Highlights:

- UniQure (NASDAQ:QURE) posted total assets of US$ 523.3 million in Q2 2022.

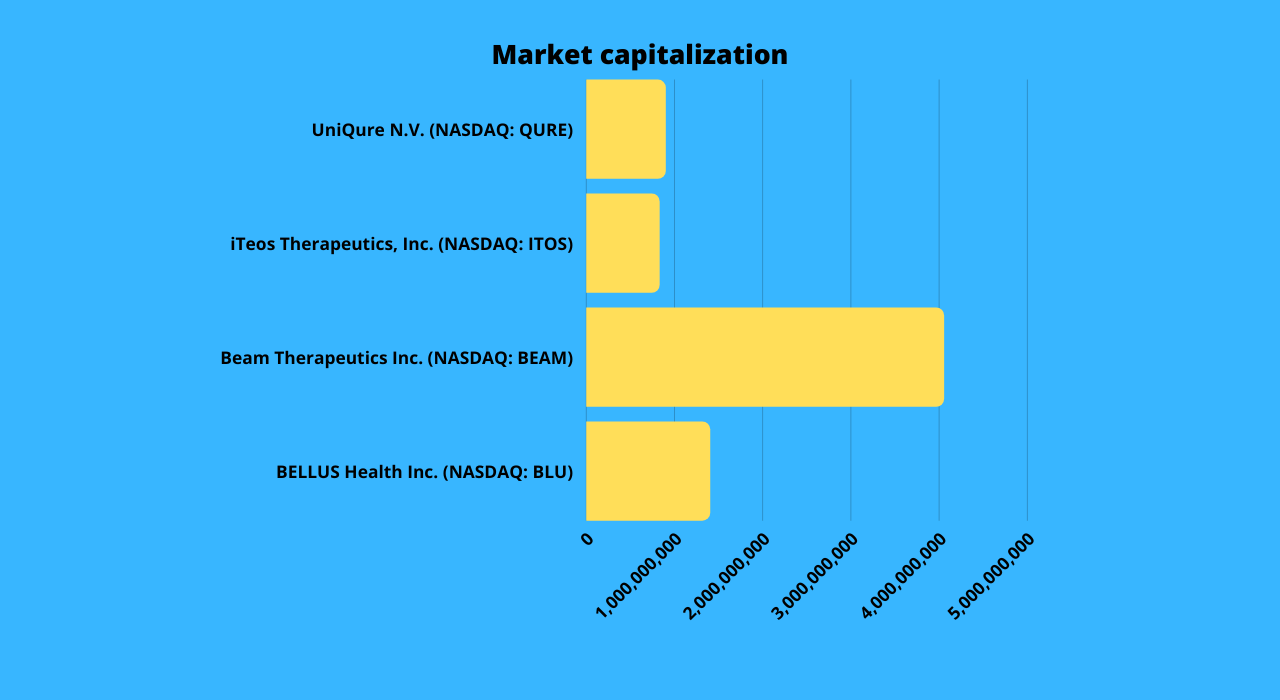

- Beam (NASDAQ:BEAM) has a market cap of US$ 4.05 billion.

- BELLUS saw a 277 per cent jump in its share price in a year.

Biotech sector startups mainly gained momentum since the pandemic began but as the markets have remained volatile in 2022, even the biotech stocks were impacted.

Often, investors explore stocks in this space due to the numerous ongoing trials for developing vaccines and medicines. Also, the constant research by these companies in innovation, therapeutics, and diagnostics draws investors' attention.

That said, we look at four biotech stocks-QURE, ITOS, BEAM, BLU- curated by Kalkine Media® and see their performances:

UniQure N.V. (NASDAQ:QURE)

UniQure NV is a gene therapy company with its products primarily focused on Huntington's disease, hemophilia, and cardiovascular diseases. The company is based in the Netherlands.

The US$ 896.6 million company, UniQure, has earnings-per-share (EPS) of US$-2.46. QURE stock declined over 10 per cent year-to-date (YTD).

For the second quarter of fiscal 2022, UniQure reported total assets of US$ 523.3 million compared to US$ 628.3 million in the quarter ended December 31, 2021.

iTeos Therapeutics, Inc. (NASDAQ:ITOS)

ITeos is involved in developing and discovering immuno-oncology therapeutics for patients. The Watertown, Massachusetts-based company, ITeos, has a market cap of US$ 827.12 million.

ITOS stock closed at US$23.25 on August 18, down 0.34 per cent from the previous day's closing. Shares of ITeos Therapeutics fell below six per cent year-over-year (YoY). Over the past month, its share price decreased by over 11 per cent.

The company reported a US$ 792 million cash balance as of June 30, 2022. In the second quarter of fiscal 2022, iTeos posted a net income of US$ 5.6 million to common shareholders.

Its general and administrative (G&A) expenses for the quarter ended June 30, 2022, were US$ 11.5 million, relative to US$ 15.1 million for the same quarter of 2021.

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

Beam Therapeutics Inc. (NASDAQ:BEAM)

Beam Therapeutics is a US biotechnology firm involved in researching gene therapies and genome editing. The Cambridge, Massachusetts-based company has a market cap of US$ 4.05 billion.

BEAM stock plunged close to 30 per cent year-to-date. Shares of Beam Therapeutics fell by over 41 per cent on a yearly basis.

Beam’s cash and cash equivalents stood at US$ 1.2 billion in the second quarter of fiscal 2022. The company said that BEAM-102 is making good progress and plans to submit an investigational new drug (IND) application for BEAM-102 for SCD treatment in the later part of 2022.

In Q2 2022 results, Beam Therapeutics posted a net loss 0f US$ 72 million or US$1.02 per share. In comparison, it was US$ 76.3 million in the second quarter of 2021, or US$1.23 per share.

BELLUS Health Inc. (NASDAQ:BLU)

BELLUS Health is developing a P2X3 antagonist to treat refractory cough which is chronic and some other hypersensitization disorders.

Shares of Bellus Health have increased 43 per cent so far this year. On a year-over-year basis, BLU galloped over 277 per cent.

BELLUS Health has a market cap of US$ 1.4 billion. Its earnings-per-share (EPS) is US$-0.78. The company ended Q2 2022 with approximately US$ 384.6 million in Pro-forma cash, cash equivalents, and short-term investments.

Bottom line:

Biotech companies need the approval of the FDA before marketing their drugs, and investors may have to wait for these rulings. Most biotech companies have now forayed into COVID-19 vaccines and treatments. Investing requires a lot of due diligence, especially when the market is undergoing a lot of uncertainties. Long-term strategies should be the goal for investors to wade through bearish phases of the market.