Highlights

- Stablecoin category of the cryptoverse is facing heat after the losses manifested by UST

- GYEN stablecoin is said to be pegged to the Japanese yen, and its trading volume has surged

- GYEN crypto’s market cap is very low as compared to USD-pegged stablecoins like Tether

Bitcoin’s price was below US$30,000 as of writing. But arguably more shocking was the trouble in another category of cryptoassets -- stablecoins.

Stablecoins are expected to maintain their fixed value at all times. For example, if TerraUSD (UST) is said to be pegged to the USD, one UST token must always have a price of US$1. However, as of writing, UST was trading below US$0.7. LUNA token of the same Terra ecosystem has lost over 99 per cent of its value over the past couple of days.

UST’s unexpected dip in value has ignited debates over how UST and other stablecoins maintain their reserves. Though most of these stablecoins including Tether (USDT) and Binance USD (BUSD) are all pegged to the USD, one stablecoin is pegged to the Japanese yen. Let’s know more.

GYEN stablecoin

USDT and BUSD are one of the top ten cryptoassets by market cap. GYEN -- pegged to the fiat currency Japanese yen -- does not have such high market cap. GMO Trust -- which claims to have launched the first regulated stablecoin pegged to the Japanese yen -- also has a USD pegged asset, ZUSD.

Also read: What are stablecoins? Top 3 assets by market cap in this category

GMO Trust claims to hold the fiat currency deposits of users in accounts maintained with FDIC-insured banks. It talks about “anti-money laundering compliance” and monthly audits of fiat currency reserves by independent entities. It is said that both GYEN and ZUSD stablecoins’ settlement is “near-instant” on platforms like BitGo.

GYEN crypto trading volume

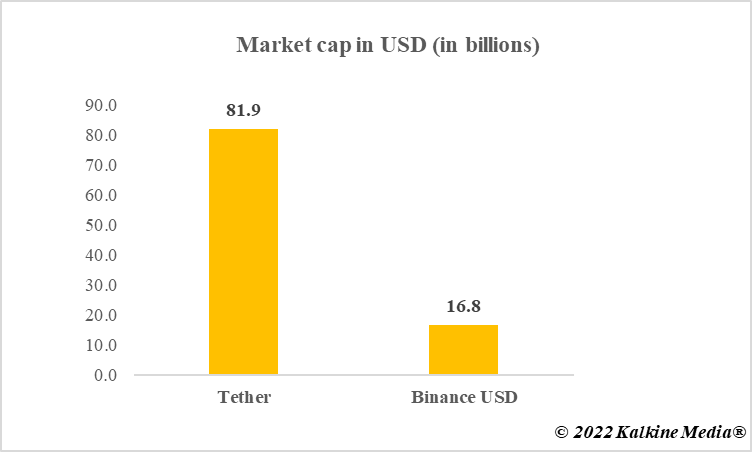

The market cap of GYEN token, as of writing, was over US$20 million. This is very low as compared with multi-billion-dollar market caps of stablecoins like Tether and Binance USD.

As the price of GYEN crypto is pegged to the Japanese yen, per token price as of writing was nearly US$0.0076. More than price, which is expected to remain stable, it is the trading volume of stablecoins that matters. GYEN token’s 24-hour volume was nearly US$2.5 million, which had gone up by almost 700 per cent as of writing.

Though Tether’s trading volume is usually the highest among all assets in the cryptoverse, the jump in the volume of GYEN may be indicative of inclination of enthusiasts toward a stablecoin pegged not to the USD but some other fiat currency.

Also read: Terra (LUNA) crypto falls more than 50%: Why?

Data provided by CoinMarketCap.com

Bottom line

It is the decline in the value of stablecoin UST that has many crypto enthusiasts worried. Though UST should ideally maintain per token value at US$1, the plunge below US$0.7 indicates the risks prevalent even in this category. This may have sparked interest of some in the Japanese yen pegged asset GYEN. GYEN stablecoin’s trading volume has surged sharply. But it has yet to match the market caps of Tether or Binance USD.

Also read: What are Madonna NFTs and are they failing to invite high bids?

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.