Highlights

Banking stocks are gaining traction in the market in recent days, as the earnings season kicked off in the prior week. Meanwhile, five of the financial companies have already reported their earnings earlier on Friday.

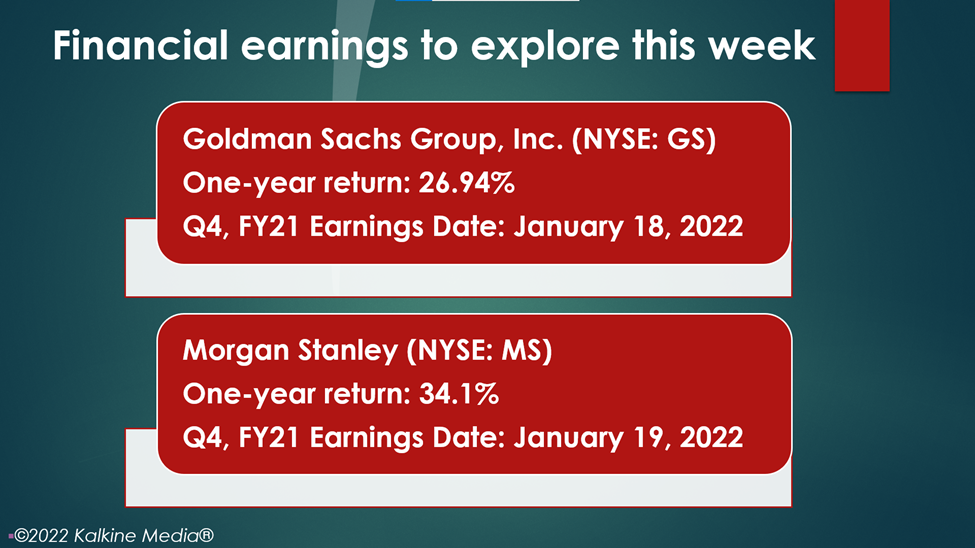

Here we explore two financial firms that are expected to report their quarterly earnings this week.

Also Read: What is DAO Maker (DAO) crypto? Venture capital token rallies

Goldman Sachs Group, Inc. (NYSE:GS)

Goldman Sachs is a leading investment banking and financial services firm based in New York City. It provides a range of financial services like investment management, asset management, and other related services to its clients.

The shares of the company traded at US$387.50 at 8:00 am ET on January 14, down by 0.84% from their closing price of January 13. Its stock value increased by 26.94% over the past 12 months.

The firm has a market cap of US$130.36 billion, a P/E ratio of 6.45, and a forward one-year P/E ratio of 6.44. Its EPS is US$60.63.

Also Read: 5 best US fintech stocks to consider in 2022

The 52-week highest and lowest stock prices were US$426.16 and US$270.62, respectively. Its trading volume was 2,493,238 on January 13.

The company is expected to report its fourth-quarter fiscal 2021 earnings results on Tuesday, January 18, before the opening bell.

The company's revenue was US$13.60 billion in Q3, FY21, representing an increase of 26% YoY. Its net earnings came in at US$5.37 billion, as compared to US$3.36 billion in Q3, FY20.

Also Read: RMRK crypto retreats after 5-day rally. What’s the NFT coin’s utility?

Also Read: Why is EPIK Prime crypto rallying? NFT token jumps 21%

Morgan Stanley (NYSE:MS)

Morgan Stanley is an investment banking and financial service providing firm based in New York. It primarily operates through its three segments -- institutional securities, wealth management, and investment management.

The stock of the company traded at US$100.94 at 8:20 am ET on January 14, down 1.57% from its previous closing price. The MS stock rose 34.1% over the past 12 months.

The market cap of the company is US$184.01 billion, the P/E ratio is 13.1, and the forward one-year P/E ratio is 12.90. Its EPS is US$7.83.

Also Read: Top 5 NYSE material stocks to follow in 2022

The stock saw the highest price of US$106.47 and the lowest price of US$66.84 in the last 52 weeks. Its share volume on January 13 was 6,243,306.

The company is expected to report its fourth-quarter fiscal 2021 results on Wednesday, January 19, before the market opens.

The company's net revenue was US$14.75 billion in Q3, FY21, representing an increase of around 26% YoY. Its attributable net income came in at US$3.7 billion, or US$1.98 per diluted share, as compared to US$2.71 billion, or US$1.66 per diluted share in Q3, FY20.

Also Read: Best US communication stocks with dividends to watch in 2022

Bottom line:

The financial sector has witnessed gains in recent months. The S&P 500 financials sector gained 31.89% over the past 12 months. However, an investor should closely evaluate the companies before investing in their stocks.