The benchmark index was trading at 6,620.9, up 1.03% from its previous close, while S&P/ASX 200 Materials (Sector) was trading at 13,209.7, up 0.56%, and S&P/ASX 200 Real Estate (Sector) was trading at 3,800.0, up 0.18% on 5 September 2019 (AEST 03:16 PM).

In this article, we would be discussing three companies from diversified sectors (real estate and materials), which have delivered healthy dividend yields in the recent past. Let us have a look at recent updates from these companies that are expected to have a direct or indirect impact on these companiesâ business.

Incitec Pivot Limited

Incitec Pivot Limited (ASX: IPL) is a producer and distributor of industrial explosives, industrial chemicals and fertilisers, catering to clients across the globe. The company is also engaged in providing related services.

Investor Day:

On 4 September 2019, IPL held its investor day in Brisbane, covering several topics including strategic review & FY2019 guidance, manufacturing excellence, explosives & technology overview and balance sheet.

During the last one year, the company made strong progress on strategic agenda with strong momentum in Health, Safety & Environment (HS&E), successfully recontracting Australian volumes, sustaining market share growth in Dyno Nobel Americas, resolving uncertainty over Gibson Island gas supply, among others.

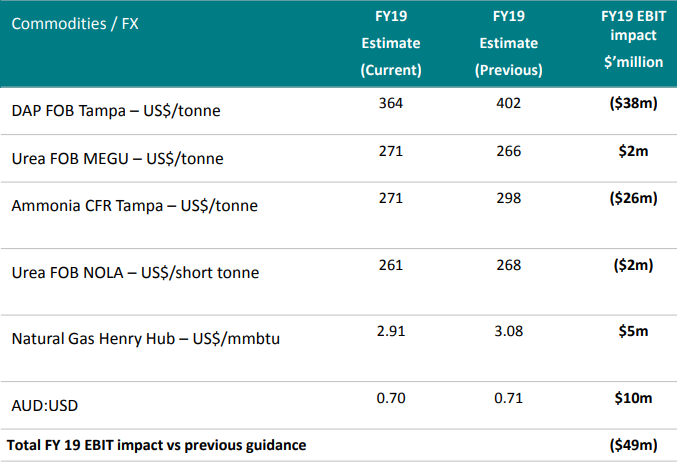

The company also highlighted about revised FY19 earnings guidance, which was announced to the market on 2 September 2019. It had issued FY19 guidance in May 2019, including $370-$415 million in EBIT, which was on the basis of disclosed forward commodity price and FX assumptions. The company has revised down the FY19 EBIT guidance to $321-$366 million, after applying the publicly available actual pricing and foreign exchange rates. However, owing to operational factors, the management feels that EBIT can further slide to $285-$295 million for FY19. IPL expects NPAT to be around $133 million to $143 million, based on tax rate and interest guidance.

FY19 Revised Guidance (Source: Companyâs Reports)

The management also highlighted regarding a $20 million benefit of potential one-off items that could arrive in FY19 or FY20. The above benefit could relate to realisation from insurance claims from Phosphate Hill rail outage and sale of extra land in the US. Interest expense guidance would remain unchanged with the previous guidance of $145 million.

Strategic Review of Fertilisers Division:

Recently, IPL unveiled its plan of a strategic review of its fertilisers segment across Asia-Pacific, namely Incitec Pivot Fertilisers. The company has appointed UBS for guidance regarding the strategic review, which is likely to progress over the course of FY20 and is aimed at maximising shareholder value. Under the strategic review, several options would be assessed including a potential sale of the business. The company would also consider a demerger or retaining the business and continuing investments towards growth as part of the review.

Incitec Pivot Fertilisers provides fertilisers to the grain, cotton, pasture, dairy, sugar, sorghum and horticulture industries in Queensland, New South Wales, Victoria, South Australia and Tasmania. The company serves these industries via a network of over 200 dealers and agents.

Stock Update:

The stock of IPL was trading at a price of $3.185 on 5 September 2019 (AEST 03:16 PM), up by 3.746% from its previous close. The stock is available at a price to earnings ratio of 20.960x. The market capitalisation of the company stands at $ 4.93 billion. The 52-week trading range of the stock is at $2.740 to $4.280. The annualised dividend yield of the company stood at 2.44%.

Growthpoint Properties Australia

Growthpoint Properties Australia (ASX: GOZ) manages and owns investment properties and has a diversified portfolio of 57 properties worth approximately $4 billion across Australia. The company has a mandate to invest in offices, as well as industrial and retail properties.

Purchase of Logistics Office/Warehouse:

On 4 September 2019, GOZ announced to have reached a contract for the acquisition of a logistics office/warehouse covering gross lettable area of 31,092 square metres. The property completely leased to HB Commerce Pty Ltd for a tenure of 3.1 years is in Victoria and is being purchased from Frasers Property Group. It is being bought on an initial income yield of 5.83%. The settlement of the acquisition is expected on 6 September 2019.

The current acquisition worth $40 million is in line with the companyâs strategy of investing across prime located logistics facilities and modern industrial investments.

On the same day, the company also informed that one of its directors, Ms Maxine Brenner acquired 11,111 ordinary fully paid stapled securities at a price of $4.43 per stapled security. The current number of securities with the director stands at 18,356.

