Highlights

- Platina Resources continued its ‘going for gold’ strategy in Western Australia during the latest quarter.

- Assays from drilling at Xanadu project highlighted gold mineralisation at depth.

- The company boosted its gold portfolio with the addition of Brimstone, Beete, and Binti Binti gold projects.

- Platina also gained exposure to gold and/or platinum group geological target through the Mt Narryer exploration licence grant.

- PGM has planned exploration activities including drilling programs across projects in 2023.

Platina Resources (ASX:PGM) has tabled its latest quarterly report, indicating significant progress across projects during the three-month period ended 31 December 2023.

During the quarter, the company reported encouraging gold assays from drilling at its Xanadu project, addition of new gold projects through the acquisition of Sangold Resources and granting of the Mt Narryer exploration licence.

At the end of the quarter, Platina held AU$1.6 million in cash and investments valued at AU$2.6 million.

Encouraging gold assays at Xanadu Project

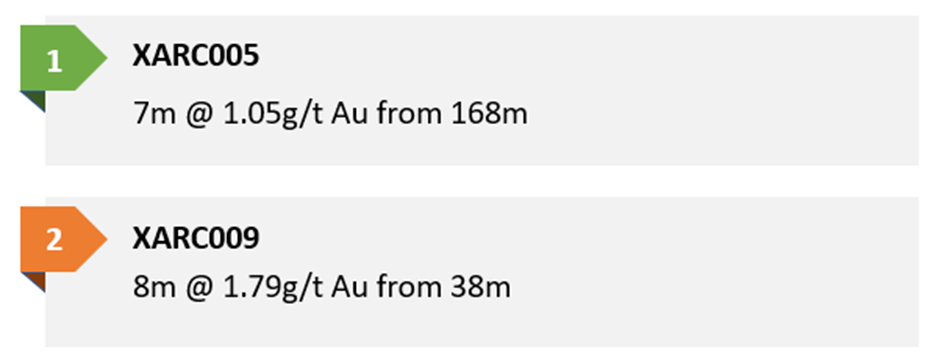

Platina shared assays from its maiden reverse circulation (RC) drilling at Xanadu, indicating the presence of gold mineralisation at depth. The results highlighted up to 900m on strike from untested ground immediately to the west of the historic Amphitheatre open pit anomaly.

Few of encouraging gold assays (Data source: PGM update)

The company plans to undertake a geochemistry and structural mapping assessment on areas west of the Amphitheatre pit and east of Cleopatra followed up by second phase drilling. The campaign will test the 900m zone as well as define the downdip extension and strike of strong mineralisation in XARC009 at Cleopatra.

The company has planned an updated cultural heritage survey and phase 2 drilling program during late-2023.

Challa Gold Project undergoes heritage surveys

The quarter saw completion of heritage surveys at the project located in-between the prolific Mt Magnet and Sandstone gold districts in Western Australia. The development would enable access to another five target areas for phase 2 drilling in the future.

Platina secures Mt Narryer exploration licence

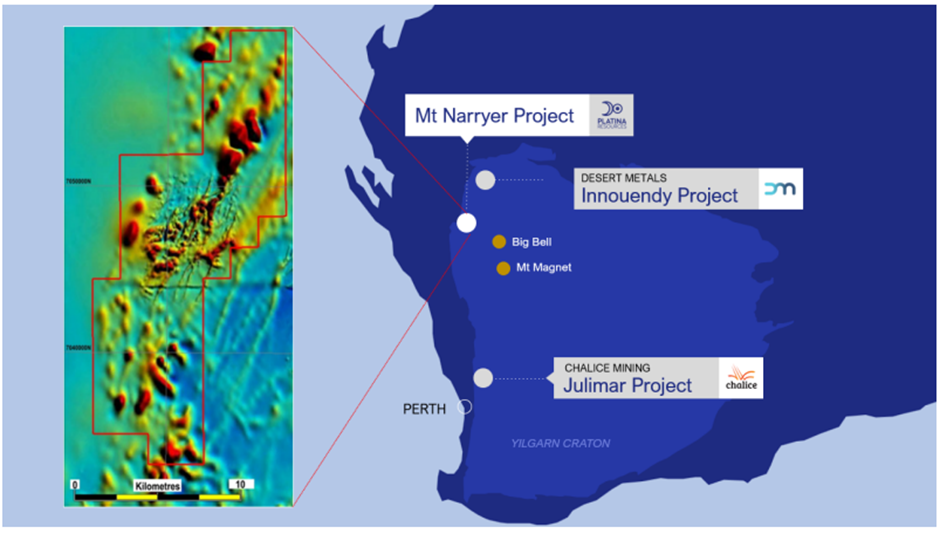

During the quarter, Platina secured the Mt Narryer exploration licence (E 09/2423), which sits within the Yilgarn Craton region.

The company has planned initial field activities including a low-cost reconnaissance geochemistry program to identify targets for follow up drilling. To know more, read here.

Project location (Image source: PGM update)

Sangold Resources acquisition adds 277km2 tenement package

Platina boosted its gold project portfolio with the successful acquisition of Sangold Resources Pty Ltd, which wholly owns the Brimstone Gold Project, an advanced, high-grade, near surface asset. With the acquisition completion, the company has been gearing up for exploration at the project. Currently, it remains focused on refining drilling targets across the tenement package, formalising cultural heritage approvals, advancing approvals process, and bedding down logistics for a planned drilling program.

This transaction also added full ownership of Beete, and Binti Binti gold projects to PGM’s Western Australian gold portfolio.

Platina highlights that many companies operating near its Beete project have reported very encouraging high-grade gold intersections and rare earth assays. Binti Binti, which has never been explored, is considered prospective for orogenic (lode) gold mineralisation.

Platina is eyeing multi-million-ounce gold deposits within its tenement portfolio covering 1,233km2 in the Ashburton Basin and Yilgarn Craton regions of Western Australia. The company plans to undertake exploration activities including drilling campaigns across projects during 2023.

PGM shares soar 13%

PGM shares traded at AU$0.025 on 2 February 2023, up more than 13.6% from the last close. In the last one month, the shares have gained more than 25%.