Highlights

- Pfizer, Inc’s (NYSE:PFE) fiscal 2021-revenue skyrocketed by 95% YoY to US$81.3 billion.

- Excluding Covid-19 vaccines, the revenue rose around 6% last year on a YoY basis.

- Pfizer raised the full-year revenue guidance in the range of US$98 billion to US$102 billion.

Pharma major Pfizer, Inc. (NYSE:PFE) on Tuesday reported triple-digit revenue growth in the fourth quarter and a 95% jump in fiscal 2021, helped by Covid-19 vaccine sales.

However, the New York-based company’s 2022 guidance for vaccine sales at US$32 billion fell short of Wall Street estimates, according to Refinitive. The Pfizer (PFE) stock was trading down at 4.34% to US$50.90 in the premarket. On Monday, it closed at US$53.21.

Also Read: 5 best US hospital stocks for 2022

Full-Year result

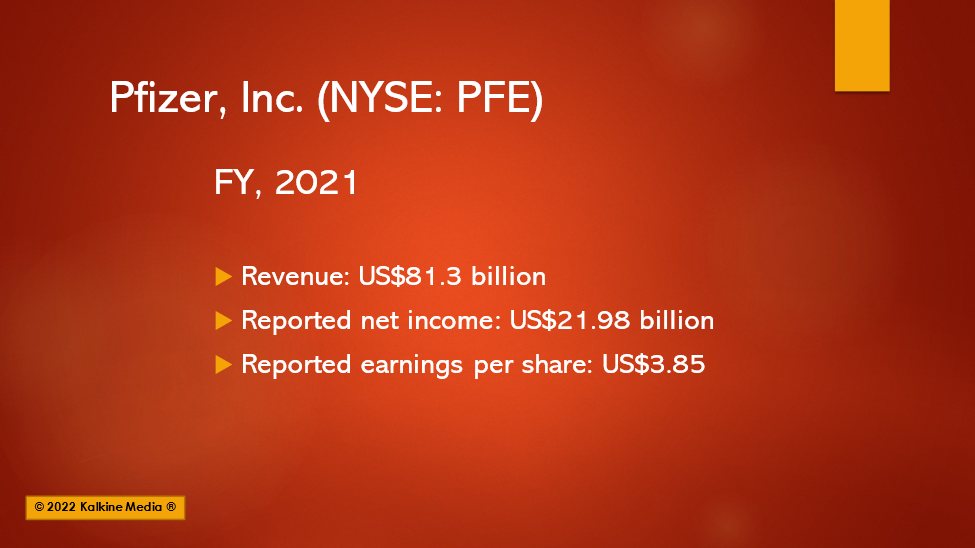

The healthcare company reported full-year revenue of US$81.3 billion, up 95% YoY. The net income grew 140% to US$21.98 billion.

Earnings per share diluted rose to US$3.85 from US$1.63 in FY 2020. Excluding sales of Covid-19 vaccines: Comirnaty and Paxlovid, the revenue rose 6% YoY.

The company paid US$8.7 billion in cash dividends, or US$1.56 per share, in fiscal 2021. Pfizer did not repurchase shares in 2021, and neither did it reveal any such plans for 2022.

Fourth-Quarter results

The fourth-quarter revenue grew by 105% YoY to US$23.84 billion. The earnings per share diluted were US$0.59, and the adjusted EPS diluted was US$1.08.

Also Read: Top 7 healthcare stocks on NASDAQ to consider

Also Read: Top 7 financial stocks on NYSE to explore

Guidance for 2022

The company expects record revenue of US$98.0 billion to US$102.0 billion in 2022. The adjusted EPS diluted is likely to be between US$6.35 and US$6.55.

Pfizer raised the revenue guidance for Covid-19 vaccine sales to US$32 billion, falling short of estimates. The forecast includes an existing signed supply contract to be executed this year.

The initial revenue guidance for oral drug Paxlovid has been set at around US$22 billion in 2022.

Also Read: Top S&P 500 consumer discretionary stocks to explore

Pfizer manufactured three billion Comirnaty doses in 2021 and plans to increase that to four billion in 2022. It is supplied in more than 160 countries.

In December 2021, the FDA had given an emergency use authorization for Paxlovid to treat patients with mild infections. The company plans to file for full regulatory approval in 2022.

It also announced to manufacture 120 million Paxlovid courses in 2022, with 30 million to be produced in the first half of the year.

Also Read: Top utility sector stocks of NYSE to watch

Bottomline

It is the first to deliver an FDA-authorized vaccine for covid treatment. While the waning Covid-19 cases may affect its revenue goal, it has several other products in the pipeline.