FY19 Financial Highlights:

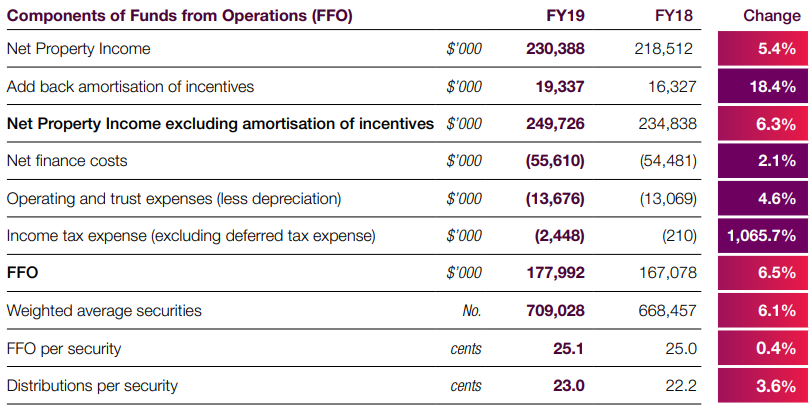

Growthpoint Properties Australia reported net property income of $230.388 million in FY19 ended 30 June 2019, which is up ~5% y-o-y, on account of $ 3.6 million of added income from LFL portfolio, a contribution of more than $13.1 million from new acquisitions partly offset by declines from properties sold. GOZ reported net property income excluding amortisation of incentives at $249.726 million, higher by 6.3% on FY18. The company reported its Fund from Operations (FFO) at $177.992 million as compared to $167.078 million in FY18. Operating and trust expenses came at $13.676 million versus $13.069 million in FY18, primarily due to higher portfolio under management. MER decline from 0.40% (in FY18) to 0.36% in FY19. Total dividend declared for FY19 per stapled security stood at 23 cents.

FY19 P&L Analysis (Source- Companyâs Reports)

Outlook: The company has provided guidance for FY20 of a minimum of 25.4 cps FFO per security and DPS of 23.8 cps, reporting 3.5% growth over FY19.

Stock Update:

The stock of GOZ was trading at a price of $4.400 on 5 September 2019 (AEST 03:16 PM), up 0.686% from its previous close. The 52-week trading range of GOZ is at $3.440 to $4.520. The market capitalisation of the stock stands at $3.37 billion, while is available at a price to earnings ratio of 8.260x and an annual dividend yield of 5.26%. The stock has delivered positive returns of ~7.64% and ~18.05% in last six months and twelve months, respectively.

Fletcher Building Limited

Fletcher Building Limited (ASX : FBU) is engaged in the production and distribution of building products, in addition to focusing on major construction and infrastructure projects. The company serves the markets of Australia, South Pacific and New Zealand. It has another segment that manufactures and distributes steel and related products.

Share Buy-Back Program:

FBU announced on 4 September 2019 its plans to start a share-buyback program from 9 September 2019 onwards. The company will be purchasing a maximum of 70 million shares via NZX and ASX order matching markets at the current market price at different intervals, with a maximum total purchase price of NZ$300 million. The company will inform the investors about its acquisition of shares. FBU cited that the buy-back program might run for up to next 12 months from 21 August 2019. Across the buy-back, the company will continue to evaluate market conditions, its stock price, current investment opportunities and all other relevant options.

Dividend Distribution:

On 3 September 2019, the company announced an unfranked dividend of NZ$0.15 on ordinary fully paid foreign exempt NZX related to a period of six months to 30 June 2019. The payment date for the dividend is 19 September 2019.

FY19 Financial Highlights:

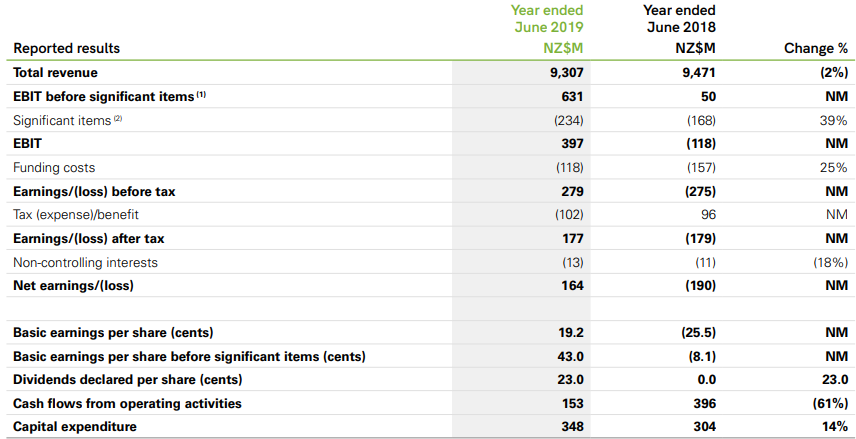

Fletcher Building Limited reported FY19 revenue at NZ$9,307 million, a decrease of ~2% over FY18 revenue. EBIT during FY19 came at NZ$397 million against NZ$ (118) million in FY18. The company reported net earnings of NZ$164 million versus a loss of NZ$190 million in FY18.

FY19 Financial Highlights (Source: Companyâs Reports)

Operational Highlights:

Revenue from building products came at NZ$759 million, up 1% y-o-y, while distribution segment delivered revenue of NZ$1,596 million, ~4% higher than previous financial year. Steel derived revenue of NZ$555 million (up ~4% y-o-y) and concrete delivered lower growth (1%) at NZ$802 million. Income from residential and development segment came higher by 11% y-o-y at NZ$639 million followed by a 2% y-o-y de-growth from the Australia segment.

Stock Update:

The stock of FBU was trading at a price of $4.340 on 5 September 2019 (AEST 03:16 PM), up 0.696% from the previous day close. The stock is available at a price to earnings ratio of 23.450x while the market capitalisation of the company stands at $3.68 billion. The annualised dividend yield of FBU stands at ~4.29%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.