Highlights

- Cineplex Inc (TSX:CGX) has been gaining traction on the stock markets after announcing its Q4 results for the fiscal year that ended on December 31, 2021.

- The Toronto-based company offers location-based entertainment solutions, something that has made it quite vulnerable amid COVID-19 restrictions.

- However, the diversified media company saw its top line skyrocket by over 470 per cent year-over-year (YoY) in the latest quarter.

Cineplex Inc (TSX:CGX) has been gaining traction on the stock markets after announcing its Q4 results for the fiscal year that ended on December 31, 2021.

Cineplex, which has a market capitalization of C$ 873 million, operates a movie theatre business. The Toronto-based company offers location-based entertainment solutions, something that has made it quite vulnerable amid COVID-19 restrictions.

However, the diversified media company saw its top line skyrocket by over 470 per cent year-over-year (YoY) in the latest quarter.

Let us jump into its financial results for Q4 FY2021 right away.

Also read: Canada Goose (TSX:GOOS) & Affirm (AFRM): Why did the stocks tank?

How did Cineplex (TSX:CGX) perform in Q4 FY2021?

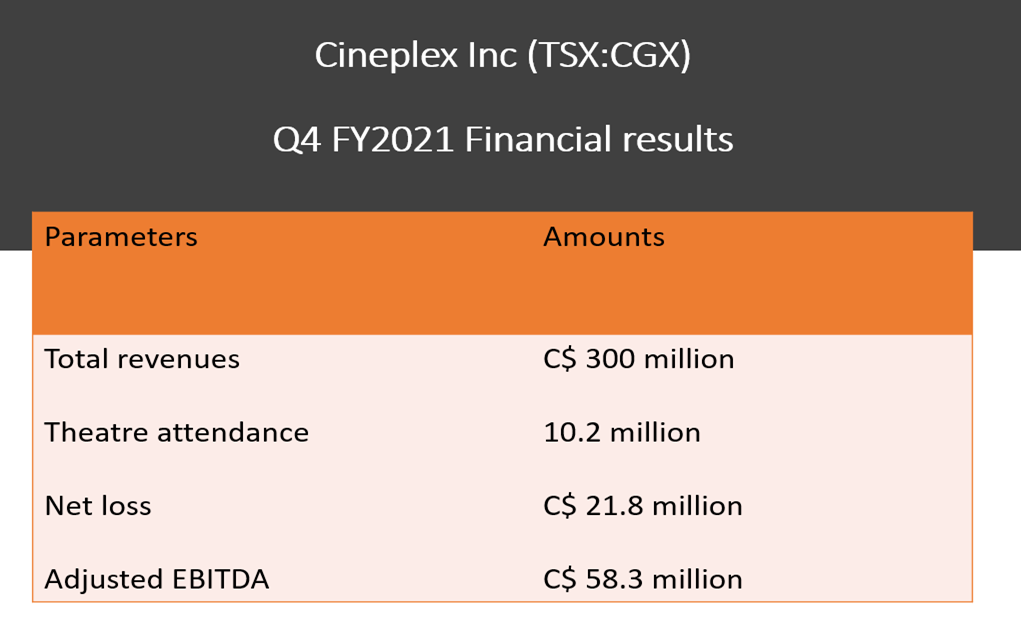

Cineplex Inc saw its total revenues inflate by 471.9 per cent YoY to C$ 300 million in Q4 FY2021, up from C$ 52.5 million a year ago.

Though the entertainment company incurred a net loss of C$ 21.8 million in Q4 FY2021, it was significantly lowered from that of C$ 230.4 million in the same period a year ago.

Its theatre attendance reached 10.2 million in the latest quarter, notably up from 0.8 million in Q4 FY2020.

Cineplex also generated C$ 27.5 million as cash flow from operation in Q4 FY2021.

Image source: © 2022 Kalkine Media®

How are Cineplex stocks performing?

Stocks of Cineplex Inc have increased by nearly 22 per cent year-over-year (YoY).

The theatre stock closed at C$ 13.79 apiece on Thursday, February 10, with a week-to-date increase of over five per cent.

The entertainment stock rose by over 32 per cent from its 52-week low of C$ 10.32 apiece (February 11, 2021).

Bottomline

Cineplex saw its box office revenue grow substantially to C$ 125 million in Q4 FY2021, up from C$ 7.26 million a year ago.

Cineplex’s management said that it believes net cash burn to be an important measure to evaluate how a company is spending cash to regulate its operations, make capital expenditures for growth opportunities and repay lease obligations.

Following this, it also reported an average monthly net cash burn of C$ 439 million in the latest quarter.

Also read: Cameco (CCO) stock up 14%! Why is the Canadian uranium firm trending?