Highlights:

- Cloudflare, Inc. (NYSE:NET) posted total revenue of US$ 234.5 million in Q2 2022.

- Juniper Networks, Inc. has an annualized dividend of US$ 0.84.

- Qualys, Inc. has a market cap of US$ 5.9 billion.

Cyber-attacks can cause extensive economic damage, which is why governments, businesses, and critical infrastructure emphasize cybersecurity.

Over the past few years, ransomware attacks have increased, prompting governments and companies to bolster their online security to thwart hacking activities.

Here, we look at five cybersecurity stocks picked by Kalkine Media® and see their performances:

Cloudflare, Inc. (NYSE:NET)

Cloudflare is a US content delivery network company that acts as a reverse proxy between its customer’s hosting provider and a website’s visitor.

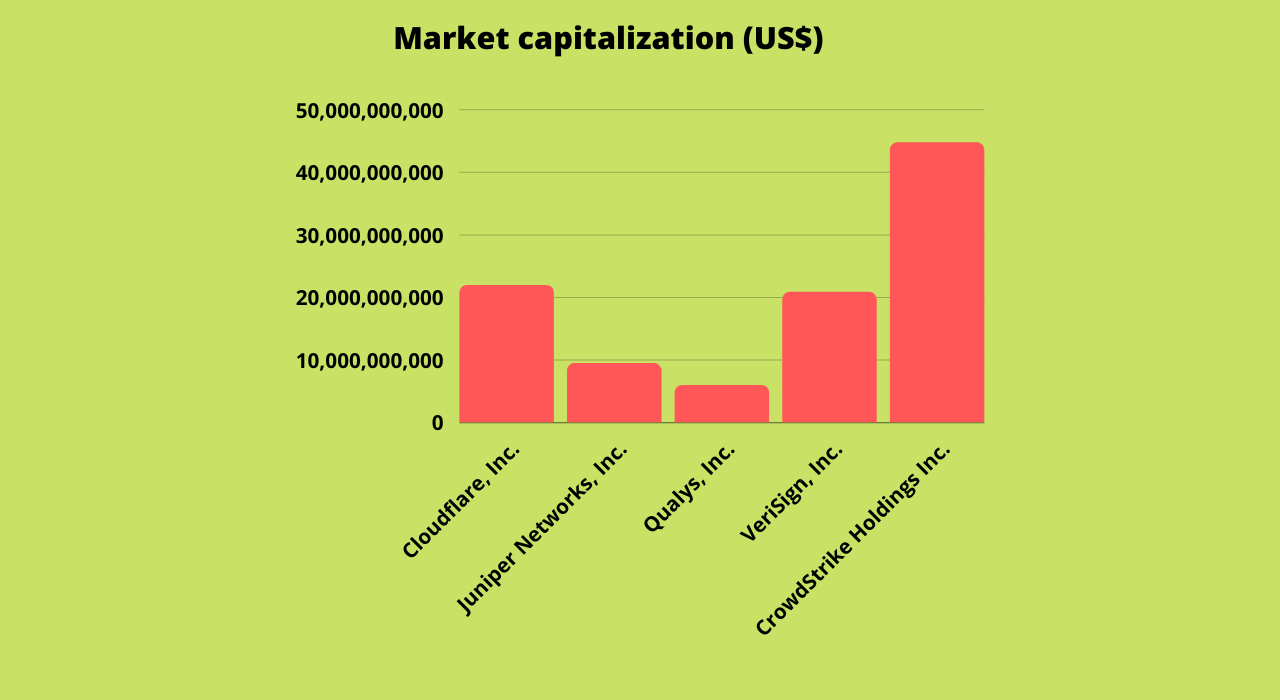

Cloudflare has a market valuation of US$ 21.9 billion. Although NET stock plummeted over 47 per cent year-to-date (YTD), it surged 32.11 per cent since the past month.

Cloudflare reported total revenue of US$ 234.5 million in the 2nd quarter of 2022, a rise of 54 per cent year-over-year. Its revenue in the year-ago quarter was US$ 152.42 million.

The company also said it achieved huge customer growth in Q2 2022, with a record addition of 212 large customers in the reported quarter.

Juniper Networks, Inc. (NYSE:JNPR)

Juniper Networks, a US multinational company, engages in developing and selling networking products, which include routers, network management software, switches, networking tech, and network security products.

The company has a market cap of US$ 9.4 billion and an annual dividend of US$ 0.84. Shares of Juniper surged by around two per cent over the past month. On August 23, 2022, the company announced that it has started facilitating the adoption of networking driven by AI with other NaaS (Network-as-a-Service) capabilities.

Juniper reported preliminary Q2 2022 financial results on July 26, last month. The company posted net revenue of US$ 1,269.6 million in Q2 2022, compared to US$ 1,172.3 in Q2 2021.

Its net income in Q2 2022 was US$ 113.4 million relative to US$ 60.02 million in the corresponding quarter in 2021.

Qualys, Inc. (NASDAQ:QLYS)

Qualys provides cloud security, compliance, and other related services. It uses SaaS (software-as-a-service) to offer vulnerability management solutions to clients. The company's price-to-earnings (P/E) ratio is 60, with a market valuation of US$ 5.9 billion.

The QLYS stock jumped over 11 per cent year-to-date. Shares of Qualys increased by over 16 per cent in the past month.

For the quarter that ended June 30, 2022, Qualys posted revenue of US$ 119.9 million, compared to US$ 99.8 million in the same period in 2021.

Its net income in the 2nd quarter of 2022 was US$ 26.6 million, whereas it was US$ 21.14 million in the year-ago quarter.

According to Refinitiv data, QLYS stocks had an RSI (Relative Strength Index) valuation of 68.88. It indicates that the stock is stable at the moment.

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

VeriSign, Inc. (NASDAQ:VRSN)

Verisign is ubiquitous when it comes to cybersecurity. It is the sole authority over many top-level domains currently in use worldwide, including the .com and .net domains. Also, the company is involved in critical internet infrastructure and operates two main root servers worldwide.

Shares of Verisign fell below seven per cent in a year. Meanwhile, VRSN stock rose by over eight per cent over the past month.

Verisign reported US$ 997 million in cash, or cash equivalents, and securities in Q2 2022. The company said it processed 10.1 million new domain name registrations for .com and .net in Q2 2022.

Verisign posted revenue of US$ 351.9 million in Q2 2022, compared to US$ 329.4 million in the same quarter in 2021. Its second-quarter 2022 net income came at US$ 167.3 million, relative to US$ 147.7 million in Q2 2021.

CrowdStrike Holdings Inc. (NASDAQ:CRWD)

CrowdStrike Holdings, Inc. provides endpoint security cloud security, threat intelligence, and cyberattack response services.

The company has a market valuation of US$ 44.7 billion; in the past six months, CRWD shares grew by 5.18 per cent. CrowdStrike is slated to announce its second quarter 2023 financial results on August 30, 2022, at market close.

For Q1 of fiscal 2023, CrowdStrike registered total revenue of US$ 487.8 million, a 61 per cent increase, compared to US$ 302.8 million in the first quarter of 2022.

Its subscription revenue was US$459.8 million, a 64 per cent jump from US$ 281.2 million in the previous year's first quarter.

Bottom line:

Cybersecurity stocks have not performed well in the broader market in 2022. It could be due to market volatility or other reasons why this sector may not be performing well. However, it is difficult to predict the future of any sector, especially when the market is going through a rough phase. Investors should look at the fundamentals before choosing any stock.