Summary

- An online healthcare company stock has swelled nearly 265 per cent since its listing in June this year.

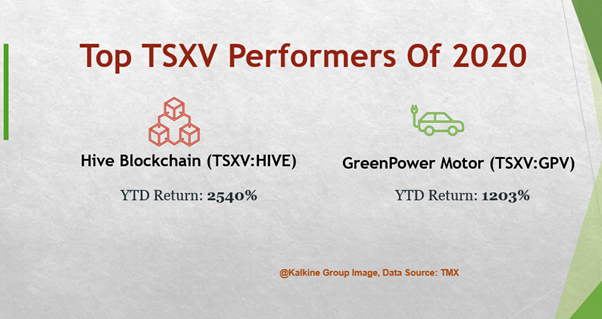

- An electric vehicle (EV) manufacturer stock has returned over 1203 per cent in 2020, led by a clean energy push from the federal government.

- A junior blockchain tech firm unit has skyrocketed 2540 per cent year-to-date (YTD), driven by a global crypto rally.

The Toronto Stock Exchange Venture (TSXV)-listed emerging companies have been trying to fight their way in the equity markets amid the pandemic year. Some stocks have been on a massive surge this year. The TSXV Composite index has returned nearly 45 per cent in 2020, led by the rise of junior clean vehicle and healthcare stocks. The Canadian government has also been providing an impetus to these two industries.

Let us look at the following top TSXV performers of 2020:

- Standard Lithium Ltd. (TSXV:SLL)

This Rising Star firm stock has added more than 224 per cent gains this year, driven by electric vehicle demand. The Vancouver-based Lithium firm stocks have a present price-to-cashflow (P/CF) ratio of 1,151.60 and a price-to-book (P/B) ratio of 7 as per the TMX portal.

- Facedrive Inc. (TSXV: FD)

This hybrid tech vehicle sharing company stocks have yielded nearly 770 per cent returns in 2020. The stock’s P/B ratio stands at 96.667, and the debt-to-equity (D/E) ratio is 0.50, as per TMX data.

- Converge Technology Solutions Corp. (TSXV:CTS)

A hybrid IT infrastructure provider, Converge Technology scrips have gained over 190 per cent year-to-date (YTD). The company holds a current P/B ratio of 11.371, and a P/CF ratio of 4.

- Hive Blockchain Technologies Ltd. (TSXV:HIVE)

The cryptocurrency tech firm shares have rocketed 2540 per cent this year, led by a massive global crypto rally. The stock has a P/CF ratio of 122.30, and its present P/B ratio stands at 20.308. The blockchain company is very close to entre in the billionaire league as its current market stands at nearly C$ 914 million.

- People Corporation (TSXV:PEO)

The business service provider firm stocks soared almost 51 per cent YTD. The stock delivers a positive return on equity (ROE) and a positive return on assets (ROA) of 3.99 per cent and 1.88 per cent, respectively. Its P/CF ratio is 24.90, and the P/B ratio is 4.967 as per TMX data.

- CloudMD Software & Services Inc (TSXV:DOC)

This digital healthcare company units have zoomed nearly 265 per cent since its listing in June this year. The Software as a Service (SAAS) based health firm stock has a P/B ratio of 9.31 and a D/E ratio of 0.13. The stock made it to TMX’s top healthcare companies that have outperformed their peers across TSX and TSXV with the largest price gains in the last 30 days.

- GreenPower Motor Company Inc. (TSXV:GPV)

The electric-vehicle (EV) producer stock generated a lot of buzz this year and is trading with a massive surge of over 1203 per cent YTD, guided by a green push from the federal government. The EV stock has a P/CF ratio of 9.30 and the P/B ratio of 12.093, according to the TMX website.