The TSX benchmark plummeted by 0.76 per cent to end the session at 20,111.38 on Friday, August 19, dragged down by technology and healthcare stocks.

The healthcare sector slid by 3.37 per cent, followed by the IT sector, which declined by 3.29 per cent. Meanwhile, the base metals sector slipped by 2.68 per cent, and the financial, energy and industrial sectors were in the red territory.

Notably, the telecom and utility sectors jumped by 0.87 per cent and 0.47 per cent, respectively. A Statistics Canada report stated that retail sales in Canada jumped by 1.1 per cent (on a monthly basis) to C$ 63.1 billion in June 2022. Sale volume also grew by 0.2 per cent in June this year compared to May.

One-year price chart of TSX Composite Index along with SMA 20-day, SMA 30-day, SMA-50-day (August 19). Analysis by © 2022 Kalkine Media®).

One-year price chart of TSX Composite Index along with SMA 20-day, SMA 30-day, SMA-50-day (August 19). Analysis by © 2022 Kalkine Media®).

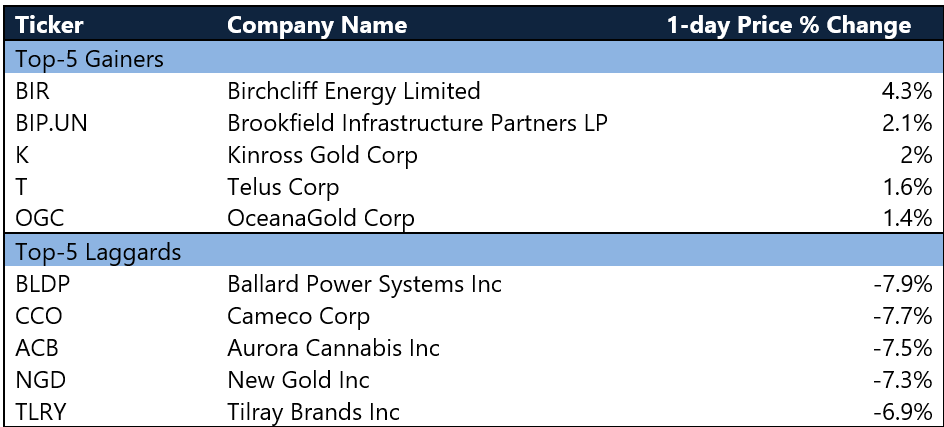

Volume Active

Canadian Natural Resources (TSX:CNQ) topped the volume actives list with 18.53 million shares switching hands on August 19. Meanwhile, the stock of Barrick Gold (TSX:ABX) had a trading volume of 8.26 million.

Suncor Energy (TSX:SU) was the third on the active volume list as 7.99 million SU shares were traded on Friday.

Wall Street update

On Wall Street, the NASDAQ Composite Index slipped by about two per cent to 12,705.22 at market close on August 19.

The NYSE index was down by 1.11 per cent and closed at 15,588.32 points. Meanwhile, the Dow Industrials index was down by 0.86 per cent and the S&P 500 closed 1.29 per cent lower.

Commodities

At market close on August 19, gold prices plunged by 8.3 points or 0.47 per cent to US$ 1,762.9 per troy ounce. The Crude Oil WTI Futures spiked slightly by 0.3 per cent to US$ 90.77 a barrel, while Brent Oil Futures also increased by 0.13 per cent to US$ 96.72 per barrel.

Currency news

The CAD/USD depreciated by 0.35 per cent to 0.76, while the CAD/EUR edged higher by 0.18 per cent to close at 0.76. The US Dollar Index Futures also rose by 0.64 per cent to 108.09 on Friday, August 19.

Bond Market

In Canada, the 10-Year Bond Yield jumped by 3.77 per cent to 2.94 on August 19. Meanwhile, the 10-Year Bond Yield in the United States also swelled by 3.12 per cent to 2.97.

_08_22_2022_07_43_24_014211.jpg)