Highlights

- EcoGraf shares surged over 87% in the past month and 275% over six months.

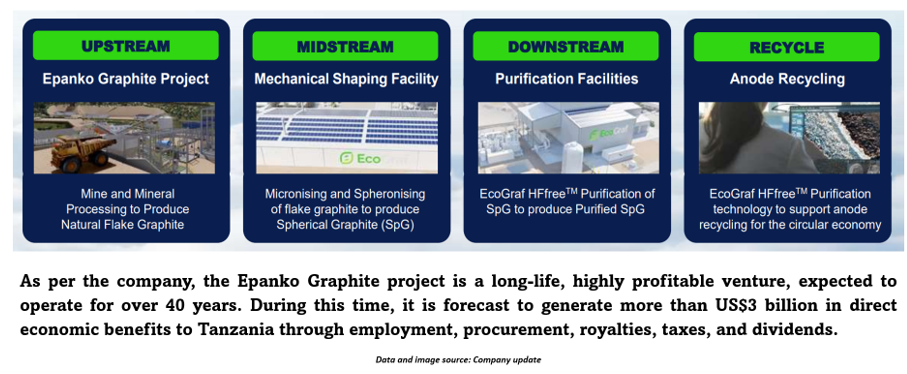

- The company is focused on building a vertically integrated battery anode materials business.

- EcoGraf’s flagship Epanko Graphite Mine in Tanzania aims to produce high-quality natural flake graphite.

- A life-of-mine Special Mining Licence was granted to Epanko in March 2025, ensuring long-term viability.

- The company’s EcoGraf HFfree™ technology ensures the sustainable production of high-performance battery anode material.

Shares of EcoGraf Limited (ASX:EGR) have been in the spotlight recently, gaining more than 87.5% in just the past month and an impressive 275% over the last six months, as of 14 April 2025.

Currently trading at AUD 0.30, EcoGraf is a penny stock on the rise. The company is focused on building a vertically integrated battery anode materials business, aiming to produce high-purity graphite products for the lithium-ion battery and advanced manufacturing markets.

EcoGraf Targets High-Purity Graphite with Epanko Mine

EcoGraf's business strategy is anchored around its Epanko Graphite Mine and its associated Mineral Processing Facility. Located approximately 370 km from Dar es Salaam in Tanzania, the project is focused on producing high-quality natural flake graphite. This project aims to establish a long-term, scalable source of high-quality feedstock for the company’s EcoGraf™ battery anode material processing facilities while also producing premium large flake graphite for specialised industrial applications.

Through its proprietary, environmentally friendly EcoGraf HFfree™ purification technology, the company aims to refine graphite to 99.95% carbon purity, creating high-performance battery anode material for the electric vehicle (EV) market.

Positive Stage 1 Economics Back Epanko Funding Plans

Epanko Mine and TanzGraphite Facility: Key Developments

EcoGraf has completed an Independent Engineering Study for the development of its TanzGraphite Mechanical Shaping Facility in Ifakara, Tanzania. The selection of Ifakara aligns with the company’s plans to expand its Epanko operation, aiming to produce around 300,000 tonnes of flake graphite annually.

The TanzGraphite facility is expected to add value by transforming 20,000 tonnes per year of Epanko's natural flake graphite into spherical graphite.

The company has also completed a major environmental and social planning update for the Stage 1 development of Epanko. Environmental and social work streams, along with independent reviews, have confirmed that there are no impediments to the project's development, ensuring it can proceed as planned.

One of the key milestones for EcoGraf came in March 2025, when the Government of the United Republic of Tanzania granted a life-of-mine Special Mining Licence (SML) for the Epanko Graphite project. This approval further bolsters the project's development and ensures its long-term viability.

EcoGraf is eyeing to capitalise on the ever-growing graphite market, driven by the rising demand for natural graphite in lithium-ion batteries used in EVs. With its Epanko project and environmentally friendly EcoGraf HFfree™ technology, the company aims to supply high-purity battery anode material, aligning with global trends toward cleaner energy and sustainable manufacturing practices.