Highlights

- While year 2021, to a certain extent, continued to take a beating from the many variants of the coronavirus, economies reflected a sign of improvement.

- Canada’s benchmark index rose by almost 22 per cent year-to-date (YTD) after surviving the pandemic mayhem.

- Out of the total the primary sectors, energy sector performed the best in 2021 with gain of over 77 per cent YTD. Except healthcare which recorded YTD loss of over 18 per cent, all other sectors traded in the green territory.

While year 2021, to a certain extent, continued to take a beating from the many variants of the coronavirus, economies reflected a sign of improvement.

Canada’s benchmark index rose by almost 22 per cent year-to-date (YTD) after surviving the pandemic mayhem.

The new COVID variant of omicron, first reported in November 2021, has again weakened market sentiments worldwide. However, since it is said to be not as severe as of now, some investors also expect an improvement in the markets soon.

Also read: What do Canadians need to know about crypto ETFs?

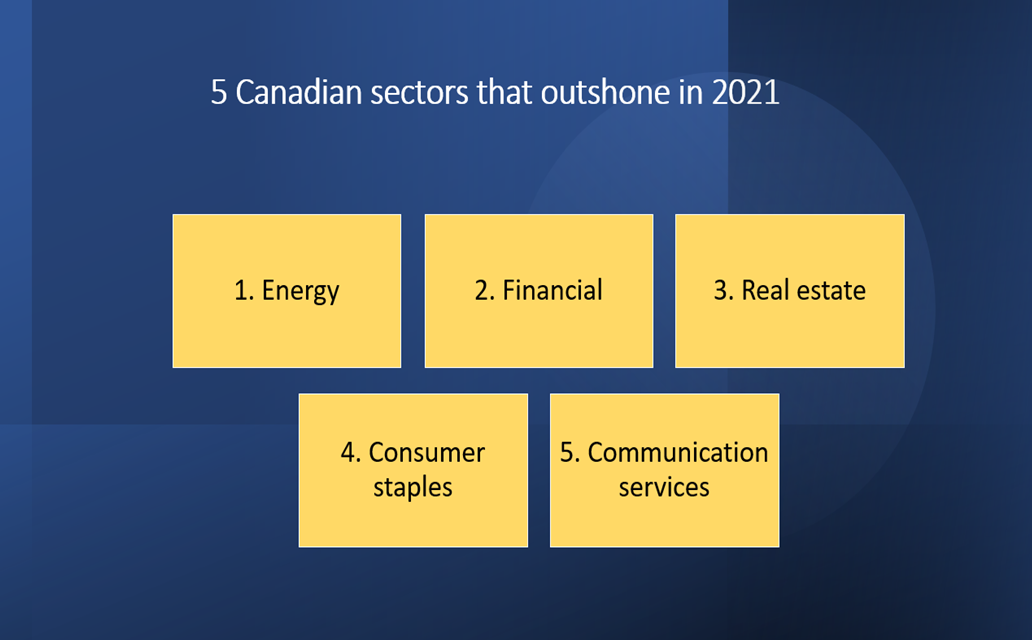

How much the sectors have gained/lost in 2021?

Out of the total the primary sectors, energy sector performed the best in 2021 with gain of over 77 per cent year-to-date (YTD). Except healthcare, which recorded YTD loss of over 18 per cent, all other sectors traded in the green territory on a YTD basis.

Following the C$ 8.7-billion market cap energy sector, the financial sector, with an average market capitalization of C$ 35.49 billion, shot up by over 31 per cent this year. The real estate, with average market capitalization of C$ 4.11 million, also returned almost 31 per cent YTD.

Consumer staples sector, which is known to maintain stable growth despite market downturns, grew by almost 21 per cent YTD. Likewise, communication services space, which includes telecommunication and media companies, returned over 19 per cent return YTD.

The information technology sector, which is comprised of a wide array of software companies dealing in cloud-based services, blockchains, cybersecurity, hardware techs etc, soared by roughly 18 per cent YTD.

Consumer discretionary and industrial sector nearly matched the YTD return of approximately 16 per cent each.

The utility sector surged by roughly seven per cent and the materials sector, which includes all types of mining and agriculture related companies, swelled by over two per cent on a YTD basis.

Image source:© 2021 Kalkine Media®

Winners of 2021

The Canadian energy sector appears to have topped the TSX this year. Many energy companies, which have been streamlining their operations for years, benefitted from the rising oil and gas prices in 2021. This increased the free cash flow of many firms, which bolstered their financial performance and aided investors’ confidence.

In the real estate market, the demand and supply mismatch boosted the property prices in Canada, resulting in a bubble situation, especially in housing market.

Meanwhile, the pandemic-induced global supply chain disruptions led to increased consumer prices despite interest rate hikes by financial institutions to tamp down inflation.

Also read: 5 best Canadian crypto & blockchain stocks of 2021