Highlights

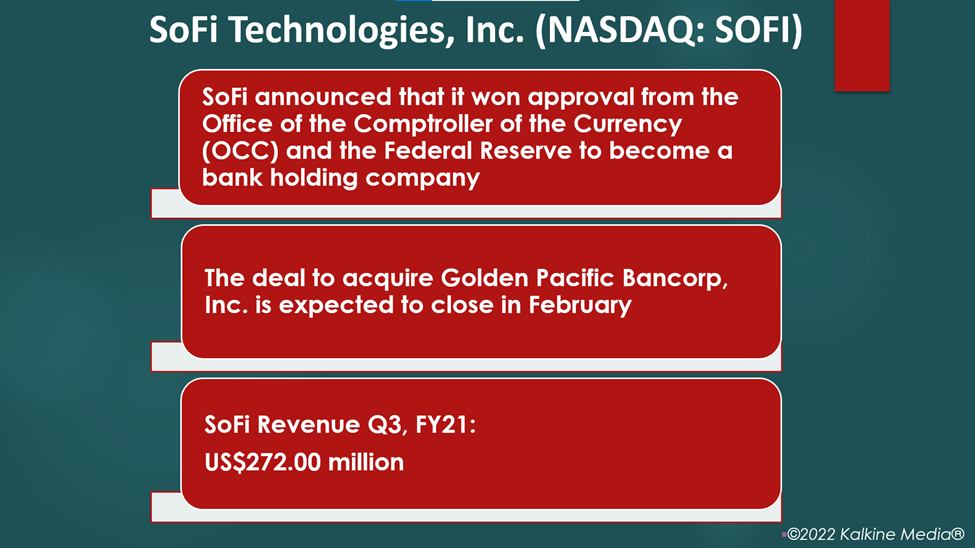

- SoFi Technologies (SOFI) received regulatory approval to operate as a bank holding company.

- The Office of the Comptroller of the Currency (OCC) and the Federal Reserve approved its application on Tuesday.

- SoFi revenue surged 35% YoY in Q3, FY21.

SoFi Technologies, Inc. (NASDAQ:SOFI) stock jumped over 16% in the premarket on Wednesday after receiving regulatory approval to function as a bank holding company.

The California-based personal finance company provides loans, credit card facilities, etc., in partnership with FDIC-insured banks. It received the nod from regulators on Tuesday.

Also Read: Why NeuroMetrix (NURO) stock jumped over 40% today?

The fintech company relies on partnerships with banks to manage customer deposits and loans.

SoFi applied for a holding company status ahead of its acquisition of Golden Pacific Bancorp, Inc., while its SoFi Bank will operate as a subsidiary. On Tuesday, SoFi said it received approval from the Office of the Comptroller of the Currency (OCC) and the Federal Reserve.

SoFi had announced the acquisition of Golden Pacific last year. The deal is expected to close in February this year.

Also Read: Axie Infinity (AXS) crypto skyrocketed 11,417% in a year - Learn more

Also Read: Five hot oil and gas stocks to explore now

SoFi Technologies, Inc. (NASDAQ:SOFI) stock performance, earnings

Shares of SOFI traded at US$14.09 at 8:24 am ET on January 19, up 16.83% from its previous close. The stock fell 20.5% in the past six months.

SoFi has a market capitalization of US$9.78 billion. Its forward P/E ratio for one year is -6.59. Its 52-week highest stock price was US$28.26, and the lowest was US$12.02.

Its trading volume was 58,153,540 on January 18.

The company's net revenue was US$272.00 million in Q3, FY21, an increase of 35% YoY. It reported a net loss of US$30.04 million against a loss of US$42.87 million a year ago.

Also Read: Rhodium Enterprises IPO set to debut on Jan 20: Things to know

Bottomline

SoFi’s new holding company status would help trim its unnecessary expenses on transactions.

CEO Anthony Noto said the national bank charter would enable SoFi to lend at more competitive interest rates while giving higher-yielding accounts to customers.