Highlights:

- Royal Gold, Inc. (NASDAQ:RGLD) raised its annual stock dividend by about seven per cent YoY.

- The HYMC stock gained about 22 per cent in 2022.

- Gold Resource Corporation (AMEX: GORO) ended Q3 FY22 with a cash balance of over US$ 22 million.

The benchmark US indices have suffered rough trading so far this year, amid growing geopolitical concerns, leading to decades-high inflation. On the other hand, Federal Reserve's aggressive move with their monetary plans to curb inflation has also weighed on the traders' sentiment, while spurring recessionary fears.

Meanwhile, some investors are keeping a close watch on gold stocks, as the yellow metal is generally considered a safer haven in times of market turmoil. Many investors typically gain exposure to the gold segment through spending in the stocks of the firms that engage in the mining and other related operations of gold.

To name some, Royal Gold, Inc. (NASDAQ:RGLD), Hycroft Mining Holding Corporation (NASDAQ:HYMC), Gold Resource Corporation (AMEX: GORO), Caledonia Mining Corporation Plc (AMEX: CMCL), and Maverix Metals Inc. (AMEX: MMX) are among the companies that engage in the exploration and mining operations of gold.

Investments in precious metals have been there for a long time, which attracts many investors. Even traders who don't involve in gold investment, wouldn't deny that gold plays a crucial role in the global markets.

Some analysts believe that gold plays a key part in diversifying the investment portfolio of the market participants. However, this does not mean necesarily that gold stocks can perform during market uncertainty. In 2022, even the gold stocks took a hit due to weak investor sentiments amid inflationary pressures and rising interest rates.

In this article, let's discuss the financial performance and other details about the stocks mentioned above.

Royal Gold, Inc. (NASDAQ:RGLD)

Royal Gold is one of the major precious metals stream and royalty firms with a dividend yield of 1.32 per cent. The company's stock, which acquires and manages precious metal streams, royalties, etc., fell two per cent YTD and about four per cent YoY.

The gold firm said on November 15, that its Board has raised its annual calendar year common stock dividend by about seven per cent from US$ 1.4 to US$ 1.5 apiece, which would be payable on a quarterly basis of US$ 0.375 apiece.

The first dividend on a quarterly basis would be payable on January 20, 2023. The company said that it was its 22nd consecutive annual increase in its common stock dividend.

Royal Gold Inc's revenue was US$ 131.4 million in Q3 FY22, of which 76 per cent came in from its gold segment, 11 per cent from silver, and eight per cent from copper. In the year-ago period, its revenue totaled US$ 174.43 million.

The major gold firm's net income was US$ 0.70 per diluted share in the latest quarter, comparatively down from US$ 1.07 in Q3 FY21.

Hycroft Mining Holding Corporation (NASDAQ:HYMC)

The precious metal development company, that engages in gold and silver-related operations, Hycroft Mining Holding Corporation holds a market cap of US$ 40.54 million. The stock price of the owner of the Hycroft Mine in Northern Nevada, surged over 22 per cent YTD through November 18, while falling about five per cent YoY.

In the running quarter through last Friday, the HYMC stock was up over 25 per cent, while gaining over 102 per cent in the last nine months.

The company provided its corporate update last Thursday, November 17, where it is said to have completed 21,600 meters of its 38,000 meters 2022-23 exploration drill program to date.

Hycroft Mining Holding Corporation is said to have ended Q3 FY22 with unrestricted cash and cash equivalents of US$ 153.4 million on hand. Its gold inventory totaled 6,700 ounces at the end of Q3 FY22, which the company anticipates selling before the end of Q1 FY23.

Gold Resource Corporation (AMEX: GORO)

Gold Resource Corporation is an American developer and producer of precious metals with a dividend yield of 2.38 per cent. The gold and silver producer's stock price surged over seven per cent YTD and about two per cent in the running quarter through last Friday, November 18.

The company's board announced a quarterly dividend of one cent or US$ 0.01 apiece for Q4 FY22, which is payable on December 30, 2022.

