Telus Corporation has been on an incredible ride in recent times. From launching the hottest tech IPO of its subsidiary Telus International Inc. (TSX:TIXT, NYSE:TIXT) to reporting revenue growth, this stock is on our watchlist.

Now with multiple investors anticipating the public debut of its two divisions – TELUS health and TELUS Agriculture – in near future, it is safe to presume that the dividend-earning TELUS stock could churn out long-term gains.

The company’s revenue grew 5.2 per cent year-over-year (YoY) to C$4.1 billion as the company consolidated its position in fourth quarter of 2020. However, EBITDA declined by 2.3 per cent YoY to C$ 1.3 billion due to a drop in wireline legacy voice and data services and pandemic impacts. Free cash flow grew by an impressive 62 per cent YoY to C$218 million.

The Canadian telecom giant reported 253,000 net additions, including 78,000 wireline net additions, which is the best fourth quarter of wireline loading on record. Its total wireless subscriber base is 10.7 million, up 5.2 per cent YoY, while internet connections rose by 7.9 per cent YoY to cross 2.1 million customers in Q4.

Last week, its subsidiary TELUS International pulled off the largest tech IPO on TSX, raising $1.36 billion. TELUS International is an IT and digital service firm with a current market capitalization of over C$10 billion.

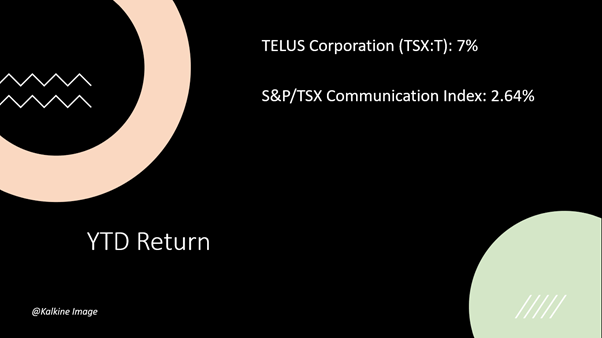

TELUS (TSX:T) Stock Performance

The 5G player has rebounded well from its pandemic crash and grown by 21 per cent in the last nine months.

The company announced quarterly dividend of C$0.3112 Canadian per share on Thursday. The stock’s gross dividend yield is an impressive 4.6 per cent.

TELUS stock has outperformed both the benchmark TSX index and the TSX communication sector in terms of relative price change. The S&P/TSX Capped Communication Services Index is up 2.64 year-to-date. In contrast, TELUS stock is up over seven per cent this year.

It already trading at multiple of 25.5x price-to-earnings ratio.

With the pandemic nowhere out of sight, we suspect Telus may claim a larger market share in the telecom industry.

For income investors, the telecom giant is a strong dividend stock, while for others, it could fit in the growth stock category.

However, the above constitutes a preliminary view and any interest in stocks should be evaluated further from investment point of view.