In recent years, Australiaâs health care industry has remarkably grown in terms of size and reputation for its world-leading technology, advanced R&D, innovation, leading scientists and health care professionals. Australia is one of the best locations for performing clinical trials all over the globe, with up to or more than 1,000 clinical trials being launched annually in the country. Clinical studies help in advancing medical knowledge and provide benefits to patients.

According to the Australian Department of Health, the yearly estimated cost of the clinical trials is nearly $1 billion. Health care companies in Australia have a robust clinical research development and are successfully conducting clinical trials.

Here we are discussing two health care stocks that are currently focusing on their research and development for the betterment of patients.

Opthea Limited (ASX: OPT)

Clinical-stage biopharmaceutical ASX-listed player, Opthea Limited (ASX: OPT) is engaged in developing novel biologic therapies targeted at ophthalmic disorders. The company, based in Victoria, is developing a novel therapeutic named as OPT-302, for the treatment of wet age-related macular degeneration (wet AMD) and diabetic macular edema (DME).

Opthea is currently advancing the clinical development of the novel therapeutic (OPT-302) in the second phase clinical trials for web AMD and DME.

Study Resultsâ Inclusion in Ophthalmology Retina

In an ASX update on 29 October 2019, Opthea announced that positive outcome from the first-in-human clinical trial of OPT-302, in patients with neovascular wet AMD, was published in a leading ophthalmic journal of the American Academy of Ophthalmology, Ophthalmology Retina. This publication included detailed data related to dose escalation and expansion trial which evaluated the safety, pharmacokinetics and biological activity of intravitreal injections of OPT-302 alone or in combination with ranibizumab. A total of 51 patients with wet AMD participated in this trial.

Opthea is scheduled to hold its 2019 annual general meeting (AGM) on 21 November 2019 in Melbourne, Victoria. During the meeting, the company will discuss financial statements and reports, as well as consider following resolutions.

- Re-Election of Director

- Adoption of the remuneration report

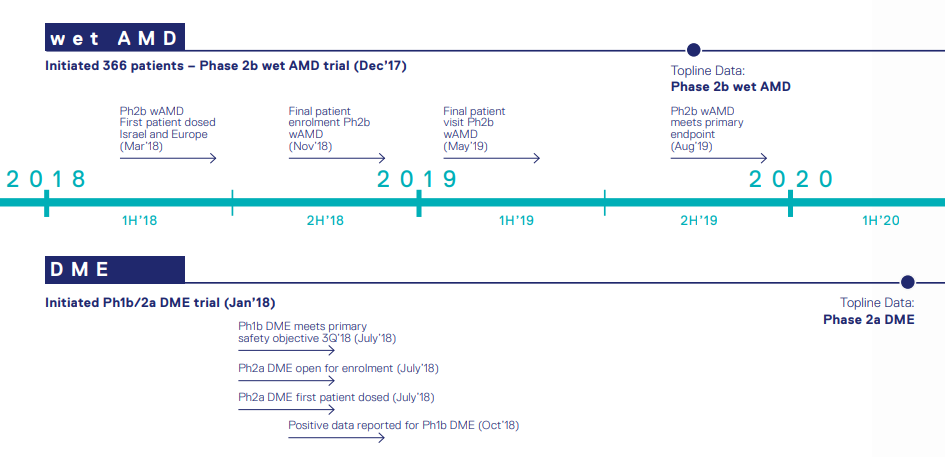

Phase 2b trial of OPT-302 in Wet AMD

- Optheaâs lead compound, OPT-302, is a soluble form of VEGFR-3 and is under clinical investigation as a novel therapy for wet age-related macular degeneration (wet AMD) and diabetic macular edema (DME).

- The Phase 2b clinical trial is a randomised, controlled, double-blind study. In this study, combination of OPT-302 with Lucentis® is compared to Lucentis alone in 366 wet AMD patients.

- Achieving superior visual acuity after the dosing is the primary endpoint of the study.

- Patients for the study were recruited across 113 trial sites in the United States, Israel, European Union and other countries.

- In phase 2b trial of OPT-302 in Wet AMD, Opthea met the primary endpoint. The combination therapy of OPT -302 and Lucentis® showed statistically significant vision benefit compared to Lucentis in wet AMD.

Wet AMD and DME trial update; Source: Companyâs Report

Financial Information for FY 2019

During the year ended 30 June 2019, the company made investments in advancing its OPT-302 ophthalmology program.

