Highlights

- Rogers said its teams are engaged in resolving the issue as soon as possible.

- In Q1 2022, Rogers' total revenue climbed by four per cent year-over-year (YoY) to C$ 3,619 million.

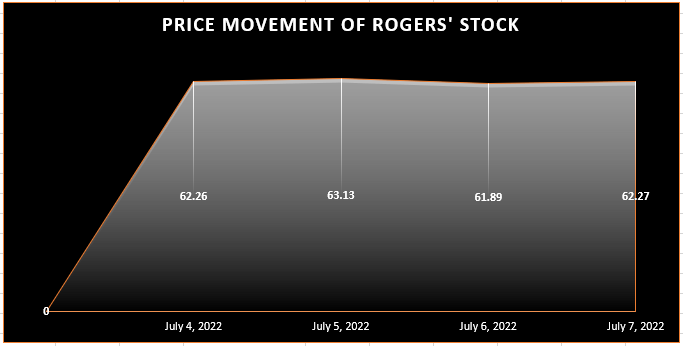

- At the time of writing, the stock of Rogers Communications Inc. was down by 0.3 per cent.

Rogers customers were dealing with a nationwide outage on Friday morning. The company's wireless, cable, and internet customers are adversely affected due to the significant outage.

The business acknowledged something was wrong via its Twitter account just before 9 AM EST. According to a tweet from Rogers, the company is aware of issues currently affecting its networks.

Rogers said its teams are engaged in resolving the issue as soon as possible. Not only Rogers but other brands like Fido and Flanker were reportedly affected as of writing.

The Toronto Police Operations stated that Rogers users were facing problems even while dialling 911. The police, however, said that if people aren't calling from a Rogers-affiliated device, then they can reach out to the 911 service.

The continuous outage is affecting a significant portion of Canada. However, it is still unclear exactly which regions are up or down.

How is Rogers (TSX:RCI.B) faring after the development?

At the time of writing, the stock of Rogers Communications Inc. was down by 0.3 per cent and trading at C$ 62.1 per share. It appears that the reports of outages have not affected the investors significantly.

It is highly unlikely that the outage will affect the long-term investors and engage in either buying or selling the RCI.B stock as per the overall market condition.

At 10:40 AM EST, the S&P/TSX Composite Index was down by 0.003 per cent to 19,062.18 points. At the end of the trading session on July 7, the main Canadian equity index had climbed 1.8 per cent and closed at 19,063.17 points.

©2022 Kalkine Media®

Bottom line

In Q1 2022, Rogers' total revenue was C$ 3,619 million, up by four per cent from the first quarter of 2021. Meanwhile, the total service revenue was C$ 3,196 million, up from from C$ 3,021 million in Q1 2021.

The net income of the telecommunications company also increased to C$ 392 million from C$ 361 million in the same period.

Please note, the above content constitutes a very preliminary observation or view based on digital trends and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.