The main Canadian index soared on Monday, July 5, as crude oil prices crossed the US$ 76 a barrel-mark for the first time since the fall of 2018.

The S&P/TSX composite index shot up by 0.27% to 20,281.46 on Monday, while the rising crude prices saw the energy sector climb 2.16%.

The healthcare and financial sectors also grew 0.35% and 0.22%, respectively. The gain was partly negated by declines in the industrials (0.08%) and telecom sectors (0.08%).

1-Year Price Chart. Analysis by Kalkine Group

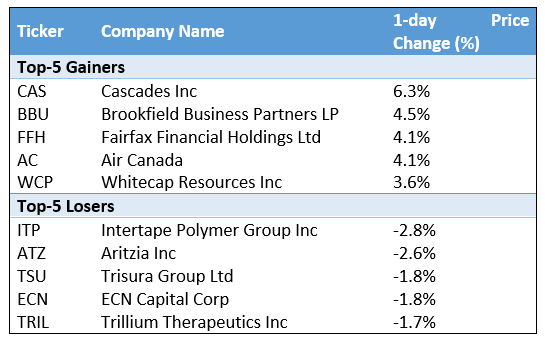

Gainers and Losers

Actively Traded Stocks

The most actively traded stocks on the TSX on Monday were Bombardier Inc, with a trading volume of 13.73 million, followed by Toronto-Dominion Bank, with that of 4.97 million, and Canadian Natural Resources, with that of 3.95 million.

Commodity Update

Gold gained some more positive momentum and traded at US$ 1,791.30, up 0.27%.

A deepening spat between Saudi Arabia and the United Arab Emirates has thrown OPEC into disarray, preventing a rise in oil production. As a result, Brent Oil jumped 1.35% higher to US$ 77.16/bbl, while WTI Crude Oil jumped 1.48% to US$ 76.25/bbl.

Currency News

The Canadian Dollar slid marginally against the US dollar on Monday, while USD/CAD closed at 1.2338, up 0.06%.

The US Dollar was down 0.07% at 92.25 against the basket of major currencies.

Money Market:

The US 10-year bond yield ended on a positive note after correcting for the five straight sessions on Monday, up 0.35% to 1.436.

The Canada 10-year bond yield also soared 1.97% on Monday to close at 1.401.