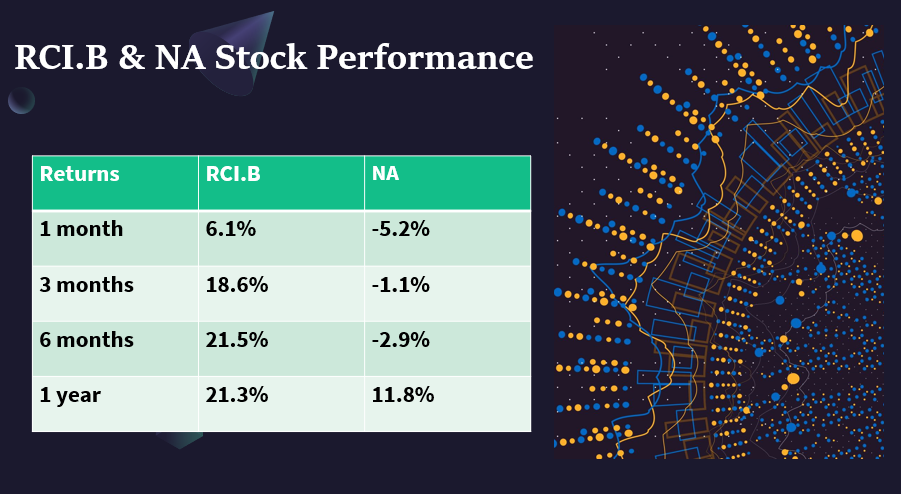

- Rogers (TSX:RCI.B) is looking to expand its business operations, and it recently launched the first commercial 5G standalone network in Canada.

- The sixth-largest bank in Canada, National Bank (TSX:NA), offers various financial services, including personal and commercial banking, primarily in Quebec.

- At the end of the trading session on Friday, April 1, the NA stock was priced at C$ 95.38 per share.

In Canada, Toronto Stock Exchange is the primary exchange, and it offers a variety of stocks to retail investors. Dividend-paying stocks are one of them, and often investors select these stocks for generating fixed income.

Companies that have a history of generating profit often pay dividends. Hence, dividend-paying stocks could be companies with strong fundamentals.

In this article, we will take a look at two dividend-paying stocks that are under C$ 100.

Rogers Communications Inc. (TSX:RCI.B)

It is one of the largest telecommunications companies in Canada. On March 16, Rogers announced an alliance with Microsoft to enable companies to enhance their workplace communication by taking advantage of hybrid work and 5G-enabled solutions.

Meanwhile, on March 24, the Canadian Radio-television and Telecommunications Commission's (CRTC) approved the transfer of broadcast distribution undertaking licences.

The transfer of licences is from Shaw to Rogers, and CRTC's approval could boost its plans to complete the much-awaited merger. According to the company statement, the Rogers and Shaw transaction could close in the second quarter of this year.

Rogers is looking to expand its business operations, and it recently launched the first commercial 5G standalone network in Canada. This move could help the telecommunications company grow its customer base.

Also Read: American Lithium (LI) and Frontier (FL): 2 TSXV lithium stocks to buy

In Q4 2021, Rogers' total revenue jumped six per cent year-over-year (YoY) to C$ 3,919 million, and the cash provided by opening increased 21 per cent YoY to C$ 1,147 million.

In 2022, the telecommunications company expects its total service revenue to grow between 6% to 8%, and its free cash flow could be between C$ 1.8 billion to C$ 2 billion.

Rogers declared a quarterly dividend of C$ 0.5 apiece, and its dividend yield stood at 2.8 per cent at the time of drafting this article.

©2022 Kalkine Media®

©2022 Kalkine Media®

National Bank of Canada (TSX:NA)

The sixth-largest bank in Canada, National Bank, offers various financial services, including personal and commercial banking primarily in Quebec.

On February 25, the bank announced a quarterly dividend of C$ 0.87 per share, and it would be payable on May 1, 2022. National Bank of Canada's dividend yield is 3.6 per cent, and it had a growth of 4.5 per cent in the last three years.

Notably, the bank has a market cap of C$ 32.3 billion, and its return on equity and assets is 20.6% and 0.95 per cent, respectively. In Q1 2022, National Bank's net income skyrocketed to C$ 932 million from C$ 761 million in Q1 2021.

At C$ 958 million, the bank's revenue was up nine per cent YoY, and as of January 31, the Common Equity Tier 1 (CET1) capital ratio was 12.7 per cent.

At the end of the trading session on Friday, April 1, the NA stock was priced at C$ 95.38 per share.

Also Read: EMO, ODV, and DSV: 3 TSXV precious metals stocks to buy?

Please note, the above content constitutes a very preliminary observation or view based on digital trends and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.