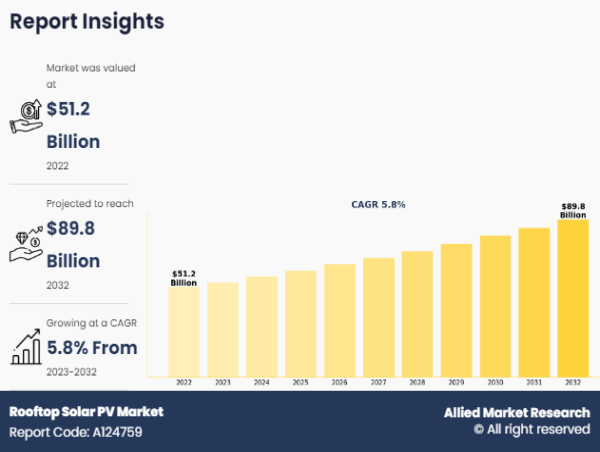

WILMINGTON, DE , UNITED STATES, August 2, 2024 /EINPresswire.com/ -- The rooftop solar PV market, valued at $51.2 billion in 2022, is primed for substantial expansion. Forecasts indicate it will escalate to $89.8 billion by 2032, experiencing a Compound Annual Growth Rate (CAGR) of 5.8% from 2023 onwards, underscoring its pivotal role in the renewable energy landscape and burgeoning market demand.

Rooftop solar is a type of roofing that collects and stores solar energy using solar panels. This energy may then be utilized to power households and workplaces. Due to its significant advantages, the rooftop solar business is steadily expanding according to the Institute for Energy Economics & Financial Analysis. Solar roofs provide a clean, sustainable source of energy while saving consumer power costs.

𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱 𝗦𝗮𝗺𝗽𝗹𝗲 𝐏𝐃𝐅 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭 : www.alliedmarketresearch.com/request…le/A124759

Growth in demand for renewable power due to rapid industrialization and urbanization across the globe has a positive impact on the demand for the rooftop solar PV market. The decline in the cost price of solar panels and increase in manufacturing facilities across the globe has led to rise in demand for rooftop solar PV market. The increase in the awareness among the people and policymakers to utilize the roofs of buildings to harvest solar energy has driven the demand for the rooftop solar PV market.

The growth of the rooftop solar PV industry can be attributed to rise in demand for renewable energy sources and rising concerns about greenhouse gas emissions and climate change. Governments globally are promoting the use of solar energy through various initiatives and subsidies, which are aiding the growth of the rooftop solar PV market.

The Asia-Pacific region holds the largest share, estimated at almost 50% in the global solar rooftop market and is anticipated to grow at a high rate which will directly result in growth in solar rooftops. Asia-Pacific's rapidly growing industrial, commercial, and utility sectors demand a significant amount of electricity for their operations that has positive impact on the market growth. The government initiatives for the use of renewable energy are making end users opt for solar energy. Such trends and investments in the development of renewable energy have a significant impact on the development of the rooftop solar PV market.

𝐁𝐮𝐲 𝐍𝐨𝐰 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭 @ www.alliedmarketresearch.com/checkou…a8498d0407

The global rooftop solar PV market is segmented into deployment, technology, grid type, end use, and region. Depending on the deployment, it is categorized into terrace-mounted and pole-mounted. On the basis of technology, it is bifurcated into thin film and crystalline silicon. On the basis of grid type, it is classified into off-grid and grid-connected. On the basis of end use, it is classified into residential, commercial, and industrial. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. Presently, Asia-Pacific accounts for the largest share of the market, followed by Europe, North America, and LAMEA.

Based on deployment, the pole mounted segment held the highest market share in 2022, accounting for more than two-third of rooftop solar PV market revenue, and is estimated to maintain its leadership status throughout the forecast period. The increase in the utilization of solar street lights and other emergency equipment on the road drives the demand for pole mounted solar PV market. However, the terrace mounted segment is projected to manifest the highest CAGR of 6.2% from 2023 to 2032. The increase in government initiatives toward the development of rooftop solar power generation has a positive impact on the terrace mounted rooftop solar PV market.

Based on the technology, the crystalline silicon segment held the highest market share in 2022, accounting for more than four-fifth of the rooftop solar PV market revenue, and is estimated to dominate during the forecast period. The dominance of crystalline silicon solar panels is mostly due to the cost-effectiveness and the presence of a well-established supply chain and manufacturing facilities over decades of commercialization have a significant impact on the market. However, the thin film segment is projected to manifest the highest CAGR of 7.0% from 2023 to 2032, mostly due to its application in commercial buildings for power generation and other applications. Thin film solar panels are widely used as solar windows of commercial buildings for power generation. This manufacturing process allows for flexibility, lighter weight, and potentially lower production costs compared to crystalline silicon panels.

𝐄𝐧𝐪𝐮𝐢𝐫𝐲 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠 : www.alliedmarketresearch.com/purchas…ry/A124759

Based on the grid type, the grid connected segment held the highest market share in 2022, accounting for more than four-fifths of the rooftop solar PV market revenue, and is estimated to dominate during the forecast period. The increase in awareness among the government and corporations towards the environment has led to an increase in investment in renewable power generation utilities related to solar power generation which boosted the grid connected rooftop solar PV market.

However, off-grid segment is projected to manifest the highest CAGR of 6.2% from 2023 to 2032. The rapid growth of off-grid rooftop solar PV is mostly due to an increase in government incentives to consumers for the installation of rooftop solar panels. In addition, the presence of rural areas and off-grid villages in developing countries has a high demand for rooftop solar panels for power generation. The presence of demand is expected to drive the rooftop solar PV market.

Based on the end-use, the industrial segment held the highest market share in 2022, accounting for more than two-fifths of the rooftop solar PV market revenue, and is estimated to dominate during the forecast period. The increase in demand for emergency backup power in the industrial building has led to the utilization of renewable power generation facilities such as rooftop solar power generation to power the instruments during the power outage which boosted the industrial rooftop solar PV market.

However, the commercial segment is projected to manifest the highest CAGR of 6.3% from 2023 to 2032. The rapid rooftop solar PV market growth is mostly due to an increase in commercial infrastructure development in developing countries such as India, China, and Brazil has driven the installation of rooftop solar panels. In addition, the shift towards the sustainable power generation capability from the construction industries is expected to drive the rooftop solar PV market.

𝐓𝐡𝐞 𝐤𝐞𝐲 𝐩𝐥𝐚𝐲𝐞𝐫𝐬

Suzlon Energy Ltd

Goldwind Science and Technology Co., Ltd.

Vestas Wind Systems A/S

Yingli Green Energy Holding Company Limited

Suntech Power Holdings Co., Ltd.

JinkoSolar Holding Co., Ltd.

Alstom SA

Constellation Energy Corporation

NTPC LIMITED

JA Solar Holdings Co. Ltd.

David Correa

Allied Market Research

+1 800-792-5285

email us here

Visit us on social media:

Facebook

X

![]()