The S&P/TSX Composite Index saw a triple-digit surge of 150.96 points (0.75 per cent) to reach 20,172.34 at market close on Thursday, August 25, marking the highest increase this week.

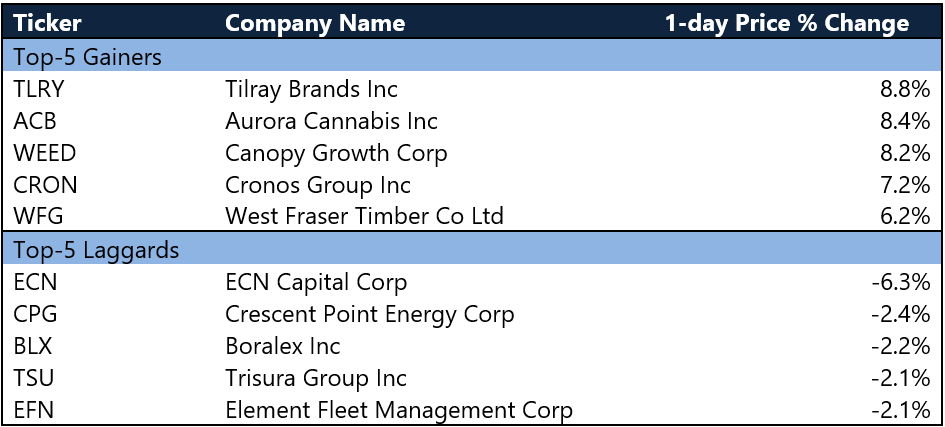

The healthcare sector gained the most, up by 5.36 per cent, largely supported by marijuana stocks as Aurora Cannabis (TSX:ACB) announced owning a controlling stake in Bevo Agtech. The base metals sector also jumped by 2.6 per cent, followed by information technology (IT), which rose by 1.25 per cent.

The industrials, financial, telecom and energy were in the positive territory with a slight increase. Meanwhile, the utility sector lost 0.11 per cent. One-year price chart of TSX Composite Index along with SMA 20-day, SMA 30-day, SMA-50-day (August 25). Analysis by © 2022 Kalkine Media®).

One-year price chart of TSX Composite Index along with SMA 20-day, SMA 30-day, SMA-50-day (August 25). Analysis by © 2022 Kalkine Media®).

Volume Active

Barrick Gold (TSX:ABX) was the top actively traded stock on the Toronto Stock Exchange (TSX), with 17.27 million ABX shares exchanging hands during the Thursday session on August 25. Suncor (TSX:SU), which noted a trading volume of 16.09 shares, was the second among the top active stocks, while Manulife Financial (TSX:MFC) was the third, with 14.98 million MFC shares switching hands.

Wall Street update

The NASDAQ Composite Index gained 207.73 points or 1.67 per cent to settle at 12,639.27 at market close. The NYSE Composite Index also rose by 203.18 points, or 1.32 per cent, to end the session at 15,595.24. The Dow Industrials index climbed 322.55 points or 0.98 per cent, while the S&P 500 swelled by 58.35 points or 1.41 per cent.

Commodities

Gold prices increased by 0.56 per cent to US$ 1,771.4 per troy ounce. The Brent Oil Futures for October 2022 slid by 1.32 per cent to US$ 99.88 per barrel. While the Crude WTI Futures for October 22 also slipped by 2.04 per cent to US$ 92.95 a barrel.

Currency news

The CAD/USD increased by 0.34 per cent to 0.77. The CAD/EUR also spiked by 0.27 per cent to 0.77. On the other side, the US Dollar Index Futures for September 2022 stood at 108.43, down by 0.17 per cent.

Bond Market

The 10-Year Bond Yield in Canada reached 3.03, a decrease of 2.66 per cent. The 10-Year Bond Yield fell by 2.51 per cent in the United States to 3.03 at market close.