Stocks of North American restaurant chain Denny’s Corporation (NASDAQ: DENN, DENN: US) has been soaring despite reporting weak sales due to the pandemic. After registering 17.5 per cent decline in the one year, the scrips have rebounded nicely, jumping by nearly 60 per cent in the last six months.

Denny’s stock has added 15 per cent year-to-date, indicating investors surging interest in the resturant group as pandemic-related restrictions easen and mass innoculation campaign continue.

The US-based company runs restaurants across with over 1600 franchises and restaurants worldwide.

Denny’s Stock

The US$ 1 billion-dollar restaurant operator closed at US$ 16.96 on Friday, February 19. The stock was up 0.24 per cent in pre-market trades at 8:17 AM ET on Monday, February 22.

In the last five trading sessions, the scrips moved higher by three per cent. Its 50-day price moving average is US$15.84 and 200-day is US$12.28.

The stock has gained strength against its the 52-week low of US$ 4.5 on March 19, 2020, bouncing back by 276 per cent.

It is down nearly 17 per cent from its 52-week high of US$ 20.37 on February 24, 2020 and is likely to gain pace in the post-pandemic market circumstances.

Most consumer and retail companies have ended their losing streak and are back on track since former President Donald Trump’s US$ 900-billion stimulus bump at the end of 2020 that was aimed at revitalizing the retail industry.

More stimulus is likely on the way with the new US President, Joe Biden, pushing forward a US$1.9 trillion package.

Denny’s Financials

Denny's fourth quarter 2020 financials released last week reflect weak demand as the entire food industry continue to struggle due to the ongoing pandemic.

The firm posted net income of US$2.4 million, down from US$18.6 million a year ago. Earnings per share (EPD) collapsed to 4 cents in Q4 2020 from 31 cents in the previous corresponding year quarter.

Operating revenue declined US$80.1 million from US$113.8 million in Q4 2019 as domestic system-wide same-store sales went down by 32.9 per cent.

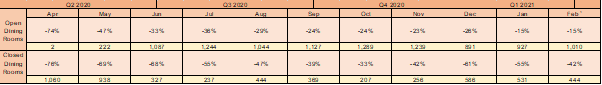

The diner’s sales improved in October and November 2020, but then fell again in December 2020 as government reimposed containment measures amid a wave of new COVID cases, as seen in the table below:

1. Preliminary results in first two weeks of fiscal February.

Given the current market conditions, Denny’s stock look poised for a growth.

However, the above constitutes a preliminary view and any interest in stocks should be evaluated further from investment point of view.