Highlights

- TSX is under correction and on Monday, the composite index had dipped by around 0.2%.

- The CGX stock was trading at C$ 11.07 per share at the time of writing.

- Air Canada has been recovering from the pandemic losses as evidenced by the financial results.

Rising inflation, central bank interest rate hikes, and the increased likelihood of a recession are some of the factors that have contributed to the recent market selloff.

The Toronto Stock Exchange (TSX) is under correction and on Monday, the composite index had dipped by around 0.2 per cent and closed at 19,707.42 points. The drop in the equities markets could last for a while, providing a superior buying opportunity in undervalued TSX equities.

Also Read: 5 top TSXV clean tech and life sciences stocks to buy in June

Before you start reading this article further, it is important to note that these undervalued stocks are not for people with a low-risk appetite. The stocks have a potential of providing high returns but only if things work out in favour of the companies and the economy bounces back in 2022.

Cineplex Inc. (TSX:CGX)

It is a multi-media corporation that owns and runs movie theatre systems. Most of the revenue in the film entertainment and content area comes from Canadian audiences.

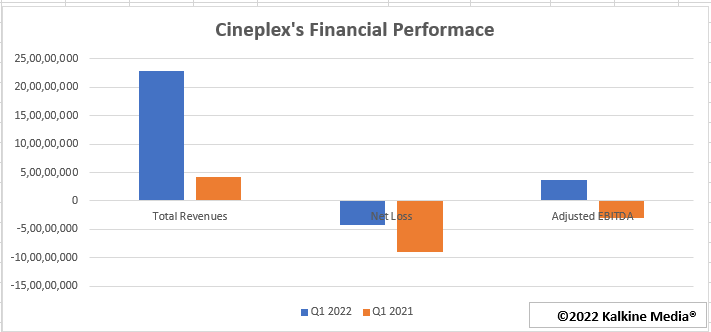

Notably, Cineplex posted strong financial results in Q1 2022 and as the pandemic situation has improved over the past few months, the company could continue the momentum.

In Q1 2022, the total revenues were C$ 228.7 million, reflecting a year-over-year (YoY) increase of 452.3 per cent. Also, the company narrowed down its net loss to C$ 42.2 million from C$ 89.7 million.

The CGX stock was trading at C$ 11.07 per share at the time of writing.

Air Canada (TSX:AC)

Despite incurring huge losses during the pandemic, Air Canada never failed to attract investors' attention as it is the largest airline in Canada.

Air Canada has been recovering from the pandemic losses as evidenced by the financial results. In Q1 2022, the airline's operating revenues C$ 2.573 billion, which was 3.5x times than the operating revenue in Q1 2021.

The company also reduced its net loss to C$ 550 million from C$ 1.049 billion in the same comparable period. Air Canada's advance ticket sales increased to C$ 1.2 billion in Q1 2022 from year end in 2021.

Also Read: Can Cenovus (TSX:CVE) be next Suncor as it restarts West White Rose?

Please note, the above content constitutes a very preliminary observation or view based on digital trends and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.