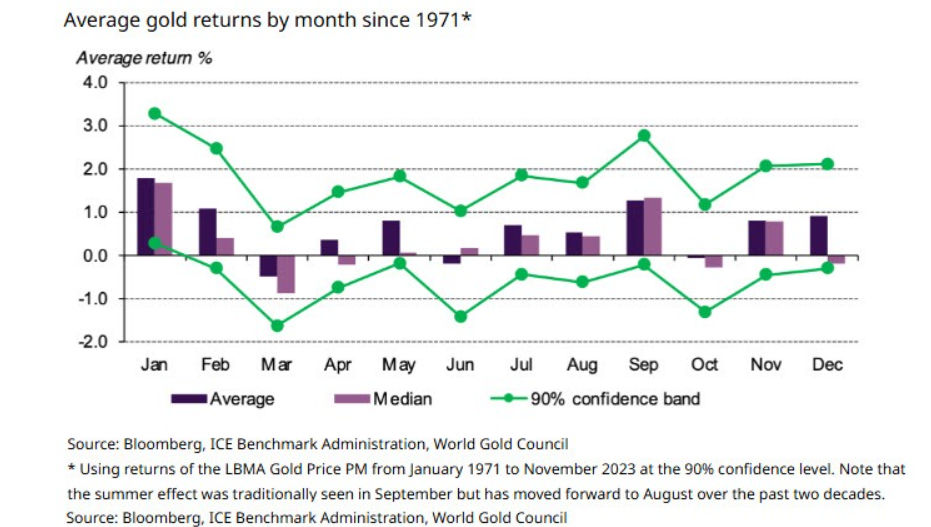

Historically, gold prices have performed very well in January.

However, there are several factors that could influence the price movement.

Gold prices rose sharply in 2024 as rate cuts by the US Federal Reserve and geopolitical tensions aided safe-haven demand.

However, the rally fizzled out in the last couple of months due to a surging dollar after Donald Trump’s victory in the 2024 US presidential elections.

Additionally, the Fed said in December it would be cautious with its rate-cutting cycle, which raised concerns that there could be fewer cuts than previously anticipated.

Justin Low, currency analyst at ForexLive told Kitco that while gold has seasonal support, the strong rally in 2024 and the Fed’s changing rate outlook make January 2025 different.

“It’s a bit of a tricky one this time around with gold prices rising by over 27% already in 2024,” Low was quoted by Kitco.

Things have cooled off in November and December so far but that arguably owes much to the US election result, which in turn has also impacted the Fed outlook somewhat for next year. A surging dollar has helped to keep things in check, for now at least.

“With gold poised to snap its December hot streak (there is still time to recover that, of course), is January – typically gold’s best performing month – also under threat?” he further said.

January is the best month for gold

According to the Kitco report, Low said that over the last 10 years, January has proven to be the best month of the year for the yellow metal.

However, this has slightly changed after the COVID-19 pandemic, he said.

“One can argue that in part, there is some frontrunning in the buying in December. But, is it perhaps due to China also struggling during this period? After all, there is always the thought of that gold rush coming through ahead of the Lunar New Year celebrations.”

According to experts, China’s gold purchases have remained strong over the past 12 months despite data suggesting that the country’s buying slowed down last year.

Low said that a couple of factors from the US could influence gold’s movement this month.

The Fed’s hawkish tone at its last policy meeting could affect buying in January, according to Low.

The Fed cut interest rates by 25 basis points at its December meeting but cautioned against further rate cuts in 2025.

Market players were expecting four rate cuts this year. However, investors now anticipate only two rate cuts in 2025.

The other factor is the technical outlook for gold.

Low said that gold prices had fallen below its 100-day moving average last week. This indicated some risks in the market. The key level is around $2,616 per ounce.

If buyers can maintain the technical control, that will be a positive boost for gold to stick with the January trend.

Gold prices: positive start so far

So far in the first two days of trading of the year, gold has shown positive signs.

Prices have risen more than $7 per ounce so far since December 31, 2024. At the time of writing, the February gold contract was around $2,644.51 per ounce, up 0.2% from the previous close.

Gold prices were higher on Thursday after its more than 27% gain in 2024, marking the best annual returns since 2010.

“Geopolitical tensions in the Middle East and the ongoing Russia-Ukraine conflict are expected to continue supporting Gold, a traditional safe-haven asset, in the near term,” FXstreet analyst Akhtar Faruqui said.

Additionally, a report from the World Gold Council stated that global central banks are likely to increase their gold purchases in 2025.

This is supportive for gold prices as central bank demand remained strong in the last few years.

“Gold is trying to stay above $2,600 while silver is hovering around $29 per ounce,” said David Morrison, senior market analyst at Trade Nation.

Both precious metals have been out of favor over the last couple of months.

Morrison added:

Could there be a resurgence in 2025? Perhaps buyers are looking for a pullback in the dollar first.

Even as positive factors remained at play, gold’s movement this January could face headwinds from uncertainty over the Fed rate cut outlook.

However, as the year progresses, there could be a further upside in prices, according to experts.

The post Gold price forecast: can the yellow metal deliver strong returns in January? appeared first on Invezz