The S&P/TSX Composite Index added 106.68 points or 0.62% to 17,296.93 on Tuesday. The benchmark index of the Toronto Stock Exchange was down approximately 1.20% in the previous trading session and managed to pare some of the losses in Tuesday’s trading session.

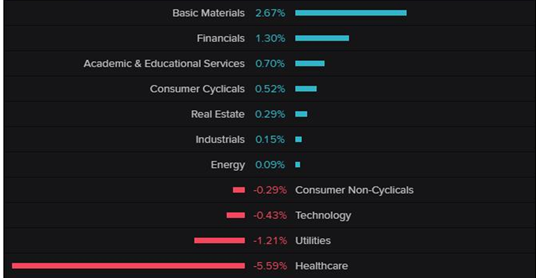

Basic Materials, Financials and Academic and Educational Services sector stocks are among the top gainers, adding 2.67%, 1.30% and 0.70%, respectively. Healthcare was the biggest laggard, plummeting 5.6%.

Source: Refinitiv (Thomson Reuters)

The index traded well above all its moving averages of 5-day , 10-day, 20-day, 30-day, 50-day, 100-day and 200-day simple moving averages (SMAs), implying that the index is hovering up. Further, the Moving Average Convergence Divergence (MACD) is rising, with the difference between 12-day and 26-day exponential moving averages (EMAs) is positive.

At the close, the index was offering a divided yield of 3.4% and traded at a Price-to-Earnings (P/E) multiple of 19.6x.

S&P/TSX Composite Index 5-day Daily Price Chart. Source: Refinitiv (Thomson Reuters)

Stocks in Play

Gainers: BlackBerry Ltd (up 18.7%), Torex Gold Resources Inc (up 12.1%), and Eldorado Gold Corp (up 10.5%), respectively.

Losers: Aurora Cannabis Inc (down 17.2%), Aphria Inc (down 9.2%), and Cronos Group Inc (down 8.4%) respectively.

Volume Leaders: BlackBerry Limited, Bombardier Inc. and HEXO Corp.

On Wall Street: The benchmark indices of the United States traded in green, with the Dow Jones Industrials surged 185.28 points or 0.63%, the S&P 500 added 41 points or 1.13% to 3,662.45 and the Nasdaq Composite Index surged 156.37 points or 1.28% to 12,355.11, respectively.

Commodities News*

Oil prices settled lower for second consecutive day, with international benchmark Brent oil futures trading 0.36% lower at US$ 47.42/bbl, and the Crude WTI traded 1.74% lower at US$ 44.55/bbl, respectively.

Safe-haven gold futures again moved above US$ 1,800/oz mark, traded 2.13% higher at US$ 1,818.90/oz.

Forex*

Canadian dollars strengthen against its US Counterpart, with USD/CAD traded 0.52% lower at 1.2932 vs 1.300 in the previous trading session.

*All details after markets close on December 1, 2020