Highlights:

- The SIDU stock noted gains of over 26 per cent in the morning trading on September 7.

- Its volume was over 17 million during writing.

- The company had announced multiple launch agreements with a spacecraft manufacturer.

The stocks of the aerospace and defense firm, Sidus Space, Inc. (NASDAQ:SIDU), gained notable attention from investors on Wednesday, September 7, after the firm announced multiple launch agreements with a spacecraft manufacturer. The price of SIDU stock was up over 26 per cent in the morning trading on Wednesday.

Now let's explore with Kalkine Media® the recent announcement of the firm that could have bolstered the recent gains in the aerospace firm's stock.

Why is SIDU stock soaring?

The investors appear to be turning their focus on the Cape Canaveral, Florida-based firm after it announced to sign of a launch agreement for five launches with SpaceX. According to the agreement for launch with Elon Musk's founded firm, the launches would start in early 2023.

Sidus Space has designed LizzieSatTM and is working on a multi-mission satellite constellation. Meanwhile, LizziSatTM was approved by the International Telecommunication Union in 2021.

Meanwhile, per the company release, the launches would support its previously announced contracts with NASA and Mission Helios and other potential clients.

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

The founder and Chief Executive Officer of Sidus Space, Carol Craig, praised the launch agreement with SpaceX and said they would advance with their mission of 'Bringing Space Down to Earth.’

Bottom line

The SIDU stock was priced at US$ 3.3599 at 9:51 am ET on September 7, up 26.31 per cent from its previous closing price of US$. Its trading volume was more than 17.12 million during the time of writing.

However, despite the robust gains today, its price was still down about 69 per cent on a year-to-date (YTD) basis. In the current week, its price jumped over 16 per cent.

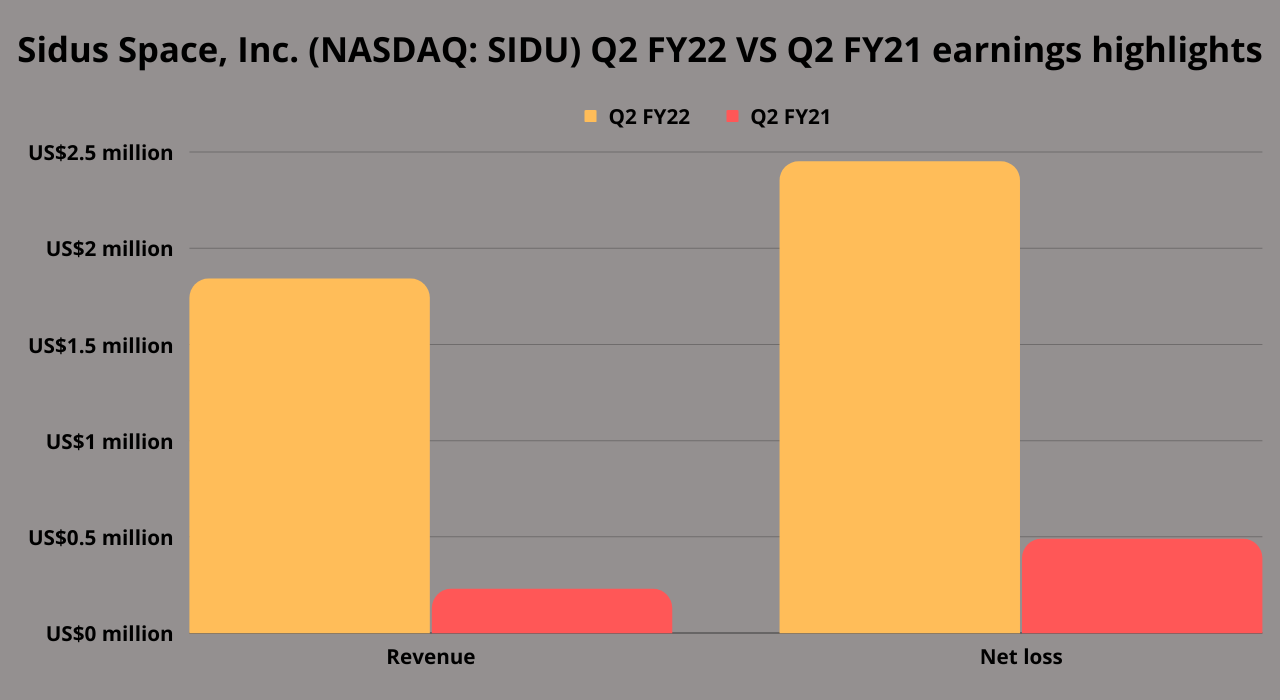

The firm also caught the eyes of investors during its second-quarter earnings release. Sidus Space's revenue jumped 695 per cent year-over-year (YoY) to US$ 1.84 million in the latest quarter, from a revenue of US$ 232,318 in Q2 FY21.

However, its net loss deteriorated to US$ 2.45 million in Q2 FY22, from a loss of US$ 497,390 in Q2 FY21.

_06_30_2023_10_37_44_979056.jpg)