Summary

- Twenty-five per cent drop in average real estate sale prices in the Greater Toronto area from April, the Toronto Real Estate Board states.

- Slower real estate activity observed in Charlottetown, Halifax and Saint John in March.

- Ontario accounts for more than half of the single-family home permits issued.

- FirstService Corporation (TSX:FSV) and Tricon Residential Inc (TSX:TCN) are two real estate stocks that performed well this year.

Canadian housing market is experiencing a slowdown in the recent times owing to higher mortgage rates, restricted lending and taxes on foreign purchases in the largest metro areas. Home purchases in Toronto and Vancouver have reduced and buying was paused temporarily, thus contributing to the slowdown. During these times of uncertainty, few real estate stocks have performed well. These are FirstService Corporation (TSX:FSV) and Tricon Residential Inc (TSX:TCN).

Statistics Canada findings reveal an upward trend in the residential sector in Ontario and Quebec with an increase in total value of building permits by 1.7 per cent to C$ 8.1 billion in August 2020. The permits issued for single family homes rose 9.9 per cent to C$ 2.5 billion and total value of residential permits increased by 7.1 per cent to C$ 5.6 billion in August.

The total value of non-residential permits saw a drop by 8.6 per cent, while Prince Edward Island showed increase by 82.2 per cent, Quebec by 9.9 per cent and Nova Scotia by 16.7 per cent. Also, commercial permits issued fell by 14.7 per cent to C$1.4 billion in August.

Let us look into the performance of two trending real estate stocks.

FirstService Corporation (FSV: TSX)

Current FSV Stock price: C$178.22

FirstService Corporation (FSV: TSX) is a North America-based rental housing company. The company caters to its customers through two platforms: FirstService Residential and FirstService Brands. For the second quarter financial report, ending June 30, 2020, the company’s revenues were US$ 621.6 million, an eight per cent increase from the same quarter last year.

Adjusted EBITDA grew 10 per cent year-over-year to C$ 71.2 million. Adjusted earnings per share was US$ 0.86, as compared to US$ 1.12 in the same quarter of 2019.

The company reported GAAP operating earnings of US$ 44.9 million in June 2020, and an operating loss of US$ 268.5 million in the same period last year. The GAAP earnings per share was US$ 0.64 in Q2 2020, as compared to US$ 7.48 loss per share in Q2 2019.

FSV stock performance

Market volatility and continued lockdown resulted in dip in stock price to C$ 84.82 on March 24. The year-to-date performance of FSV stock increased by 48 per cent. The company’s current market capital is C$7.74 billion and price-to-earnings ratio (P/E ratio) is 75.0, as per data on the TSX. The board of directors declared a quarterly dividend of C$ 0.165 per common share to be paid on October 7.

The 10-day average volume of shares traded on the exchange is 70,212. The price-to-book (P/B) ratio is 9.681 and a price-to-cash flow (P/CF) ratio is 25.40, TSX data added. The company’s return on equity (RoE) is 14.09 per cent and return of asset (RoA) of 2.93 per cent. FirstService Corporation (TSX:FSV) has a 24,000 strong workforce across North America. Its annual revenues amount to US$ 2.4 billion.

Tricon Residential Inc. (TCN: TSX)

Current TCN Stock price: $11.25

Tricon Residential Inc is one of the growing rental housing companies in the US and Canada focused on serving the middle-market demographic. The company has a current market capitalisation of C$ 2.17 billion. It paid quarterly dividends of C$ 0.07 and currently yields 2.48 per cent.

TCN stock performance

Tricon’s price-to-book (P/B) ratio is 1.014, price-to-earnings ratio (P/E ratio) is 32.80 and price-to-cash flow (P/CF) ratio is 21, as per data on the Toronto Stock Exchange (TSX). The company’s RoE stands at 3.23% and RoA at 1.17 per cent. The stock grew by 7.04 per cent year-to-date performance.

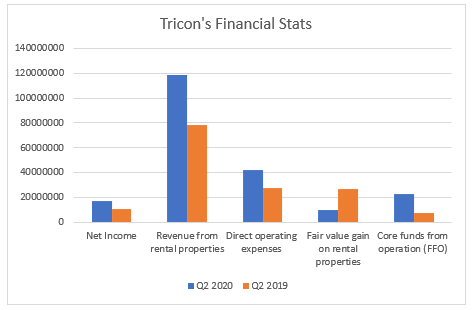

Tricon's earnings per diluted share is US$ 0.09 in Q2 2020, as compared to US$ 0.03 in Q2 2019. Net income for the second quarter of 2020 was US$ 17.3 million as compared to US$ 10.7million in the second quarter of 2019.

Revenue from rental properties was US$ 118.9 million in comparison to US$ 78.7 million in the second quarter of 2019. Direct operating expenses stood at US$ 41.9 million, as compared to US$ 27.9 million in the second quarter of 2019. Fair value gain on rental properties was US$ 10.3 million, as compared to US$ 27 million in the second quarter of 2019.

Source: Tricon / Image: ©Kalkine Group 2020

The core funds from operation for Q2 2020 was US$ 23 million, up 214 per cent year-over-year.

After acquiring 68 single-family rental homes and bringing its portfolio to 21,622 homes, the company paused its acquisition program temporarily during the pandemic. Tricon plans to resume acquisitions in the third quarter of 2020.

Blackstone Real Estate Income Trust recently invested US$ 395 million equity investment in Tricon Residential in exchange of preferred equity worth US 240 million.