Latest

Tinkerine Studios: Shaping Future Creators Through Advanced 3D Pr...

June 19, 2025 09:27 PM EDT | By Team Kalkine Media

Sage Potash Announces Director Resignation and Grant of Stock Opt...

July 07, 2025 03:30 PM EDT | By News File Corp

Primary Hydrogen Announces LOI with Respect to Arthur Lake Proper...

July 07, 2025 02:47 PM EDT | By News File Corp

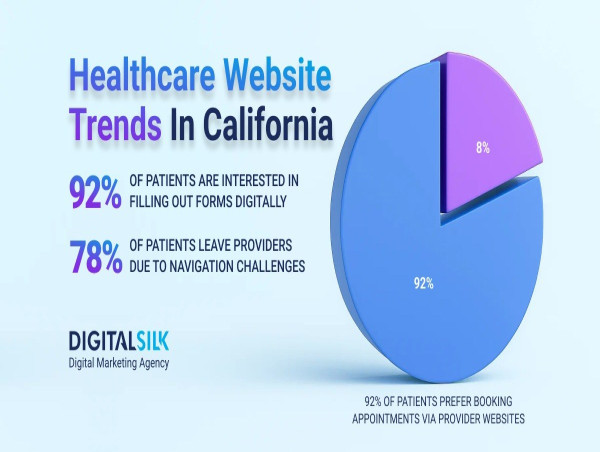

Digital Silk Examines Key Healthcare Website Trends in California...

July 07, 2025 01:22 PM EDT | By News File Corp

"How to Sell My Business at Peak Value" - IRAEmpire Publishes Gui...

July 07, 2025 01:12 PM EDT | By News File Corp

Trending

Crypto

View AllData provided by CoinMarketCap.com. & delayed by few minutes. Read Disclosure

ASSETS

| Index | Price(USD) | Change |

|---|