Highlights

- Inspira Technologies (IINN) stock rallied over 130% in premarket trading.

- Inspira has signed an exclusive distribution agreement with Innovimed Sp.

- It has filed a patent application (PCT) for its novel ART device.

Israel-headquartered Inspira Technologies Oxy Ltd. (NASDAQ:IINN) stock jumped over 130% in the premarket session on Thursday after positive news from the company.

Inspira signed an exclusive distribution agreement with Innovimed Sp. on Dec 9. Last month, it had signed a US$66-million deal with WAAS Group for Spain and Portugal markets.

The initial term of the Inspira-Innovimed deal is of seven years, depending on the completion of product development and regulatory approval.

The companies will jointly work on the marketing and deployment of the ART device, an early extracorporeal respiratory support system used to treat patients' respiratory problems.

Also Read: World News in Brief: Indian general dies in crash; Germany gets new chancellor

Innovimed has committed to buying a minimum of 1,552 ART devices and 59,040 disposal units for deployment at hospitals and health centers, subject to regulatory approvals for the commercialization and selling of ART devices in Poland, the Czech Republic, and Slovakia.

Inspira Technologies is a specialty medical device maker. It develops and manufactures respiratory support technology as an alternative to invasive mechanical ventilation (MV).

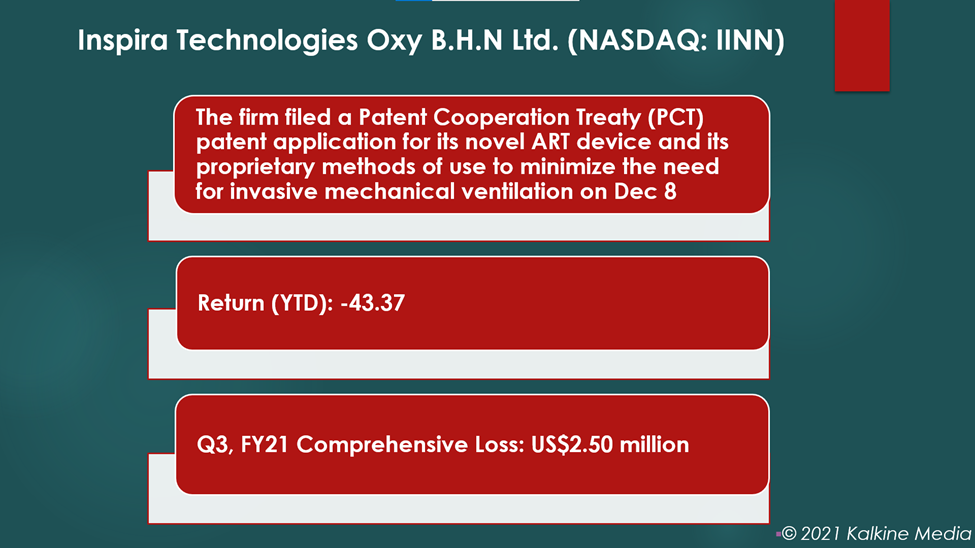

In addition, on Dec 8, it has filed a patent application (Patent Cooperation Treaty or PCT) for its novel ART device and proprietary methods of use to minimize the need for invasive mechanical ventilation, requiring intubation and induced coma.

On the other hand, Innovimed is a master distributor. It focuses on state-of-the-art medical solutions for supplies in Eastern Europe, the Middle East, and Africa.

Also Read: Will these five travel stocks weather the Covid-19 threat in 2022?

Also Read: Why did Dare Bioscience (DARE) stock jump Wednesday?

Stock performance and financial highlights:

The IINN stocks were priced at US$6.19 at 9:29 am ET on Dec 9, up 130.11% from their previous close. The farm has a market cap of US$20.74 million, with a forward P/E one year of -1.77. Its stock saw the highest price of US$9.59 and lowest price of US$2.25 in the last 52-week. The trading volume of IINN on Dec 8 was 550,053.

Also Read: Grove Collaborative to go public in merger with Branson-backed SPAC

In its IPO on July 16, 2021, the company raised US$16 million from selling 2,909,091 shares for US$5.51 apiece. As of Sept 30, 2021, the firm had cash and cash equivalent of US$17 million.

The company reported a comprehensive loss of US$2.50 million in Q3, FY21, compared to a loss of US$289 thousand in the same quarter of the previous year.

Also Read: Holiday shipping deadlines for USPS, UPS & FedEx: All you need to know

Bottomline

The healthcare sector saw significant growth this year, driven by covid vaccine sales. The S&P 500 healthcare sector rose 17.51% YTD while increasing 4.84% QTD. By contrast, the IINN stock fell 43.37% YTD.