Highlights

- CMC Materials, Inc.’s (NASDAQ:CCMP) stock soared 25.59% Wednesday, December 15.

- Entegris, Inc. (NASDAQ:ENTG) will acquire CMC Materials under a definitive merger agreement for an enterprise value of US$6.5 billion, approximately.

- The CCMP stock raked in 23.13% YTD.

CMC Materials, Inc.’s (NASDAQ:CCMP) stock soared 25.59% on the announcement early Wednesday that Entegris, Inc. (NASDAQ:ENTG) will acquire CMC Materials under a definitive merger agreement. The stock traded at US$183.32 at 10:20 am ET.

The agreement

The acquisition will be made in a cash and stock transaction under the agreement with an enterprise value of US$6.5 billion, approximately. CMC shareholders will get US$133.0 in cash and 0.4506 shares of Entegris common stock against each share of CMC Materials common stock. This amount to a 35% premium over the closing price of CMC Materials’ shares on December 14, the previous trading day.

As a result, CMC Materials shareholders will hold around 9%, and Entegris Inc. shareholders will own approximately 91% in the combined company after completing the transaction.

Also Read: Top 8 US vaccine stocks of 2021

CMC Materials has Goldman Sachs & Co. LLC as its financial advisor, and Lipton, Wachtell and Rosen & Katz as its legal counsel for the transaction.

The acquisition will help Entegris Inc. to offer a comprehensive electronic material offering to its customers. With the technology, advanced materials, and innovative process solutions for advanced manufacturing, its customers are likely to achieve improved productivity.

Also Read: 5 US real estate stocks to watch in 2022

Also Read: Are these 7 utility stocks poised for another year of growth?

Aurora, Illinois-based CMC Materials Inc. supplies advanced materials used in integrated circuit devices in the semiconductor industry. Its products are primarily used in the process of flattening the materials layer on the silicon wafer in producing an integrated circuit.

CMC Materials was founded in 1999 and went public in April 2000. CMC Materials has a market capitalization of US$5.2 billion, a one year forward P/E ratio of 19.59, and a P/B ratio of 4.72. Its dividend yield is 1.27%, with an annualized dividend of US$1.84.

The stock traded in the range of US$198.60 to US$119.19 in the last 52 weeks. Its traded volume increased significantly today to 2,036,850 at 11:03 am ET compared to its 90-day average volume of 208,033.

Also Read: Red hot blue-chip technology stocks to explore in 2022

Financials

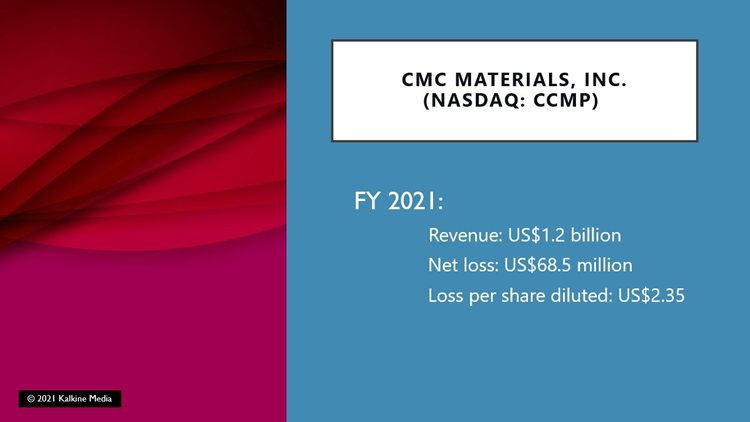

For the fiscal year ended September 30, 2021, it posted revenue of US$1.2 billion in the fiscal year 2021, up 7.49% compared to US$1.12 billion in the prior year.

The company booked a net loss of US$68.5 million compared to a net income of US$142.8 million for FY 2020. The loss per share diluted came in at US$2.35 compared to earnings per share of US$4.83 diluted in the previous fiscal year.

Also Read: 5 US cybersecurity stocks to watch in 2022

Bottom line

The semiconductor and related products and activities remain in demand due to the chips’ requirement in digital things. Amid this, the semiconductor technology company’s stock grew 23.13% YTD and 51.27% QTD whereas the Dow Jones U.S. Semiconductors Index rose 44.06% YTD.