Highlights

- Institutional entities have adjusted their shares in Cohu, Inc.

- The stock carries a consensus rating centered around.

- Recent financial results revealed earnings per share surpassing forecasts despite a decline in revenue compared to the prior year.

Cohu, Inc. (NASDAQ:COHU) stands out in the semiconductor equipment sector, playing a key role in semiconductor manufacturing and testing technology. Recent changes in major institutional share allocations highlight ongoing adjustments within this critical segment of the top companies in the NASDAQ.

Shifts in Institutional Share Allocations

Several prominent institutions have adjusted their stake in Cohu, Inc. The Manufacturers Life Insurance Company notably trimmed its position slightly during the latest quarter. Conversely, other firms have expanded their shares substantially. Barclays PLC increased its exposure markedly in the previous quarter, while Tributary Capital Management also added to its portfolio. Additional notable adjustments include KBC Group NV and Hodges Capital Management Inc., with the latter entering a new position. These maneuvers illustrate diverse strategic approaches within entities managing large portfolios in this sector.

Analyst Ratings and Market Sentiment

Market perspectives on Cohu, Inc. demonstrate a spectrum of opinions, ranging from cautious to optimistic evaluations. The average assessment on the stock reflects tempered expectations amid fluctuating market conditions. This divergence highlights the complexity of forecasting in a sector subject to rapid technological changes and global economic influences.

Financial Performance

Cohu’s recent quarterly report revealed an earnings per share figure exceeding market expectations, despite a negative net margin and return on equity. Revenue figures came in marginally above forecasts, though reflecting a year-over-year decline. The company’s product offerings in semiconductor test and inspection equipment, alongside micro-electromechanical system modules, maintain operations across key global regions including China, Taiwan, Malaysia, and the Philippines. This geographic diversification remains integral to the company’s operational footprint.

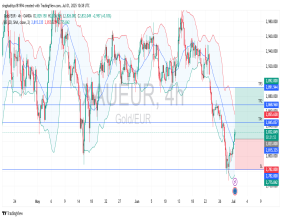

Market Capitalization and Stock Price Context

The current market capitalization and stock price reflect ongoing adjustments to the company’s valuation within the sector. These figures mirror the broader trends and competitive pressures impacting companies focused on semiconductor manufacturing support technologies. The interplay between financial results and market sentiment contributes to ongoing fluctuations in the stock's trading levels.

Broader Industry Considerations

Cohu, Inc.’s (NASDAQ:COHU) role in supplying semiconductor test and inspection equipment places it within a crucial niche in the technology supply chain. While recent results showed resilience in certain financial metrics, the revenue decrease year-over-year points to challenges within the sector. The evolving strategies by large entities holding significant shares demonstrate a dynamic environment requiring constant realignment.