Highlights

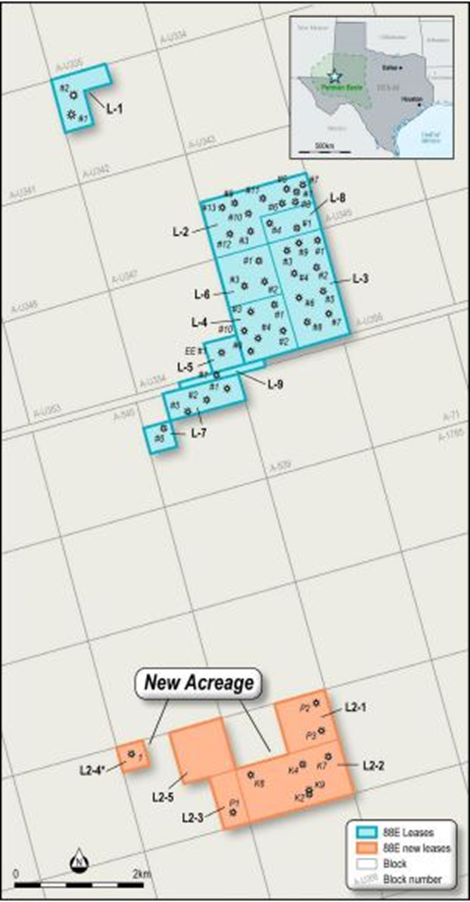

- 88E's new oil & gas production assets are situated in very close proximity to the existing Project Longhorn acreage

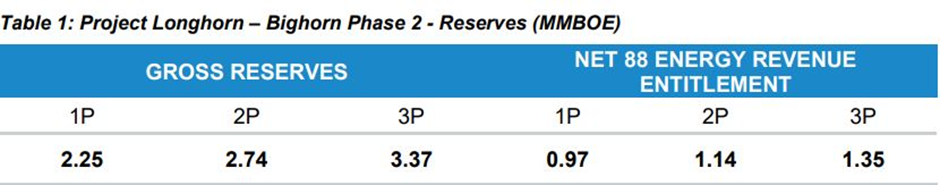

- All the proposed well locations, 88E confirms, are classified as low risk (accessing Proven reserves of 0.97 MMBOE)

- 88E states that the operator is targeting two new wells in 2H 2023, which are projected to expand the production to 160-200 BOE gross per day

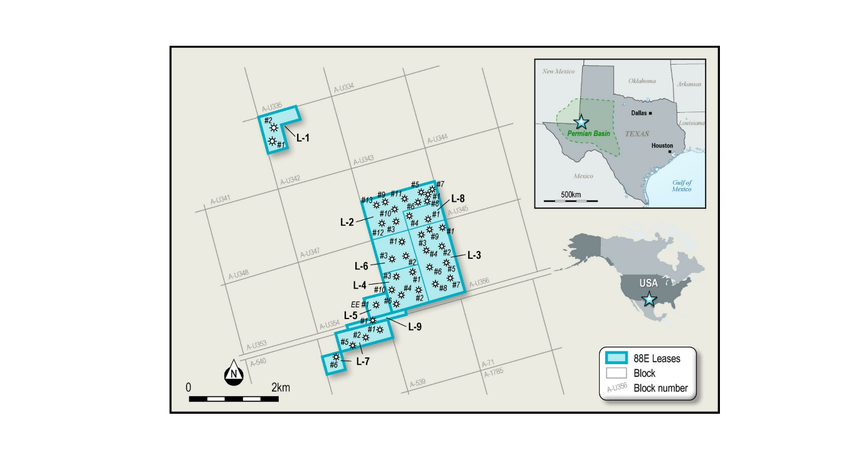

Listed oil & gas (O&G) company 88 Energy Limited (ASX:88E, AIM:88E, OTC:EEENF) recently announced that it has acquired additional non-operated working interest -- at purchase price of US$1.5 million (net to 88E US$1.1 million) -- in leases and wells, which are stated to have conventional onshore production and in development assets, within the Permian Basin (Texas). The new acreage is nearly four miles south of Project Longhorn production assets, with the average net working interest for 88E being ~45%.

This development provides the benefit of attractive low-cost entry, alongside additional upside potential identified in multiple zones, 88E mentions.

Source: Company update

More

88 Energy has executed binding agreements with respect to the acquisition of additional leases and wells within the Permian Basin (Texas, U.S.). The new non-operated working interest of 88E averages nearly 45% under the agreement. The new conventional onshore production and in development assets (estimated to have independently certified net 2P reserves of 1.1 MMBOE) are just ~4 miles to the south of company's Longhorn Project.

Notably, all the proposed well locations are classified as "low risk". 88E mentions that the wells should intersect a number of potentially oil-bearing intervals that have been successfully developed around Project Longhorn. The upside has been identified, with classification as Contingent or Prospective Resources, 88E states, and this will be quantified in due course.

While the costs involved for the latest acquisition is US$1.5 million (net to 88 Energy US$1.1 million), the company mentions that the development provides near-term production upside through two new wells that are planned in 2H of this year. Each well is anticipated to deliver IP30 of ~80-100 BOE per day gross (approximately 75% oil). It is pertinent to note that the existing Project Longhorn assets are presently producing ~400 BOE per day gross (approximately 75% oil).

Independently assessed by PJG Petroleum Engineers LLC as at 1 June 2023; Source: Company update

Expansion of 88 Energy’s O&G assets

The company states the latest development represents incremental expansion with respect to producing oil & gas assets. This step -- which has been undertaken in a "measured fashion" -- is in accordance with 88 Energy's strategy to build a strong oil & gas exploration and production company.

88 Energy expects the total gross production of Project Longhorn to reach ~500 BOE per day (~75% oil) by 2023 end, subject to completion of the new wells and workovers across all its Texan acreage.

88E ASX shares were priced at AU$0.007 (market cap over AU$140 million) on 12 July 2023.