Highlights

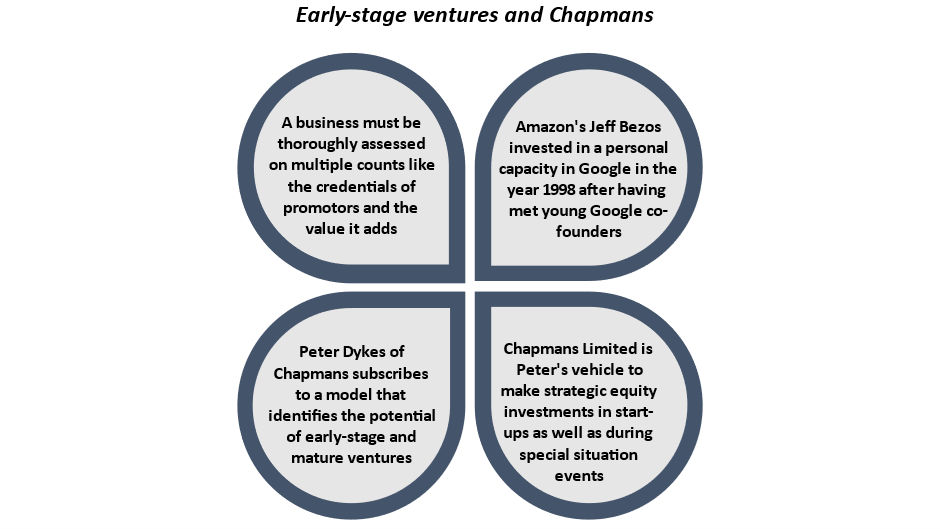

- Chapmans Limited subscribes to a diversified investment strategy, where both start-ups and mature businesses are thoroughly analysed

- Investment in early-stage ventures can be profitable, a popular example is Jeff Bezos’ Google bet

- Chapmans is an Australian investment firm led by Peter Dykes, who swears by due diligence in identifying a commercially viable opportunity

Is it true that eight out of 10 businesses fail in their first one and a half years? Some news reports have highlighted this subject over past years. However, there is a lack of empirical data to back up this argument. Nevertheless, the ‘8 out of 10’ theory has made inroads into investor circles across the globe.

Even though the exact success rate remains debatable, it is irrefutable that many businesses fail to perform and do not yield a return for their backers. This highlights the value that qualified investment firms bring to the market. These ventures, which include Australia’s Chapmans Limited, consider even the most minute details before making any investment commitment. Chapmans is not only into early-stage investment prospects but also explores possibilities in mature businesses and short-term trading like arbitrage.

A business is thoroughly assessed on multiple counts, including credentials of promotors and the incremental value that the venture seeks to add to the respective industry.

Let us explore the opportunities that early-stage ventures bring and how Chapmans Limited applies its diversified strategy to finding the right businesses and backing them financially.

Jeff Bezos’ Google connection

One of the world’s wealthiest persons, tech entrepreneur Jeff Bezos, is famous as the founder and former CEO of Amazon. That he began the venture in his garage is also a captivating story. But did you know that Bezos was one of the early investors in another tech venture, Google? Yes, Bezos invested in a personal capacity in Google in the year 1998. The irony is Google emerged as one of the staunchest competitors of Amazon in the tech space. Not many might know that according to an estimate, Jeff Bezos would have been a billionaire even outside of his own venture Amazon, thanks to his well-timed investment during the initial phase of Google.

A prudent investor never fails to miss an opportunity. This is also true for Peter Dykes, who heads Chapmans Limited.

© 2022 Kalkine Media®; (Data Source: Chapmans Limited)

Chapmans and Peter Dykes

Peter subscribes to the same investment model that identifies the potential of early-stage ventures and makes no delay in backing the right business after thorough due diligence. Peter has been in the investment space for more than 20 years with Chapmans Limited as its vehicle to make strategic equity investments in start-ups and mature businesses.

Before making any investment, Chapmans has a defined approach that relies heavily on due diligence.

Early-stage businesses are Chapmans’ key focus area, but the company’s approach is diversified and includes critical elements like special situation investment, short-term arbitrage, and trading. Peter and his company realise how publicly listed companies, undergoing rough phases like suspension or distressed revenues, can bring a unique investment opportunity. Here, Chapmans considers how these mature businesses would tide over the special situation to subsequently exhibit a period of accelerated growth.

Fears around the ‘8 out of 10’ theory justify the presence of entities like Chapmans Limited. To identify the right business, it takes a deep understanding and a data-driven analysis which the Dykes-led firm swears by. You can know more about Chapmans’ stock market listing here.