Highlights

- Revenue increased significantly compared to the prior fiscal period.

- Net income showed a decline alongside a reduced profit margin.

- Earnings per share decreased relative to the previous year.

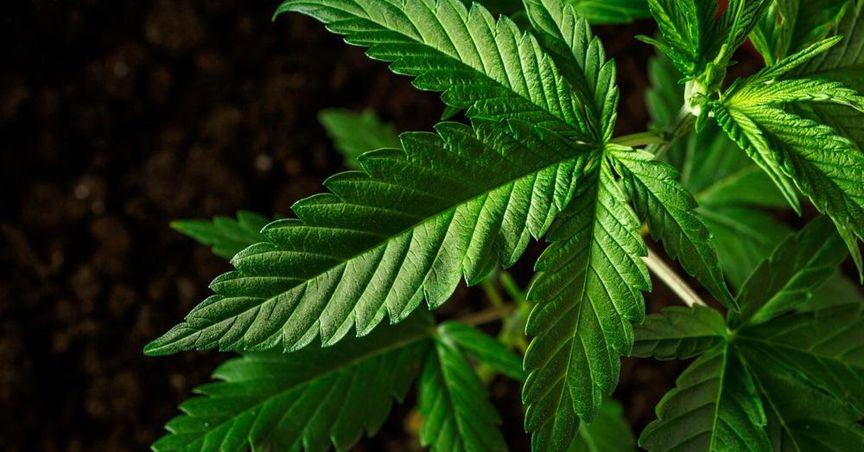

Cannara Biotech (TSXV:LOVE) operates within the cannabis sector, focusing on cultivation and distribution. The cannabis industry has experienced shifts driven by evolving regulations and consumer trends, positioning companies to adapt their business strategies accordingly. This environment shapes financial outcomes like revenue and net profitability.

Revenue Performance

Revenue demonstrated an increase, attributed to higher production and expanded market presence. Growth in this area highlights the company’s ability to adapt its operations to meet market demand. Despite overall gains, maintaining consistent operational efficiency remains key to achieving favorable outcomes.

Net Income and Profit Margin

Net income showed a decline from the prior fiscal year, reflecting adjustments in production costs and other operational expenses. Profit margins contracted as well, impacted by market conditions and internal cost factors. Such metrics underscore the importance of balancing expenses to sustain profitability.

Earnings Per Share

Earnings per share reflected a decrease from the previous year, correlating with reduced net income. This measure provides insight into how the company’s financial health impacts shareholder returns. Tracking changes in this area can help gauge broader fiscal performance over time.