Latest

DOT Miners Expands Crypto Access with User-Friendly, Regulated Pl...

July 07, 2025 10:10 AM EDT | By Team Kalkine Media

TSX Declines Amid REITs and Energy Slump as Trade Tensions Reemer...

July 09, 2025 07:01 AM EDT | By Team Kalkine Media

Energy Gains Offset Materials Drag as S&P/TSX Composite Index Clo...

July 09, 2025 06:54 AM EDT | By Team Kalkine Media

Basic Materials Drag Down S&P/TSX Composite Index Amid Copper Tra...

July 09, 2025 06:49 AM EDT | By Team Kalkine Media

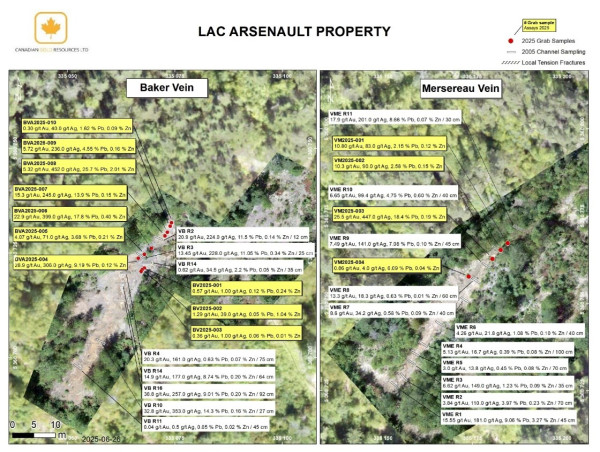

Canadian Gold Resources Uncovers High-Grade Gold-Silver Mineraliz...

July 09, 2025 06:46 AM EDT | By News File Corp

Cigo Tracker Expands Operations into the U.S. Market, Bringing Le...

July 09, 2025 06:36 AM EDT | By News File Corp

Trending

Crypto

View AllData provided by CoinMarketCap.com. & delayed by few minutes. Read Disclosure

ASSETS

| Index | Price(USD) | Change |

|---|