Highlights

- Gold Road Resources Limited offers an improved takeover bid to DGO Gold Limited.

- The improved offer shall reportedly close on 30 June 2022.

- GOR share price is slightly up today, though still loss making on a YTD basis.

Gold explorer and miner, Gold Road Resources Limited (ASX:GOR), has announced an improved share offer consideration to DGO Gold Limited shareholders. Gold Road had made a conditional, off‑market, takeover bid to DGO on 4 April 2022, offering 2.16 Gold Road shares for every DGO share held. In absence of any superior proposal, the offer by Gold Road continues to be unanimously recommended by the DGO board of directors.

What’s in Gold Road’s updated takeover offer?

Gold Road has launched the third supplementary bidder’s statement and variation notice with the Australian Securities and Investments Commission (ASIC) for DGO takeover.

Key highlights of the improved offer are-

Image source: © 2022 Kalkine Media ®, source-ASX announcement

As per Gold Road, the improved offer is ‘best and final’ and will not be increased further except for few limited circumstances like absence of a competing proposal or material change in circumstances with respect to DGO or its investment entities. Gold Road also reports that offer shall be extended if it’s voting power in DGO shares increases to 75% or more by trade close on 21 June 2022. Gold Road also reports that the improved offer has compelling value and a significant premium in relation to the unaffected volume weighted average share prices (VWAPs) of both companies.

Meanwhile, Gold Road has received acceptances from 21.5% of DGO shareholders DGO (as of 27 May 2022) alongside unanimous support from DGO directors.

How has DGO reacted to the improved takeover bid?

While some DGO shareholders have already accepted the offer, as of 28 May 2022, no competing proposal has emerged yet. So, the DGO directors continue to recommend the remaining DGO shareholders to accept the offer. Based on the prevailing market prices as of 27 May 2022, which is the last trading day prior to the current announcement, the implied value of DGO share is AU$2.95. The amount represents a premium of 7.6% to DGO’s 10 Day VWAP as of that date.

Also, As at 28 May 2022, DGO directors have confirmed no intention to withdraw their acceptance to Gold Road, except for a superior proposal cropping up. Gold Road has also encouraged DGO shareholders to accept the new offer at the earliest to enable consideration payment early. Also, notably the DGO shareholders who have accepted the bid earlier are now entitled to the improved consideration.

Share price performance

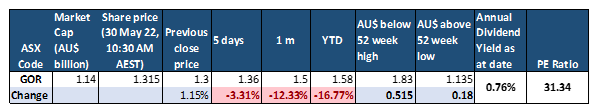

Image source: © 2022 Kalkine Media ®, source-ASX website

After today’s announcement, Gold Road share price has gained 1.15% over Friday’s close. While in the last 30 days GOR shares have lost 3.31%, they are down 16.77% on a year-to-date basis. However, the company’s price earnings ratio is still as high as 31.34. While the takeover bidding seems to be influencing GOR’s share price, it is not the only factor. GOR being a gold explorer and miner, the yellow metal’s price fluctuations also seem to have an impact on share price.

More from Mining- Here's why Core Lithium (ASX:CXO) shares gained 422% in a year