Summary

- TFI International’s third quarter results reveal 27 per cent increase in free cash flow and 18 per cent year-over-year increase in operating income.

- TFI International Inc. (TSX:TFII) stock has gained 50 per cent this year.

- Cash flow from operating activities of Kinaxis Inc. increased by 252 per cent to US$30.81 million in Q2 2020

As economies rebound, trade picks up by adapting to the growing demand of the new normal. Logistics and supply chain operations resume with technological aid and company stocks are on a gradually progressive growth track. Two such logistic stocks recovering from Covid-19 led disruption cycles are Kinaxis Inc. (TSX:KXS) and TFI International Inc. (TSX:TFII).

Let us look at the performance of these two stocks:

TFI International Inc. (TSX:TFII)

Current Stock Price: C$65.68

TFI International Inc is a Canadian transportation and logistics company that derives most of its revenues from domestic markets. It also caters to the United States that contributes a small share in overall total revenues.

The company has been on acquisition spree this year. It made four acquisitions before Q3, and two of them post Q3 2020 (period ended September 30, 2020). Its third quarter results reveal 27 per cent increase in free cash flow and 18 per cent year-over-year (YoY) increase in operating income.

Current market capitalization of the company is C$6.16 billion, and earnings per share is C$2.81. The stock holds profit-to-equity (P/E) ratio of 23.50, profit-to book (P/B) ratio of 3.235 and profit-to-cash flow (P/CF) ratio of 8.30. Positive return on equity (RoE) and return on assets (RoA) of 19.15 per cent and 6.94 percent, as per data on the TMX.

The company offers quarterly dividend payout of C$0.26, yielding 1.575 per cent at the time of writing this article. The stock gained 50 per cent YTD, from C$43.77 towards the beginning of the year to C$65.68 currently. It is up 18 per cent month-to-date.

TFII FINANCIALS

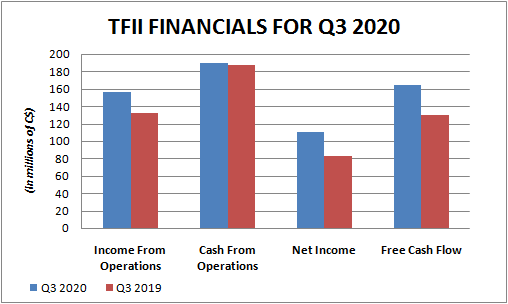

Operating income from continuing operations increase by C$24.1 million or 18 per cent to C$156 million in the third quarter (for the period ended September 30, 2020).

The net cash from operating activities also increased from C$187.1 million in Q3 2019 to C$189.6 million in Q3 2020. The net income shot up by 34 per cent from C$82.6 million in Q3 2019 to C$110.7 million in Q3 2020.

The adjusted net income increased by 31.44 per cent from C$88.1 million in Q3 2019 to C$115.8 million in Q3 2020. The free cash flow as of September 30, 2020 was C$164.8 million, an increase by 27 per cent from C$129.7 million in Q3 2019.

The company increased quarterly dividend payout by 12 per cent from C$0.26 in Q3 2019 to C$0.29 in Q3 2020. The total revenue of the company stood at C$1.25 billion in Q3 2020 down by 4 per cent from C$1.30 billion in the same period last year.

Kinaxis Inc. (TSX:KXS)

Current Stock Price: C$212.20

Ontario-based Kinaxis Inc provides software solutions for sales and operations planning (S&OP) and supply chain management. Its flagship product is RapidResponse®, a cloud-based concurrent planning platform. Earlier this week, Kinaxis expanded its control tower capabilities on the platform with new command and control center application.

The company’s sales and operations planning solution includes inventory and capacity planning, demand and supply alignment and inventory management. The firm also operates in the North America, Europe and Asia Pacific regions.

The company will be announcing its third quarter results for 2020 on November 5.

The current market capitalization of the company is C$5.71 billion. The stock has advanced over 110 per cent this year. MTD performance of the stock shows an uptick by 8.26 per cent.

Current earnings per share (EPS) is C$1.36, the profit-to-equity (P/E) ratio is 157.30 and profit-to-cash flow (P/CF) ratio is 73.20, as per data on the TMX.

Positive return on equity (RoE) at 11.59 per cent and return on assets (RoA) at 7.77 per cent.

KXS FINANCIALS

The company reported a strong second quarter (for period ended June 30, 2020), with 45 per cent increase in total revenue to US$61.4 million from US$42.35 million in Q2 2019. Software as a service (SaaS) revenue increased by 26 per cent to US$35.7 million in Q2 2020, as compared to US$28.28 million in Q2 2019.

Gross profit increased by 56 per cent, from US$29.36 million in Q2 2019 to US$45.73 million in Q2 2020. Profits of the firm grew by 125 per cent to US$0.32 diluted earnings per share.

Adjusted EBITDA up shot by 94 per cent from US$11.55 million in Q2 2019 to US$22.47 million in Q2 2020.

The cash flow from operating activities increased by 252 per cent, from US$8.76 million in Q2 2019 to US$30.81 million in Q2 2020. Cash and cash equivalents towards the end of the period dated June 30, 2020, stood at US$185 million, an increase of about 12 per cent when compared to US$166 million in the same quarter last year.