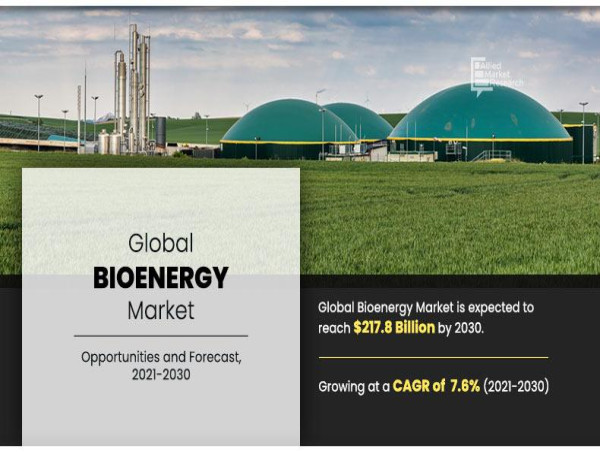

WILMINGTON, DE , UNITED STATES, May 31, 2024 /EINPresswire.com/ -- The bioenergy market size was valued at $102.5 billion in 2020, and is projected to reach $217.8 billion by 2030, growing at a CAGR of 7.6% from 2021 to 2030. Bioenergy is the form of energy generated by using bio-based sources such as agricultural waste, solid waste, animal manure & human sewage, biomass, and others.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐬𝐚𝐦𝐩𝐥𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 𝐰𝐢𝐭𝐡 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬: https://www.alliedmarketresearch.com/request-sample/A06874

Bioenergy offers various key benefits such as carbon neutrality, independency on fossil fuels, less cost, wide availability, less environmental pollution, less landfills, and others. Applications of bioenergy include heat & power generation, transportation as lubricants, biorefinery operations, aviation, marine, and manufacturing applications. Rise in awareness and regulations toward waste management significantly contributes toward growth of the market in the coming years.

Significant development of end-use industries such as manufacturing, building & construction, transportation, and power generation fuels growth of the bioenergy market during the forecast period. In addition, increase in demand for biomass and biofuels for efficient heat generation in Europe and North America is expected to propel growth of the market during the forecast period. However, some of the disadvantages of bioenergy such as high cost & space for plant setup, less efficiency of ethanol as compared to gasoline, and risk of deforestation in the future are the key factors expected to hamper growth of the global market in the upcoming years.

Depending on product type, the liquid biofuel segment held the highest market share of about 40.2% in 2020, and is expected to maintain its dominance during the bioenergy market forecast period. This is attributed to rise in demand for liquid biofuels from transportation applications such as passenger vehicles, trucks, ships, and airplanes. In addition, increase in demand for liquid biofuels from power generation applications in building & construction, residential, and other commercial applications is further anticipated to drive the market growth in the coming years.

𝐁𝐮𝐲 𝐍𝐨𝐰 & 𝐆𝐞𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐎𝐧 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.alliedmarketresearch.com/checkout-final/7e5bd474eb0d79d3d9fa2f7d9da95b9a

On the basis of feedstock, the solid waste segment holds the largest share, in terms of revenue, and is expected to maintain its dominance during the forecast period. This growth is attributed to rise in solid waste generation from residential, commercial, and industrial sectors, which can be increasingly used in bioenergy generation.

In addition, rise in demand for sustainable electricity, transportation fuels, heat generation, and other purposes is expected to fuel growth of the bioenergy market for solid waste during the forecast period.

On the basis of application, the transportation segment holds the largest share, in terms of revenue, and is expected to maintain its dominance during the forecast period. This growth is attributed to stringent government regulations toward carbon emissions from conventional fuel sources such as diesel, kerosene, petrol, and others in transportation applications. In addition, rapid growth of the transportation sector across the globe is expected to fuel growth of the global bioenergy market from 2021 to 2030.

On the basis of region, the market is analyzed across four major regions such as North America, Europe, Asia-Pacific, and LAMEA. Europe garnered a dominant share in 2020, and is anticipated to maintain this dominance in during the forecast period. This is attributed to presence of key players and huge consumer base in the region.

𝐈𝐟 𝐲𝐨𝐮 𝐡𝐚𝐯𝐞 𝐚𝐧𝐲 𝐪𝐮𝐞𝐬𝐭𝐢𝐨𝐧𝐬, 𝐏𝐥𝐞𝐚𝐬𝐞 𝐟𝐞𝐞𝐥 𝐟𝐫𝐞𝐞 𝐭𝐨 𝐜𝐨𝐧𝐭𝐚𝐜𝐭 𝐨𝐮𝐫 𝐚𝐧𝐚𝐥𝐲𝐬𝐭 𝐚𝐭: https://www.alliedmarketresearch.com/connect-to-analyst/A06874

In addition, increase in investments and R&D toward bioenergy to achieve future renewable energy targets by European Union member states is expected to augment growth of the Europe bioenergy market during the forecast period.

The global market analysis covers in-depth information of the major bioenergy industry participants. The key players operating and profiled in the report include EnviTec Biogas AG, Babcock & Wilcox, Orsted A/S, Fortum Oyj, Hitachi Zosen Corporation, Pacific Bioenergy Corp, Royal Dutch Shell Plc, BP Plc, Enerkem, and MVV Energie AG.

𝐊𝐞𝐲 𝐅𝐢𝐧𝐝𝐢𝐧𝐠𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐒𝐭𝐮𝐝𝐲:

In 2020, the liquid biofuel segment accounted for about 40.2% of the share in the global market, and is expected to maintain its dominance till the end of the forecast period.

In 2020, the solid waste segment accounted for 36.8% bioenergy market share in the year 2020, and is anticipated to grow at a rate of 7.3% in terms of revenue, increasing its share in the global market.

Heat generation is the fastest-growing application segment in the global bioenergy market, expected to grow at a CAGR of 8.3% during 2021–2030.

Europe is expected to grow at the fastest rate, registering a CAGR of 8.1%, throughout the forecast period.

In 2020, Europe dominated the global bioenergy market with more than 47.5% of the share, in terms of revenue.

David Correa

Allied Market Research

+ 18007925285

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Other

![]()