Highlights

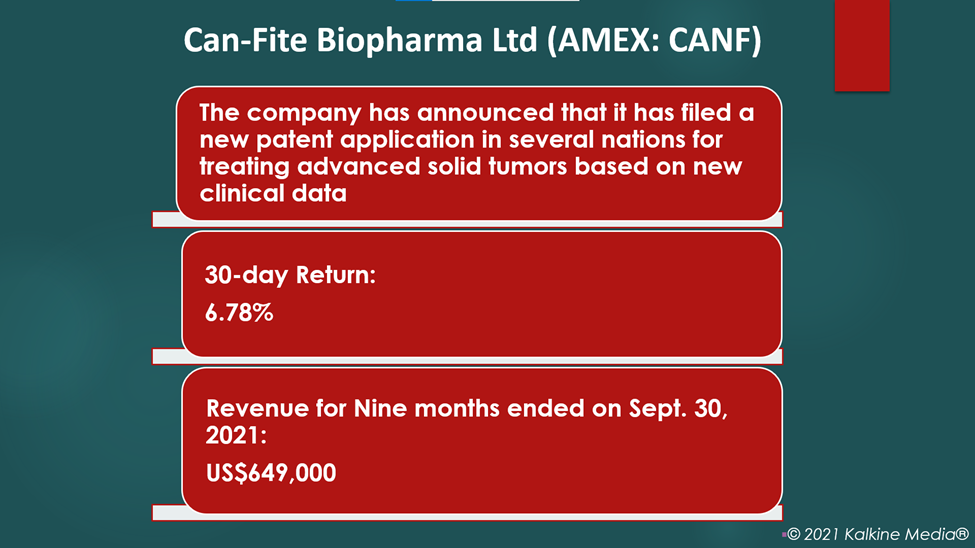

- The company has filed patent applications in several countries for its lead drug for treating all solid tumors.

- The stock was up over 13% in intraday trading.

- The CANF stock grew over 6% over the last month.

Can-Fite Biopharma Ltd (AMEX: CANF) stock was up 13% on Wednesday after announcing filing patent applications in several countries for its lead drug for treating all advanced solid tumors.

The Israel-based company said that it has filed for patent applications in several countries for its lead cancer drug Namodenoson, an A3 adenosine receptor (A3AR) ligand.

The company said Namodenoson was found to be effective against all advanced solid tumors. Its clinical trial data showed that a patient with advanced hepatocellular carcinoma (HCC) was cleared of all tumor lesions after treating with Namodenoson.

Hepatocellular carcinoma (HCC) is the most form of liver cancer.

Also Read: How to buy BarnBridge (BOND) token?

The biotechnology company focuses on a range of proprietary small molecule drugs for treating inflammatory, cancer, and liver disorders. Its lead drug candidate, Piclidenoson, is also undergoing a Phase III trial for psoriasis.

Also Read: How to buy Harvest Finance (FARM) crypto?

The pending patent applications are the latest in the company's growing IP portfolio.

Can-Fite Chairman Ilan Cohn said the company's IP portfolio includes around 200 patents and pending patent applications in 16 patent families. Given the strong data on Namodenoson’s efficacy in advanced HCC, the patent filings seek to further fortify its IP position, he added.

Also Read: When is the Reddit IPO coming?

Also Read: What is Paribus Crypto? How to buy it?

Can-Fite Biopharma Ltd.’s (AMEX: CANF) stock performance, financial highlights

The CANF stock was priced at US$1.43 at 9:50 am ET on Dec 29, up 13.49% from its previous close. Its market cap is US$28.67 million, the forward P/E one year is -2.25, and the EPS is US$-0.80. The CANF stock saw the highest price of US$4.39 and the lowest price of US$0.94 in the last 52 weeks. Its trading volume on Dec 28 was 1,721,915.

For the nine months ended on Sept 30, 2021, its revenue was US$649,000 compared to US$613,000 in the same period of the previous year. It reported a net loss of US$8.49 million, or US$0.02 per share, for the period, against a loss of US$10.81 million, or US$0.04 per share for the nine months ended on Sept 30, 2020.

Also Read: Yearender: Top EV stocks that continue to hog limelight

Bottomline

The stock saw modest growth this year. It was up 6.78% over the last month. However, investors should evaluate the companies carefully before investing in stocks.