Highlights

- ALQ offers technical testing services to the minerals, energy, life sciences and industrial sectors globally.

- The company delivered 52.9% YoY growth in statutory net profit after tax in FY23.

- The Vanguard Group, Inc. have the maximum stake in the company with a shareholding of nearly 5%.

ALS Limited (ASX:ALQ) is an ASX-listed firm that offers professional technical testing, certification, verification and inspection services to the minerals, energy, life sciences and industrial sectors globally.

In the financial year 2023, the company registered 19.5% YoY growth in revenue to AUD 2,421 million, largely underpinned by the performance of Metallurgy, Geochemistry and Environmental business and the acquisition within the Life Sciences business segment. The period saw 52.9% YoY growth in statutory net profit after tax to AUD 291 million.

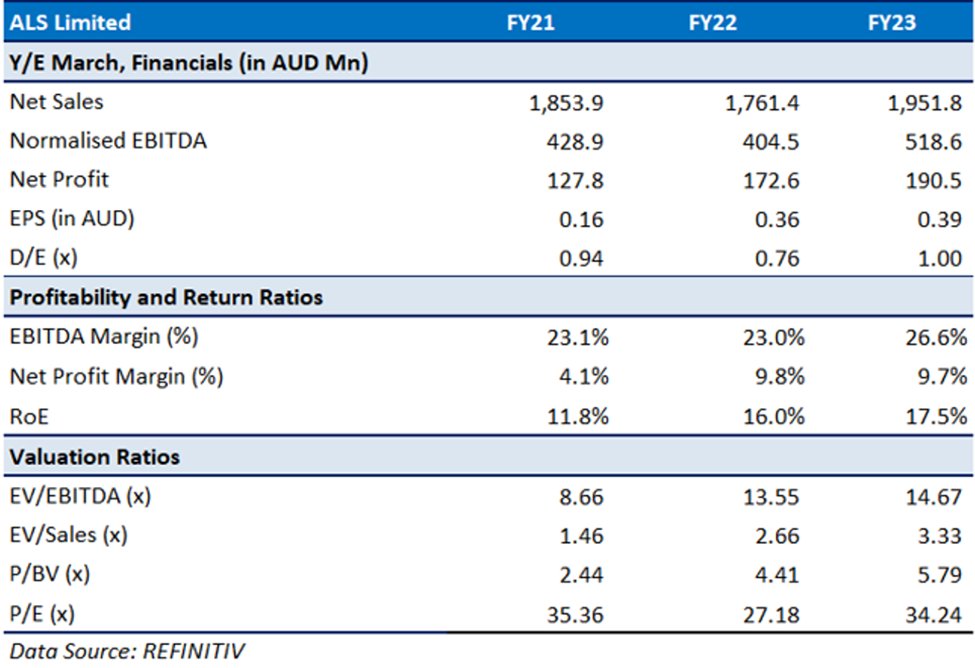

Here’s the historical financial trend of ALQ.

Top 10 shareholders of ALQ

The top 10 shareholders of ALQ together have nearly 31.09% stake in the company. The Vanguard Group, Inc. has the highest interest in the company with a shareholding of around 5%, followed by Paradice Investment Management Pty. Ltd., which has approximately 3.63% shareholding.

Recent business update

Through an ASX update dated 15 August 2023, the company notified that the Vanguard Group, Inc. and its controlled entities became substantial holders on 9 August 2023 with more than 29.22 million securities.

Outlook

ALQ shared that the Environmental business under the Life Sciences division met the expectations across all geographies, and the underlying pharmaceutical business continued its growth momentum.

For the Life Sciences and Commodities division, the company’s medium to long-term outlook is favourable.

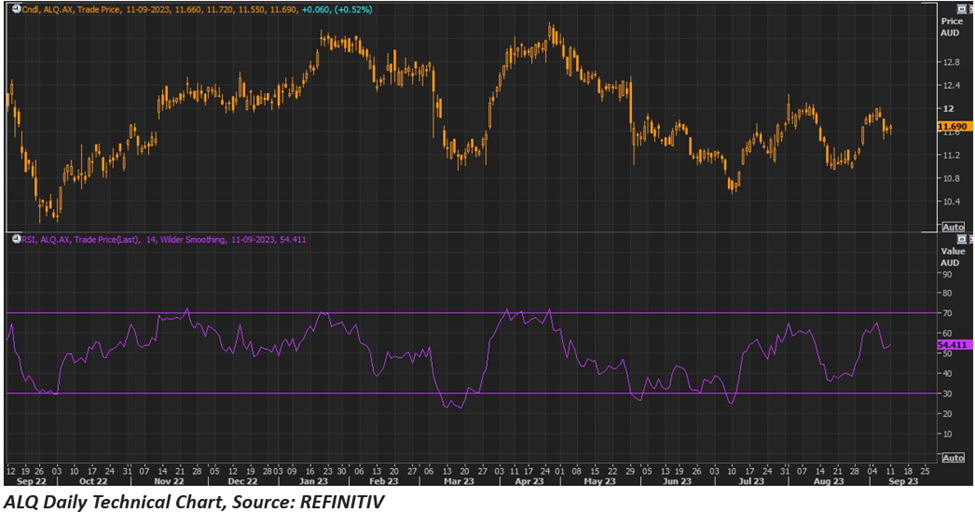

Share performance of ALQ

ALQ shares closed 0.52% up at AUD 11.69 apiece on 11 September 2023. With this, ALQ’s share price dropped by 1.76% in the last 12 months and increased by 3.27% in the last six months.

The 52-week high of ALQ is AUD 13.48 apiece, recorded on 26 April 2023, and the 52-week low is AUD 10.2 apiece, recorded on 26 September 2022. Noteworthy here is that the today’s closing price is 16.67% higher than its 52-week low.\

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 11 September 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.