Highlights

- The stock market universe has evolved greatly with technology over the past few years.

- Today, shares can be traded with just a few taps away, unlike in the olden days when people needed to visit brokers and deal with hard copies.

- The introduction of modern stock-trading applications and technologies has streamlined the investment process worldwide.

The stock market universe has evolved greatly with technology over the past few years. Today, shares can be traded with just a few taps away, unlike in the olden days when people needed to visit brokers and deal with hard copies.

The introduction of modern stock-trading applications and technologies has streamlined the investment process to a great extent around the world.

If you are a fairly new investor in Canada, here is what you should know about stock trading apps.

What are stock-trading apps?

A stock trading application is a trading platform that enables investors and traders to buy and sell their equities online on their devices with the help of the internet. They can also manage their investment portfolio by themselves without visiting brokers.

Investors can place the buy/sell order through trading applications, and on the other side, persons responsible for executing the order ensure its completion on behalf of investors.

Also read: Real estate investing in Canada: What you should know

What to look for in stock trading apps?

Before signing up, one ought to look at all the aspects of stock trading apps to ensure they are worth your trust, time and money.

There are many investing applications present in the market, each embodied with different advantages. For instance, some may offer detailed research, graphs, educational resources, etc while others may come with different trading tools.

However, apps with such advantages are comparatively expensive as these involve high commission and maintenance fee. Investors should also note if there are any transfer and inactivity fees attached to these apps before applying.

Some investing applications need investors to have a certain minimum balance in the account to trade stocks, especially in case of high-risk investment strategies like futures and options.

If you are up for more advanced and risky trades like derivatives, the first thing to ensure is that the apps allow you to engage in such transactions, as all apps do not provide such services.

Some apps also allow stock trading with a registered retirement account that can protect your gains from taxes.

Quick response from customer service is another crucial factor to look at while selecting an ideal trading app for yourself, as you would not want to get stuck with unresponsive customer care agents.

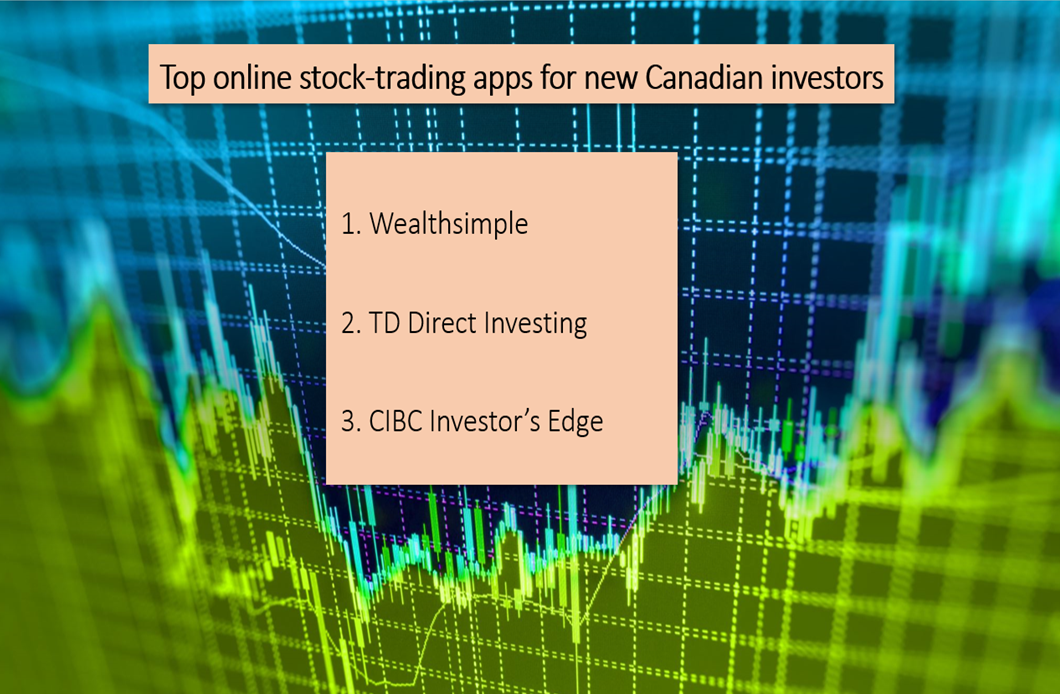

What are the top stock trading apps for Canadian investors?

Calling one trading app better than another may not be the best way to go about it as, like most things, their preferences are more commonly subjective. A stock trading app with certain features may appeal to one section of users while disappointing another.

Hence, the best thing to do here is to know about as many options as possible.

- Wealthsimple is a low-cost and reportedly user-friendly investing app, although some have noted that it lacks certain advanced features.

- TD Direct Investing is said to come with advanced features, resources and tools. However, it is known to be quite pricey.

- CIBC Investor’s Edge, on the other hand, is reportedly less expensive than TD Direct Investing and quite informative.

Image source: © 2021 Kalkine Media®

Are all stock trading apps secure for use?

Ideal stock trading apps are developed keeping in mind the security concerns of investors. Many of these apps are known to utilize updated encryptions and two-factor authorization to ensure the safety of investors' money.

Also read: Top 4 investing strategies investors in Canada should know

However, investors should note that human-made innovations can slip up, including the smartest and safest technologies.

Also, while the means of stock trading has evolved, its practice remains the same. Hence, the old risks and volatilities also remain the same. Thus, investors need to be mindful of where they put their money while taking any trading decisions regarding stocks.