- Significant expenditure of the company concerned R&D, in particular, costs associated with the Phase 2b and Phase1b/2a clinical trials of OPT -302 for wet AMD and DME and sourcing of standard of care anti-VEGF-A agents used in clinical research.

- Direct R&D expenditure amounted to $31,347,891, which also included personnel costs and other R&D support costs.

- Total expenditure on research and development stood at $33,679,391.

- The company received an R&D tax incentive payment of $12,017,247 during the year ended on 30 June 2019.

- Cash balance of the company at 30 June 2019 amounted to $21,534,919.

- Net current asset surplus of the company is $30,376,200.

Intellectual Property Information-

- Opthea has a patent family, which covers the OPT -302 molecule and uses.

- This patent is filed in 19 countries and received the grant in the United States, Australia, South Africa, Singapore, Colombia and Japan.

- In addition, the company has two granted patents in the United States, which relate to soluble VEGFR-3 molecules.

Stock Performance

The companyâs stock settled at $3.360, going down by 4% with a daily volume of 315,346 and a market cap of nearly $876.01 million, on 01 November 2019. The stock has a 52 weeks high price of $4.150 and a 52 weeks low price of $ 0.050. The stock has delivered an excellent return of 514.04% on a year to date basis and 403.60% in the last six months.

PolyNovo Limited (ASX: PNV)

Australian medical device company, PolyNovo Limited (ASX:PNV) is in the business of dermal regeneration solutions (NovoSorb BTM). The company designs, develops and manufactures NovoSorb BTM by using its patented NovoSorb biodegradable polymer technology and, it provides solutions for Breast Sling, Hernia, and Orthopaedic applications.

According to an ASX update on 28 October 2019, PolyNovo appointed Dr Robyn Elliot as a Non-Executive Director of the company. Dr Elliot has a Bachelor of Science (Hons) Chemistry and PhD Inorganic Chemistry from Monash University and is an accomplished pharmaceutical professional with more than 30 yearsâ experience.

Annual General Meeting - 2019

PolyNovo is due to conduct 2019 AGM on 15 November 2019 in Melbourne. The highlights of this meeting are financial statements and reports, along with following resolutions:

- Re-election of Directors - David Williams and Leon Hoare

- Remuneration Report

- Non-executive Directorsâ Fees

- Employee Share Option Plan

Clinical Trial Update

- CE Burn trial is complete with the final publication of results due by the end of Feb/March 2020

- Biomedical Advanced Research and Development Authority (BARDA) funded Feasibility trial results are scheduled for publishing by March 2020.

- BARDA funded Pivotal burn trial will start once the US FDA approves the protocol.

- Expected December/January with US FDA opening âBreakthrough technologyâ assessment pathway for NovoSorb BTM

Financial Year 2019 Highlights (ended 30 June 2019)

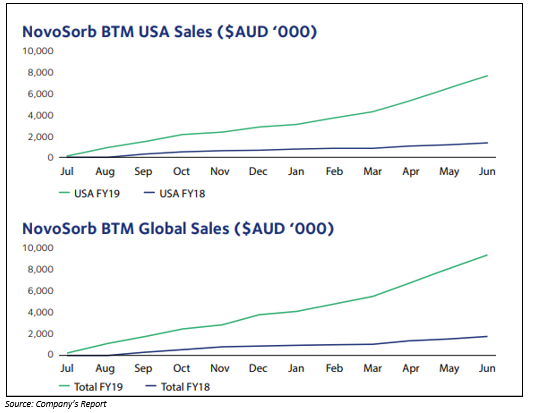

- Revenue from the sales of NovoSorb BTM was approximately $9.3 million.

- Cash on hand of the company stood at $13.9 million.

- Net cash outflow of the company from operating activities decreased by 51%.

Financial Year 2020 Strategy

- In FY 2020, the company is planning to significantly expand sales of BTM in the United States, Australia and New Zealand.

- New product pipeline in breast and hernia in FY 2020.

- PolyNovo is planning to increase the manufacturing capacity for hernia device production.

- At the end of the year 2020, the company would file hernia USFDA 510 (K)

Stock Performance

The companyâs stock closed the dayâs trading at a price of $2.360, going up by 4.425% with a daily volume of approx. 3.02 million and a market cap of nearly $1.49 billion, on 01 November 2019. The stock has a 52 weeks high price of $2.660 and a 52 weeks low price of $0.510. The stock has delivered an excellent return of 276.67% on a YTD basis and 120.49% in the last six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.