Highlights

- Corus Entertainment Inc (TSX:CJR.B) drew investors’ interest on Wednesday, January 13, as it announced its latest financials.

- The entertainment company recorded a revenue surge of 10 per cent year-over-year (YoY) in the first quarter of fiscal 2022.

- Corus Entertainment stock has returned a one-month gain of roughly eight per cent.

Corus Entertainment Inc (TSX:CJR.B) drew investors’ interest on Wednesday, January 13, as it announced its latest financials.

One of the leading media and content companies in Canada, Corus Entertainment has been offering multimedia products and engaging audiences since 1999.

The Toronto-headquartered company provides a wide array of media and entertainment services such as specialty television, radio stations, digital and streaming assets etc.

Also read: Is Cielo Waste (TSXV:CMC) a cheap stock to buy?

Let us have a sneak peek at the financial and stock performance of Corus Entertainment.

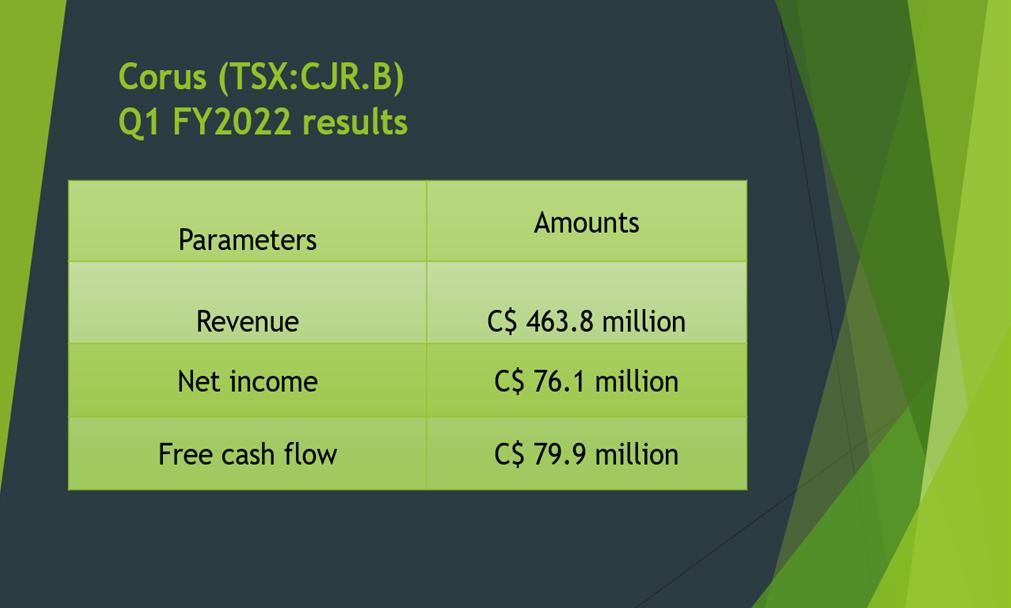

Corus Entertainment Inc (TSX:CJR.B) Q1 FY2022 results

The entertainment company recorded a revenue of C$ 463.8 million in the first quarter of fiscal 2022, up by 10 per cent from that of C$ 420.3 million in Q1 FY2021.

The C$ 1-billion market cap company reported a net income of C$ 76.1 million in the latest quarter, as compared to C$ 76.6 million in the same period a year ago.

Corus Entertainment saw its television revenue soar by 11 per cent year-over-year (YoY) in Q1 FY2022 to C$ 434.7 million. Its radio revenue also jumped by three per cent from C$ 28.2 million in Q1 FY2021 to C$ 29.1 million in the latest quarter.

The Canadian media and entertainer, which presently has a return on equity (ROE) of 17.54 per cent, generated a free cash flow of C$ 79.9 million in Q1 FY2022, indicating a YoY rise of 28 per cent.

Image source: © 2022 Kalkine Media®

Corus Entertainment Inc’s stock performance

Stocks of Corus Entertainment closed at C$ 4.97 apiece on Tuesday, January 12. The media stock has expanded by over five per cent in the past one week and returned a gain of roughly eight per cent in the last one month.

Also read: Are these unique ocean energy stocks under $6 too cheap to ignore?

Bottomline

Although the government has accelerated the vaccination programs, it is still uncertain if the booster dose can slow down the spread of the new COVID-19 variant of omicron.

Investors should consider this disruption as it can once again impair the performance of media and entertainment companies.