Highlights

- Fundie Perpetual Limited has rejected a takeover offer from a consortium comprising Regal Partners and BPEA Private Equity Fund VIII.

- As per Perpetual, the offer of AU$30 per share proposed by the consortium, was undervaluing the company.

- The company is now focusing on accelerating the acquisition of rival Pendal Group, announced on 25 August 2022.

Australian funds manager Perpetual Limited (ASX:PPT), on 3 November 2022, announced that it has rejected the buyout proposal made by a consortium to acquire 100% of PPT for AU$30 apiece. The consortium comprised of BPEA Private Equity Fund VIII and Regal Partners Limited (ASX:RPL)

The shares of the company, that closed at AU$26.90 per share on Wednesday (2 November 2022), jumped nearly 9% during the opening hours of trading on the ASX. At 10:51 AM AEDT, the stock was trading at AU$28.495 per share, up 6%, with a market capitalisation of AU$1.54 billion.

Key details from the Consortium’s proposal

- The indicative proposal of AU$30.00 cash per share, according to Perpetual, was undervaluing the company.

- The AU$1.749 billion takeover offer was a premium of 16% to the Perpetual shares on 2 November 2022 of AU$25.68 per share.

- Perpetual stated that now it is focusing towards accelerating its acquisition of Pendal Group (ASX:PDL). This acquisition was announced on 25 August 2022.

- Meanwhile, Regal Funds Management had recently acquired VGI Partners Ltd in June.

Perpetual Limited declared a scrip and cash deal in August 2022. The companies arrived at this stage months after the board of Pendal had rejected Perpetual’s offer of AU$2.4 billion as too low and undervaluing.

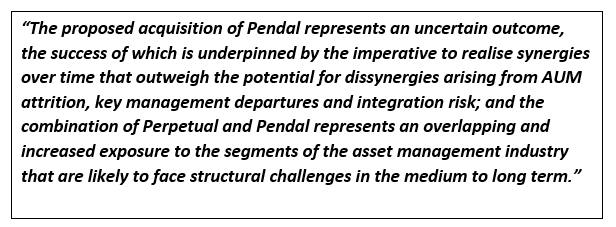

Regal Partners said in a statement:

Meanwhile, the shares of the company (Regal Partners) were spotted trading 1.8% strong at AU$2.730 apiece at 11:22 AM AEDT on the ASX today.