Highlights

- Cannindah Resources announced a notable upgrade to the mineral resource estimate (MRE) at its flagship Mt Cannindah project during the September quarter.

- The company completed a capital raise of AU$5 million.

- Additional drilling is planned to expand the MRE and explore other high-priority IP targets.

During the September quarter, Cannindah Resources Limited (ASX:CAE), a Queensland-based exploration and resource development company, announced a significant upgrade to the mineral resource estimates (MRE) for its flagship Mt Cannindah Cu/Au project.

The company also concluded a capital raise of AU$5 million. Additionally, Cannindah Resources engaged in commercial discussions with interested parties regarding the Mt Cannindah project.

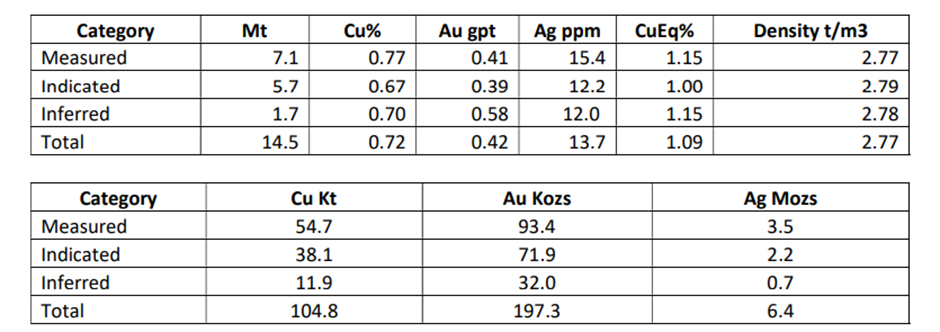

On 3 July 2024, Cannindah Resources announced a significant upgrade to the Mineral Resource Estimate (MRE) for the Mt Cannindah project, with notable increases in key resources:

Data source: Company update

- Copper metal tonnes increased by 117%. The overall increase in tonnes was 183% at a cut-off grade of 0.3%CuEq.

- Gold ounces increased by 229% in the updated resource

- Silver was improved with a 148% increase in ounces.

The company plans additional drilling to expand the MRE and explore high-priority IP targets, located approximately 800m southwest of the current resource area. A significant portion of the updated resource is classified as Measured and Indicated under the 2012 JORC code.

No exploration drilling occurred during the quarter as the company focused on completing the capital raise and preparing for the upcoming drilling program, which is expected to start soon.

The company closed the September quarter with a cash position of AU$4,688,285.

The share price of CAE was AU$0.038 at the time of writing on 07 November 2024.