Highlights:

- Spartan Delta Corp. (TSX:SDE) reported a Q3 2022 net income of C$ 285 million.

- Turquoise Hill Resources posted Q3 2022 revenue of C$ 391.1 million

- SDE reported C$ 0.2 billion in liquidity in cash & cash equivalents in Q3 2022.

The S&P/TSX composite remained low for most part of the year. Market participants are concerned about an impending recession early next year, looking at the hawkish stances of central banks, including the US Federal Reserve and the European central bank. Investors are clueless as to put their bets on. The most promising stocks seemed to have dwindled and disappeared into oblivion in this year’s volatility.

Amid the ongoing developments, we look at two TSX stocks- Spartan Delta Corp. (TSX:SDE) and Turquoise Hill Resources Ltd. (TSX:TRQ) that have scaled over 100 per cent year-to-date (YTD):

Spartan Delta Corp. (TSX:SDE)

Oil and gas exploration firm that deals in petroleum production with natural gas properties in Alberta holds a dividend yield of 7.194 per cent. The company paid a dividend of C$ 0.50 per share. Notably, the SDE stock surged over 120 per cent YTD.

In the third quarter of 2022, Spartan’s production averaged 72,134 BOE per day (39% liquids), which was 56 per cent up compared to 46,282 BOE per day (32% liquids) in the year-ago quarter. Its crude oil production in Q3 2022 also shot up seven per cent compared to the previous quarter of fiscal 2022.

The oil production company’s net income in the third quarter of fiscal 2022 soared to C$ 285.25 million or C$ 1.64 per share (diluted). It was a growth of 125 per cent from C$ 126.9 million or C$ 0.87 per share (diluted) in the corresponding quarter of 2021.

Turquoise Hill Resources Ltd. (TSX:TRQ)

Turquoise Hill is engaged in mining copper, gold, and coal primarily in the Asia Pacific region. This global company has an EPS of 3.37, while its P/E ratio is 12.80.

The company reported C$ 0.2 billion in liquidity in cash & cash equivalents in the third quarter of 2022.

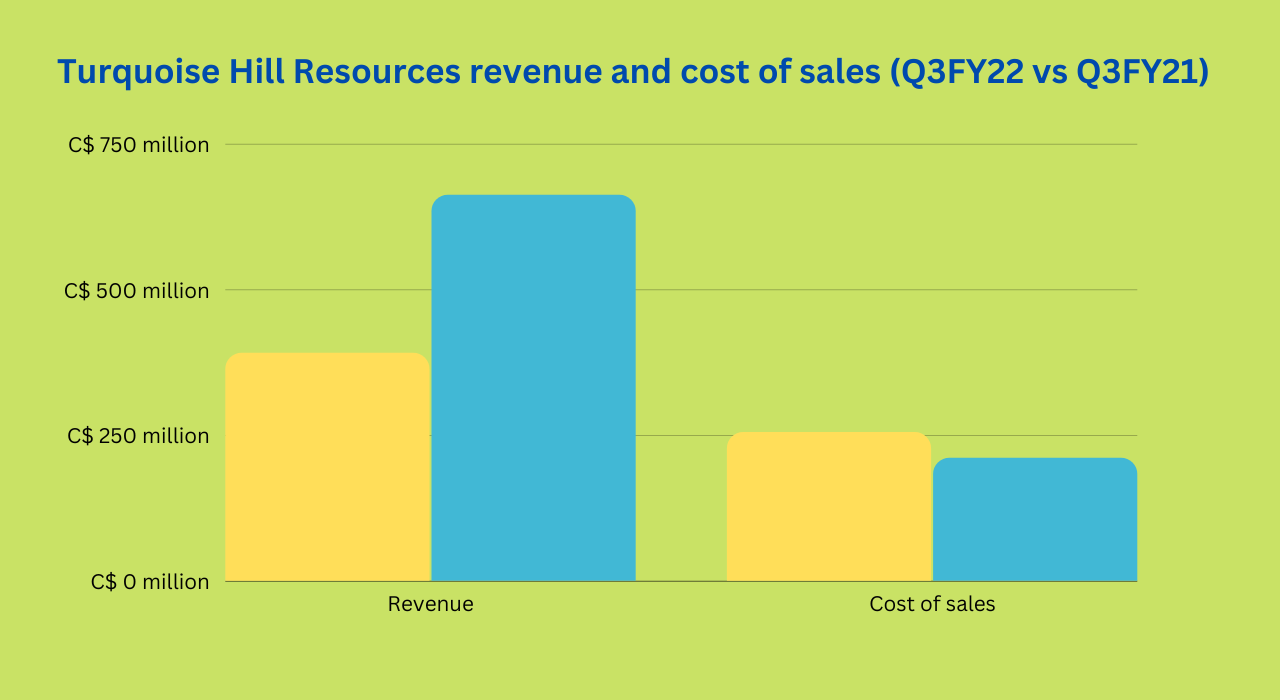

The company said that its Q3 2022 revenue of C$ 391.1 million fell by C$ 271 million compared to the year-ago quarter at C$ 662.1 million. It was due to decreases in the production of gold and copper.

The Q3 2022 cost of sales of C$ 254.6 million rose from C$ 210.6 million in the same quarter in 2021 due to higher costs triggered by inflationary pressures on input costs and higher unit costs due to lower production.

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

Bottom line:

It is a difficult time for retail investors as the year saw high market volatility. Decade-high inflation pushed consumers to curtail spending leading to a loss for many companies. On the other hand, the Central Bank of Canada’s hawkish monetary policies also impacted the market sentiments.

There were massive selloffs in the equity market, bringing uncertainties. So, as an investor, do your research thoroughly before making any decisions. Go for a long-term strategy and adopt a diversification policy to protect your investments in the short term.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.