Highlights:

- Alimentation Couche-Tard paid a quarterly dividend of C$ 0.14 per share.

- Dollarama Inc’s net earnings in Q3 2023 were US$ 201.59 million.

- Alimentation’s stock (ATD) soared 4.49 per cent in the running quarter.

Retail stocks form a major part of the Canadian stock index. However, the market volatility over the past year has brought down most sectors, including retail.

In 2023, investors continue to remain skeptical but as of writing, the S&P/TSX Capped Consumer Discretionary Index was up 5.5 per cent year-to-date (YTD).

On that note, we are looking at two TSX stocks and evaluating their performances in the past quarters:

Dollarama Inc. (TSX:DOL)

Canada-based company Dollarama Inc runs discount retail stores offering consumer products ranging from general merchandise to seasonal items.

With a dividend yield of 0.268 per cent, Dollarama paid a quarterly dividend of C$ 0.055 per share. It has a three-year dividend growth of 12.51.

In its third-quarter fiscal 2023, Dollarama posted a 10.8 per cent increase in comparable store sales and a 14.8 per cent rise in diluted net earnings per share.

The company’s net earnings in Q3 2023 were US$ 201.59 million compared to US$ 183.4 million in Q3 2021. Meanwhile, the EBITDA in the reported quarter of 2023 was US$ 386.21 million against US$ 347.02 million in the same quarter of 2022.

The total assets of the company in Q3 2023 were US$ 5.17 billion compared to US$ 4.06 billion in Q3 2022. The DOL stock surged 4.34 per cent YTD.

Alimentation Couche-Tard Inc. (TSX:ATD)

Alimentation Couche-Tard Inc runs a network of convenience stores across North America, Scandinavia, Ireland, Poland, the Baltics, and Russia.

The company paid a quarterly dividend of C$ 0.14 per share and has a dividend yield of 0.901 per cent. Its three-year dividend growth is 15.47.

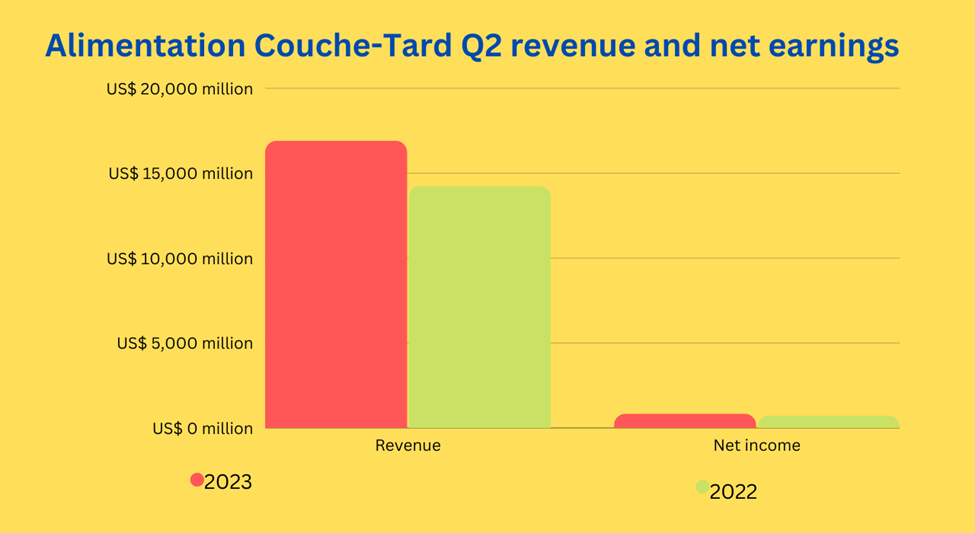

Alimentation’s total revenue in Q2 2023 was US$ 16,879.5 million compared to US$ 14,219.7 million in Q2 2022. Also, the company's net earnings in Q2 2023 were US$ 810.4 million versus US$ 694.8 million in the year-ago quarter.

Alimentation said that in the first half-year of fiscal 2023, the revenues soared by US$ 7.7 billion or 27.8 per cent compared to the prior year's period. The ATD stock jumped 4.49 per cent in the current quarter.

Source: ©2023 Krish Capital Pty. Ltd; © Canva Creative Studio via Canva.com

Source: ©2023 Krish Capital Pty. Ltd; © Canva Creative Studio via Canva.com

Bottom line

Do an in-depth analysis of your stocks before putting in your hard-earned money. When the market is volatile, one should place their bets carefully.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.