At the end of Q3 FY22, Gold Resource Corp had a cash balance of more than US$ 22 million. The company claimed to have invested over US$ 24 million in capital and exploration.

Meanwhile, the gold firm's net loss for Q3 FY22 was US$ 9.7 million, which the company said is due to lower metal prices, and higher depreciation expense due to a lower mineral reserve base.

Caledonia Mining Corporation Plc (AMEX: CMCL)

The cash-generative gold producer, Caledonia Mining Corporation's dividend yield was 4.84 per cent. The stock of the firm, which claims to have its primary asset mine in Zimbabwe, fell over two per cent YTD and about 18 per cent YoY.

The US$ 145.78 million market cap gold producer's revenue was US$ 35.84 million and US$ 107.90 million, for the quarter and nine months ended on September 30, 2022, respectively.

This compares to the revenue of US$ 33.49 million and US$ 89.19 million, for the quarter and nine months that ended on September 30, 2021, respectively.

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

Maverix Metals Inc. (AMEX: MMX)

Another emerging gold royalty and streaming firm, Maverix Metals had a dividend yield of 1.29 per cent. The stock of the firm, whose business mode provides investors lower risk exposure to gold, plunged nine per cent YTD and about 23 per cent YoY.

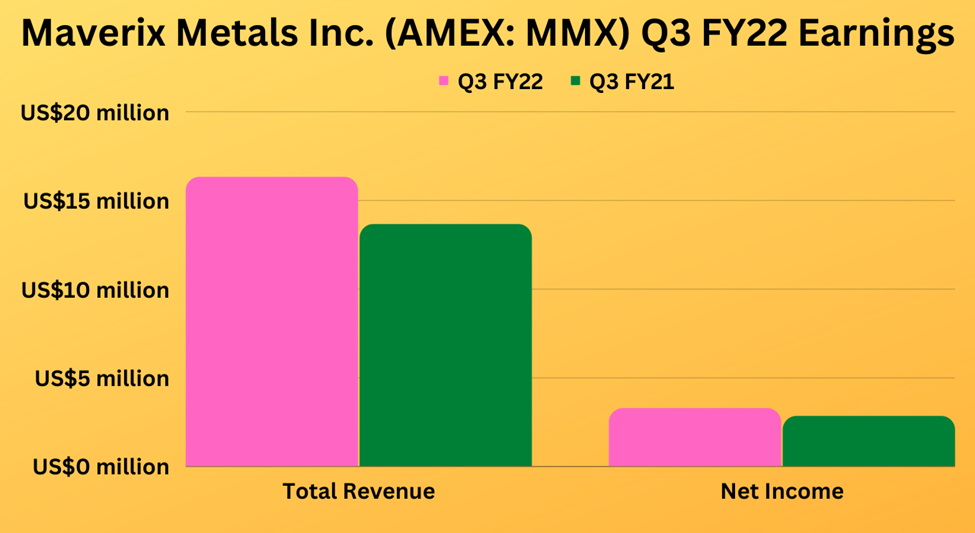

Maverix Metals reported a diluted EPS of US$ 0.02 apiece on revenue of US$ 16.31 million in Q3 FY22, compared to US$ 0.02 apiece on revenue of US$ 13.65 million in Q3 FY21.

Bottom line:

The recent market uncertainties due to soaring prices, rising borrowing costs, and a strong dollar have left investors in the cold this year. The US dollar has had a close relationship with the precious metal since the gold standard was introduced in the 1880s.

The gold standard indicates that the nation's currency is directly linked to an amount of yellow metal. Although the gold standard was eliminated in 1933 by former President Franklin D. Roosevelt, the US dollar still maintains a close relationship with gold, as it is priced in US dollars.

So, a strong US dollar indicates weaker prices of the precious metal as it cools the demand from foreign buyers, and vice-versa. Having said that, investors should also carefully tread while considering an investment into the precious metal segment.

Notably, the S&P 500 Gold Hedged Index was down over 21 per cent YTD and about 22 per cent YoY.