Highlights

- Cyprium Metals is taking all the necessary actions for restarting operations at its Nifty Copper Project.

- Most of the activities related to operational readiness and environmental cleanup have been completed, while some processes for Environment and Regulatory Approvals are nearing finish line.

- The Phase 1 of the Nifty Restart Project optimisation will include reviewed mineral resource estimates, adding further copper tonnes, mine life as well as cashflow.

In the latest announcement, Cyprium Metals Limited (ASX:CYM) provides further details related to the restart of operations at the Nifty Copper Project. The ASX copper player is advancing its steps for arranging the finance process for refurbishment of the project.

Advancement in refurbishment activities

Cyprium has secured the Nifty site with sufficient number of personnel placed on site for maintenance related activities. This will allow a swift transition to construction activities after finance for the project is arranged. With personnel placed at the site, there will be a check on maintenance of statutory regulations and reporting requirements, and electrical, operational, and mechanical integrity of the infrastructure.

The company believes that the Nifty workforce is doing a commendable job for the project’s refurbishment whilst the site remains under maintenance since its acquisition. The continuous efforts have now lasted for around 450 days now (approximately 300,000 hours worked) with no Lost Time Injury.

Alongside, Cyprium is advancing efforts for arranging funds from debt financiers. The due diligence activities and financing documentation related review is being conducted by interested parties.

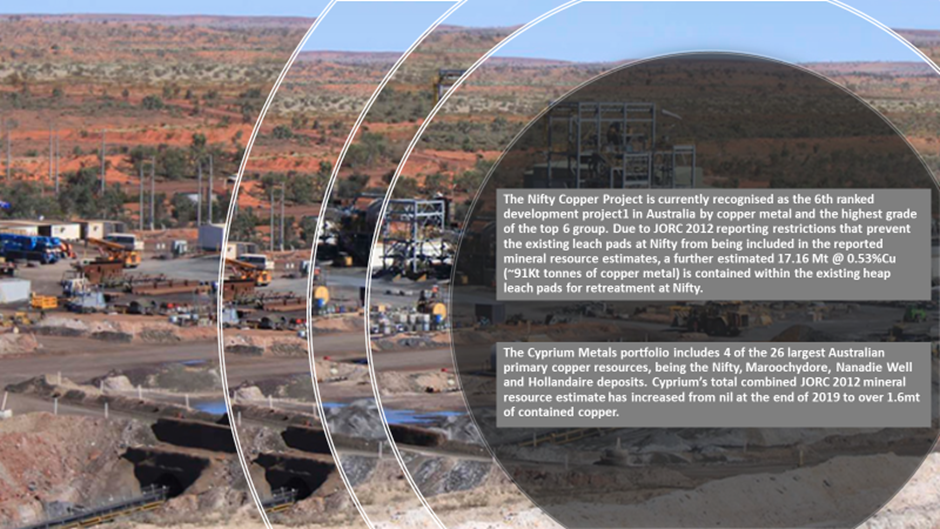

Nifty Copper Portfolio

At the time of acquisition, the Nifty Copper Project had a reported mineral resource estimate of 658.5 kt of contained copper metal in resource. However, Cyprium conducted a review of the Nifty mineral resource estimate, concluded inclusion of previous drilling and merged the resources databases for the purposes of the open pit design.

The reviewed mineral resource estimate was found to be 732.2 kt of contained copper in resource. This includes the estimate of a single model with geo-metallurgical domains.

A second review was conducted after Cyprium finished drilling of more than 18,000 m of reverse circulation (RC) into the west of the Nifty deposit, returning a mineral resource estimate of 940.2 kt contained copper in resource. 84% of the total estimate was classified in the measured and indicted category.

Image: © 2022 Kalkine Media®

Cyprium has completed ~5,000m of RC drilling into the eastern portion of the mineralisation. However, it has not been included in the latest mineral resource estimate yet. The eastern area is still open for further drilling.

The mineral resource endowment at Nifty Copper Project has been increased by over 40% and the west and east of the orebody is not closed off.

More copper tonnes (and cashflow) from the conversion of inferred to indicated resources and the increase in resource by the drilling undertaken along with mine life will be added to the Phase 1 oxide schedule after inclusion of the updated mineral resource estimates in the optimisation.

An overview of Nifty Restart Study

As per CYM, the Nifty Copper Project Restart Study highlighted a solid Phase 1 Oxide copper project with the potential to deliver massive financial returns.

The results of the study highlighted:

- C1 costs of USD1.91/lb and C3 costs of USD2.82/lb

- Average production of 25,000 tpa copper cathode

- Cathode production 146,100 tonnes copper metal

- Pre-production capital AUD149M

- NPV @7% of AUD277M with an IRR of 37% (post tax)

- Oxide mine life 2023-29 at ~6.3 years (pre-MRE upgrade) with sulphide potential +20yrs

- Free cashflow AUD544M

- Payback in 3 years

Image: © 2022 Kalkine Media®

CYM stock last traded at AU$0.069 on 5 October 2022.