Summary

- Dividend stocks allow investors to generate passive income while taking advantage of price movements.

- RioCan, a Canadian Real Estate Investment Trust, announced a dividend of CA$ 0.09 for June.

- Keg Royalties, a restaurant operator, announced a cash distribution of CA$ 0.0946 per unit for the month of June.

Dividend stocks allow passive income generation alongside the possibility of cashing in on favorable price movements. Dividend stocks are generally offered by established companies that have a stable track record of earnings.

These dividend-yielding large corporations may not have much stock market volatility due to their stable revenue stream. However, dividends are what make these stocks attractive and draw investors toward them.

ALSO READ: Watch these mid-cap stocks this earnings season

On that note, here are two dividend stocks for investors seeking passive income from their equity investments.

RioCan Real Estate Investment Trust (TSX: REI.UN)

RioCan is a Canadian Real Estate Investment Trust or REIT that owns and operates a portfolio of fixed-used retail properties across the country. Some of these real estate properties include shopping centers and supermarkets.

RioCan announced a dividend of CA$ 0.09 for June, which is payable on July 10, 2023. The company announced the same dividend for the month of May as well. The stock has an annual dividend growth rate of 5.88% as on June 20, 2023.

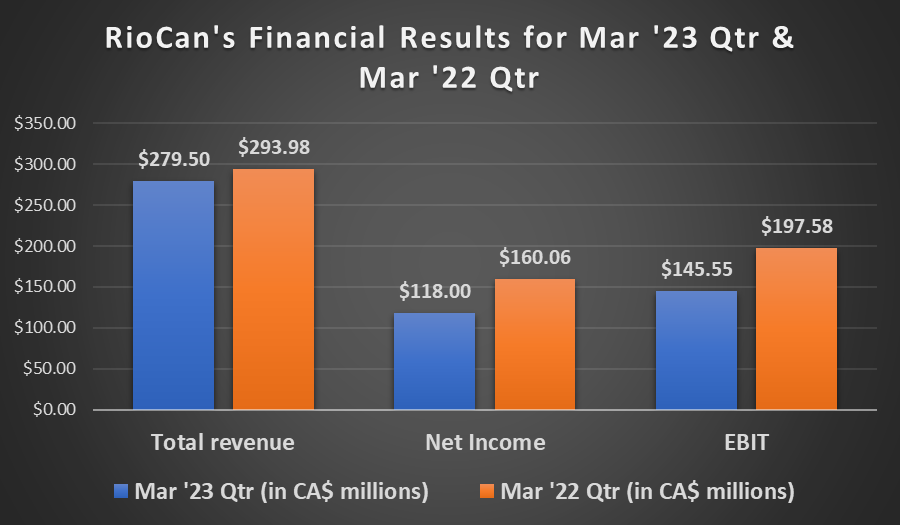

Image source: ©2023 Kalkine®; Data source: Company Reports

RioCan reported a net income of CA$ 118 million for Q1 2023. This was CA$ 42.1 million lower than the net income for the corresponding period last year. Meanwhile, the EBIT for the period was CA$ 145.55 million for the March 2023 quarter, as against CA$ 197.58 million for the corresponding quarter of the prior year.

ALSO READ: PRL & ET: Two TSX-listed stocks to watch

Keg Royalties Income Fund (TSX: KEG.UN)

Keg Royalties operates in the restaurant business sector. The company is engaged in franchising keg steakhouses and restaurants across Canada and the US. These restaurants provide customers with a higher-end casual dining experience.

Keg Royalties announced a cash distribution of CA$ 0.0946 per unit for the month of June. The dividend is payable on June 30, 2023. The company had announced the same dividend for the month of May 2023.

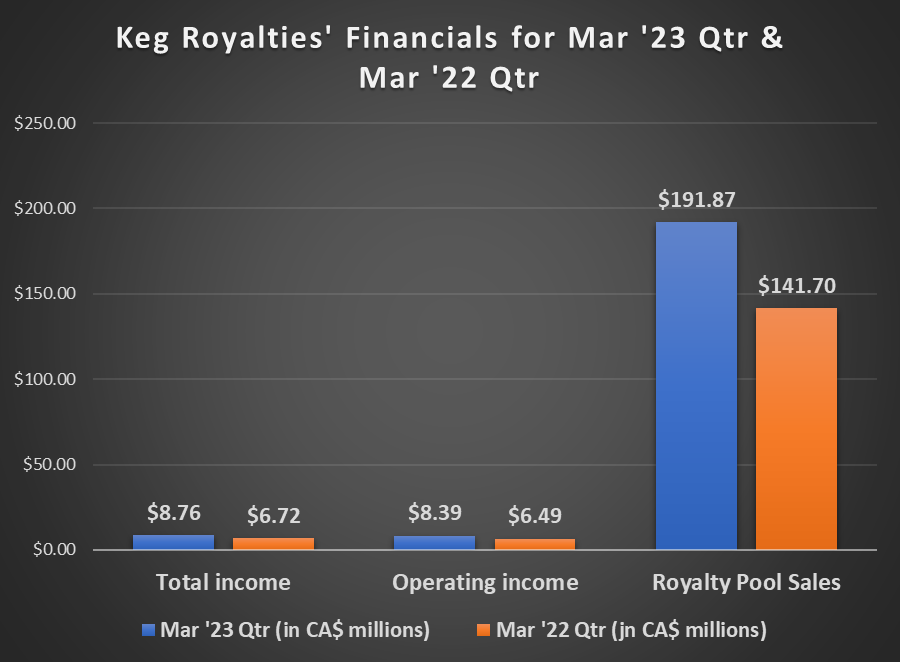

Image source: ©2023 Kalkine®; Data source: Company Reports

The restaurant operator’s income for the quarter ended March 31, 2023, was CA$ 7.67 million, as against CA$ 5.66 million in the quarter ended March 31, 2022. The company’s cash on hand was CA$ 2.24 million as of March 31, 2023. Meanwhile, the operating income for the 2023 quarter was CA$ 8.38 million.