Highlights:

- The SMCI stock jumped over 15 per cent soon after the US market opened on Thursday.

- The company released its Q1 FY23 preliminary results on October 19.

- Super Micro Computer expects to exceed its prior financial guidance in the first quarter.

The stocks of the information technology firm Super Micro Computer, Inc. (NASDAQ:SMCI) gained traction from the market participants in the morning hours on October 20, as seen by the surge in its price.

The SMCI stock price shot up more than 15 per cent soon after the opening bell of Wall Street on Thursday, October 20, a day after the firm reported its business update or preliminary financial information for the latest quarter.

Let's explore the key highlights from its first quarter fiscal 2023 business update and its stock details with Kalkine Media®.

Preliminary results of Super Micro Computer:

Super Micro Computer is an information technology firm, which has manufacturing units in Silicon Valley, the Netherlands, and Taiwan. The company provides advanced Server Building Block Solutions for global data centers, the cloud, and other related markets.

The investors seem to have lauded the recent business update of the company, among other details, which might have helped gains in its recent price gains. The company also said it expects to exceed its prior financial guidance for the first quarter of fiscal 2023.

According to the preliminary financial updates by the San Jose, California-based firm reported on October 19, the company now expects its net sales to be between US$ 1.78 billion and US$ 1.82 billion in Q1 FY23, up from its prior guidance range of US$ 1.52 billion to US$ 1.62 billion.

Regarding its GAAP diluted EPS, Super Micro Computer now expects it to be between US$ 3 per share and US$ 3.15 apiece, a jump from its prior guidance range of US$ 2.01 per share to US$ 2.27 per share.

The information technology firm said it would announce its fiscal 2023 first-quarter financial updates in a press release on Tuesday, November 1.

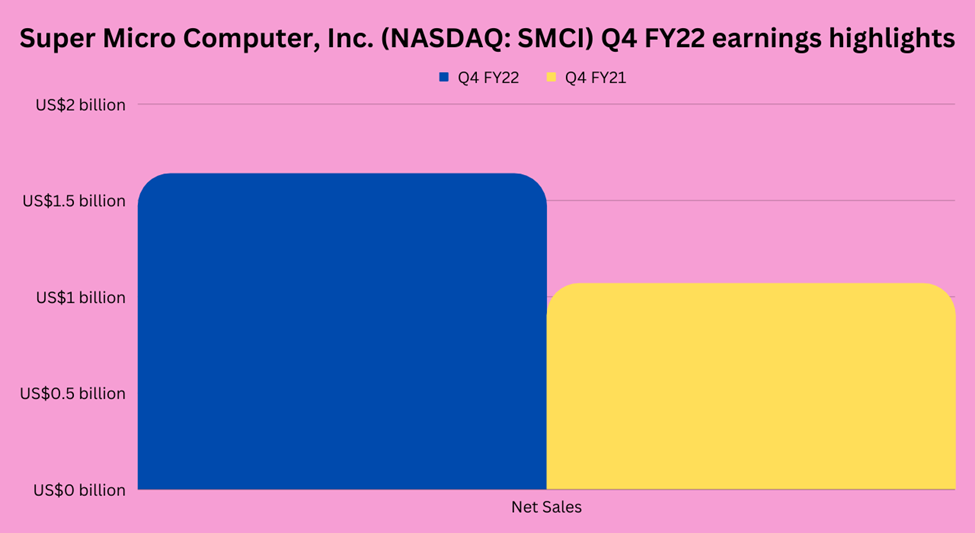

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

Bottom line:

The trading stock price of the technology company was up 15.56 per cent at 9:39 am ET on October 20, to trade at US$ 64.24, while its volume was 209,562 at the time of drafting this article. The stock of the US$ 3.28 billion market cap firm closed at US$ 55.59 in the prior session.

Meanwhile, the information on the preliminary release is based on the estimates done by the firm's management, and it may differ from the actual release, which is scheduled for November 1, the company said.